How Big Data Shapes Lending Decisions?

How Big Data Shapes Lending Decisions?

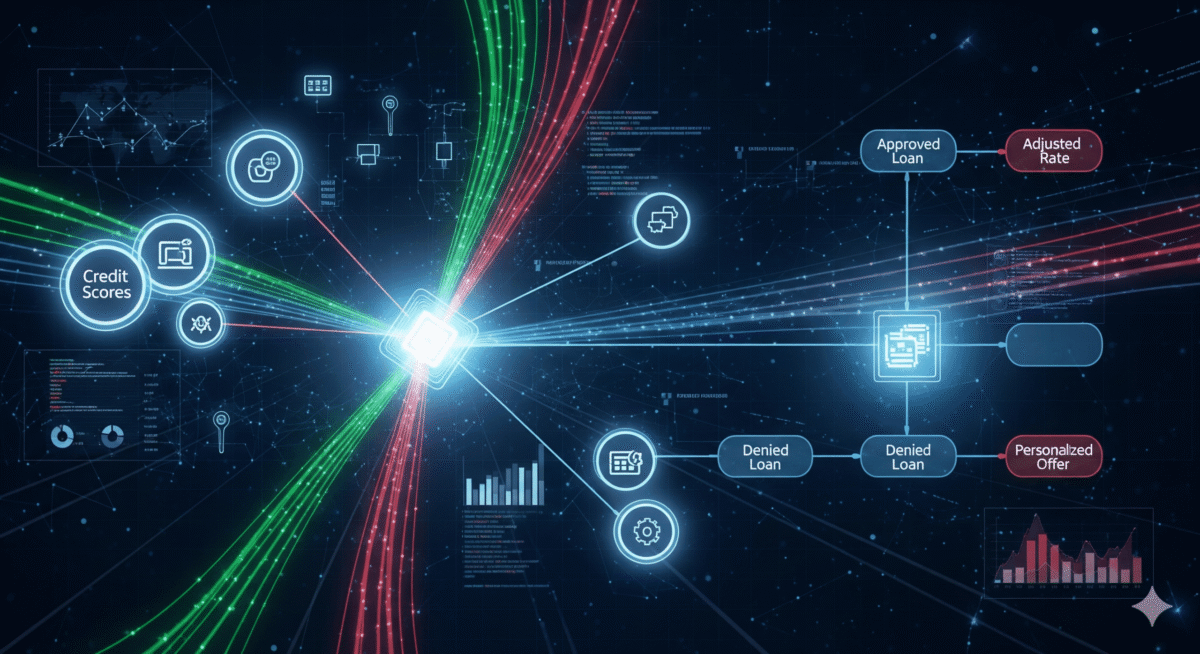

The lending industry has always relied on information. From the earliest credit reports to today’s sophisticated scoring systems, access to accurate data has determined who receives loans and at what cost. In recent years, the rise of big data has revolutionized this process, allowing lenders to move beyond traditional credit scores and tap into vast pools of information.

In the United States, where consumer lending drives housing, education, and small business growth, the role of big data is especially profound. Financial institutions now analyze millions of data points—from social media activity to real-time spending habits—to make lending decisions faster, fairer, and more precise. But this transformation also raises questions about privacy, bias, and regulation.

HSBC Cashback Credit Card 2025 – Benefits, Rewards & How to Apply?

Big Data’s Ascent in Lending

Lenders have always evaluated creditworthiness based on a small set of data, including collateral, income statements, and credit scores. Although somewhat successful, these approaches frequently left out sizable populations with no official credit records, such as young adults, immigrants, and small business owners.

The proliferation of big data has allowed lenders to assess:

- History of digital payments (Cash App, Venmo, and PayPal transactions)

- E-commerce practices (such as using online subscription services, Amazon, or eBay)

- Payment of phone and utility bills

- Records of employment and education

- Patterns on social media

Financial companies are able to create a more comprehensive picture of a borrower’s financial health because to these unconventional data sources.

How Credit Scoring Is Improved by Big Data

Traditional models like FICO have been replaced or supplemented by big data, which has completely changed credit scoring.

- Alternative Credit Information: Scores take into account streaming subscriptions, utility bills, and rent payments.

- Machine Learning Models: To more accurately forecast default risk, algorithms examine thousands of variables.

- Real-Time Scoring: Unlike static scores, big data models update continuously based on new behavior, giving lenders a dynamic view of risk.

For example, fintech companies like Upstart and SoFi leverage artificial intelligence to evaluate borrowers beyond their credit history. They may consider education level, job stability, or even career trajectory when making lending decisions.

Speed and Efficiency in Loan Approvals

Big data enables instant lending decisions. Instead of waiting days or weeks, borrowers can now receive approval within minutes.

- Automated Underwriting: AI-powered underwriting systems analyze huge datasets in seconds.

- Reduced Paperwork: Applicants no longer need to provide extensive documentation, as digital footprints can be verified instantly.

- Improved Customer Experience: Faster approval times increase borrower satisfaction and loyalty.

This has given rise to digital-first lenders like LendingClub and Affirm, which process thousands of loans daily with minimal human intervention.

Risk Management and Fraud Detection

Lenders face constant risks: defaults, fraud, and economic downturns. Big data offers tools to mitigate these challenges.

- Predictive Analytics: By analyzing patterns, lenders can forecast default risks before they occur.

- Fraud Detection Systems: Algorithms detect unusual behavior, such as sudden changes in spending or location.

- Macro-Economic Insights: Lenders can track trends like inflation, unemployment, and industry downturns to adjust lending strategies.

For instance, during the COVID-19 pandemic, big data helped banks identify at-risk borrowers quickly and offer restructuring options before defaults escalated.

Expanding Financial Inclusion

One of the most promising benefits of big data in lending is financial inclusion.

Millions of Americans—particularly immigrants, gig workers, and low-income households—lack traditional credit histories. Big data bridges this gap by using alternative information to assess risk.

- Gig Economy Workers: Platforms like Uber or DoorDash provide earnings data that lenders can analyze.

- Immigrants: Social and professional networks, rental history, and remittance patterns help build creditworthiness.

- Small Businesses: Transaction-level data from POS systems and e-commerce stores can demonstrate stability and growth potential.

This democratization of lending allows more people to access affordable credit, boosting entrepreneurship and economic growth.

Fintech’s Function in Big Data Lending

Leading the charge to incorporate big data into lending are fintech companies. Unlike traditional banks, fintech companies embrace data-driven decision-making from the start.

- Peer-to-Peer Lending Platforms use big data to match borrowers with investors.

- Buy Now, Pay Later (BNPL) Services like Klarna and Afterpay analyze shopping behavior to determine repayment capