The Role of Bonds in a Diversified Portfolio:

The Role of Bonds in a Diversified Portfolio:

In today’s fast-changing financial markets, investors constantly search for ways to balance growth potential with security. Stocks are often seen as the engine of wealth creation, but bonds play an equally critical—if sometimes overlooked—role in building a diversified investment portfolio.

This comprehensive article explores why bonds matter in a diversified portfolio, how they function, their risks and rewards, and the best strategies to use them effectively in the U.S. market.

HSBC Cashback Credit Card 2025 – Benefits, Rewards & How to Apply?

Bonds: What Are They?

Bonds are fixed-income securities that represent a loan made by an investor to a borrower—typically a government, corporation, or municipality. In return, the borrower promises to pay back the principal (the original loan amount) at maturity, along with periodic interest payments known as coupon payments.

Unlike stocks, which represent ownership in a company, bonds represent debt. They are generally considered more stable and predictable than equities, making them an essential component of risk management in a portfolio.

Why Diversification Matters

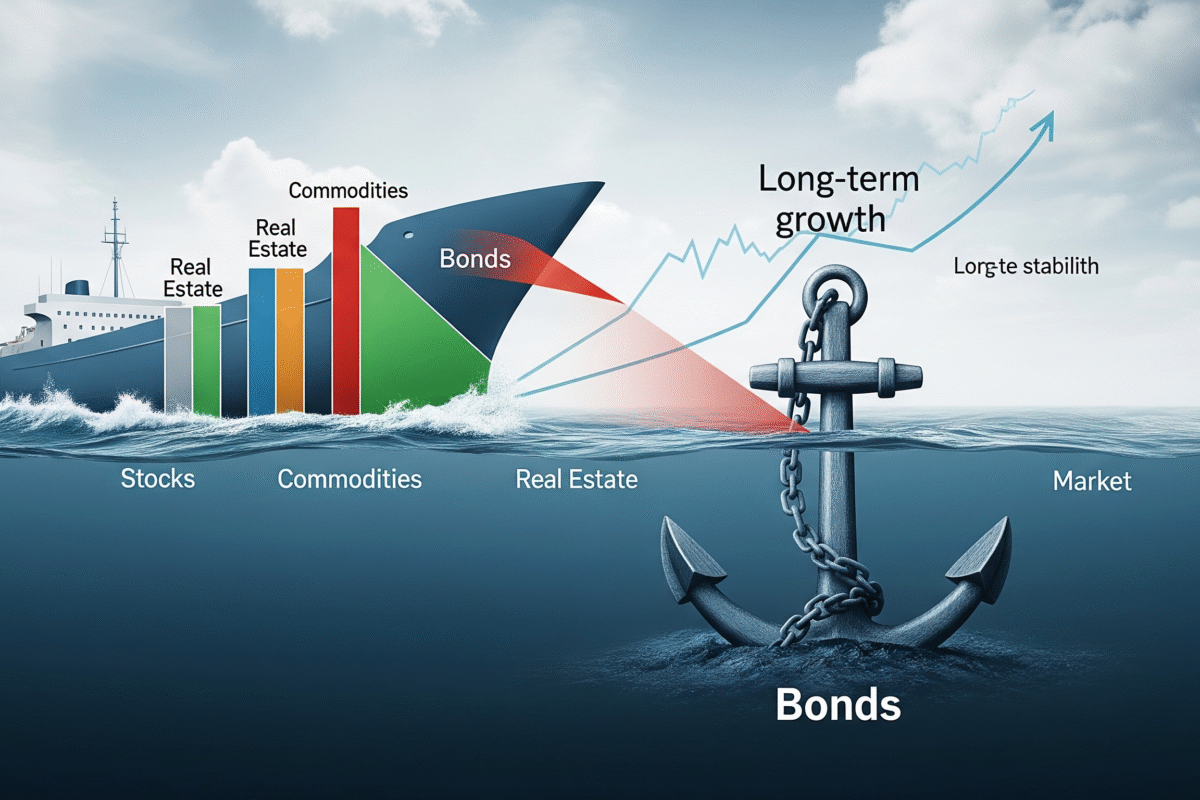

Diversification means spreading investments across different asset classes—such as stocks, bonds, real estate, and commodities—to reduce risk. The idea is simple: if one investment performs poorly, others may offset the loss.

- Stocks provide growth potential but carry volatility.

- Bonds provide income and stability, acting as a counterbalance.

- Other assets (like real estate or gold) offer inflation protection and hedging.

Bonds are particularly valuable because their performance often moves differently than stocks. When markets fall, investors often seek safety in bonds, making them rise in value.

The Key Role of Bonds in a Diversified Portfolio

Stability During Market Volatility

Stocks can experience sharp price swings due to economic conditions, earnings reports, or geopolitical events. Bonds, especially government bonds, tend to remain more stable. For example, during the 2008 financial crisis, U.S. Treasury bonds gained in value as investors fled to safety.

Predictable Income Stream

Bonds pay regular interest, making them attractive for retirees or conservative investors who prioritize income over high growth. This cash flow can be reinvested or used as a steady income source.

Capital Preservation

While stocks may decline in value, bonds (if held to maturity) return the principal amount—assuming the issuer does not default. This makes bonds critical for preserving wealth.

Diversification & Risk Reduction

Bonds typically have a negative or low correlation with stocks, meaning they often move in opposite directions. This reduces overall portfolio volatility.

- Inflation and Interest Rate Hedge (Selective)

- While inflation erodes bond returns, certain bonds like Treasury Inflation-Protected Securities (TIPS) can protect investors.

Types of Bonds in the U.S. Market

Investors can choose from a wide variety of bonds depending on risk tolerance, goals, and investment horizon.

Government Bonds (Treasuries)

- Issued by the U.S. government.

- Considered virtually risk-free.

- Includes Treasury bills, notes, and bonds.

- TIPS provide inflation protection.

Municipal Bonds (Munis)

- Issued by states, cities, or municipalities.

- Offer tax-free interest income in many cases.

- Useful for high-income investors seeking tax efficiency.

Business Bonds

- issued by businesses in order to raise money.

- Generally greater returns, but more risky than Treasuries.

- Creditworthiness is used to provide a rating (AAA to trash).

Bonds issued by agencies

- issued by government agencies such as Freddie Mac or Fannie Mae.

High-Yield Bonds (Junk)

- Greater potential profits come with greater risk.

- frequently employed for aggressive revenue-generating tactics.

Foreign Bonds

- issued by corporations or governments abroad.

- Offer worldwide diversification, but be mindful of exchange rate risks.

Bonds vs. Stocks: Balancing Growth and Safety

| Feature | Bonds | Stocks |

| Ownership | Debt obligation | Ownership in company |

| Risk Level | Lower (depends on issuer) | Higher (market volatility) |

| Returns | Fixed interest (coupon) | Dividends + capital gains |

| Income | Predictable | Variable |

| Inflation Impact | Negative (unless inflation-protected) | Generally positive in long run |

| Liquidity | Moderate (depends on market) | High (easy to buy/sell) |

An investor looking for long-term growth cannot rely solely on bonds, but those seeking security cannot rely solely on stocks. The ideal portfolio blends the two.

The Function of Relationships at Various Stages of Life

The proportion of your portfolio that should be allocated to bonds depends largely on your age and level of risk tolerance.

Investors in their 20s to 30s

- Emphasis: Growth Portfolio: 10–20% bonds, 80–90% stocks

- Bonds are not the main focus, but they act as a buffer.

Investors in their mid-career (40s to 50s)

- Focus: Stability and growth in balance

- Portfolio: 60–70% stocks, 30–40% bonds

- Bonds reduce volatility as retirement approaches.

Pre-Retirement & Retirees (60s and beyond)

- Focus: Income and preservation of capital

- Portfolio: 40% stocks, 60% bonds (or even more bonds)

- Bonds provide predictable cash flow.

Risks Associated with Bond Investing

Bonds are not risk-free, even though they are typically safer than equities.

- Interest Rate Risk: When interest rates increase, bond prices decline.

- Credit Risk: Issuers may fail, particularly when it comes to trash or corporate bonds.

- Inflation Risk: Fixed interest payments lose value as inflation rises.

- Liquidity Risk: It could be challenging to sell some bonds at reasonable market prices.

Strategies for Using Bonds in a Portfolio

Laddering of Bonds

- To lower interest rate risk, purchase bonds with varying maturities.

Diversifying Across Bond Types

- combining municipal, corporate, and Treasury bonds to strike a balance between return and risk.

Using Bond Funds or ETFs

- Instead of buying individual bonds, investors can gain exposure through exchange-traded funds (ETFs) like iShares Core U.S. Aggregate Bond ETF (AGG).

Bond Investing: Active vs. Passive

- Active management can help take advantage of interest rate movements.

- Passive funds provide broad exposure with lower costs.

The Bond Market in 2025: Current Outlook

As of 2025, the U.S. bond market faces a complex environment:

- Interest rates remain elevated after the Federal Reserve’s inflation-fighting policies in 2023–2024.

- Yields on Treasuries are higher than in the past decade, making them attractive again.

- Corporate bond spreads are narrowing, signaling investor confidence in corporate debt.

- Municipal bonds remain strong due to state-level infrastructure spending.

This environment means investors have more opportunities to lock in attractive yields compared to the near-zero rate era of the 2010s.

Conclusion: Why Bonds Are Essential in Any Portfolio

Bonds may not generate the same excitement as high-flying tech stocks, but they are the bedrock of a well-diversified portfolio. By providing stability, predictable income, and a hedge against market downturns, bonds remain indispensable for U.S. investors in 2025 and beyond.

Whether you are a young investor just starting out, a mid-career professional planning for retirement, or a retiree seeking income, bonds should play a role in your investment strategy. The key lies in choosing the right type of bonds, balancing them with stocks, and adjusting allocation as life goals evolve.

In the end, diversification is about resilience—and bonds are the anchor that keeps your financial ship steady through the storms of the market.

Tax Deductions Every American Should Know in 2025 | Maximize Your Refund

Tax Deductions Every American Should Know in 2025 | Maximize Your Refund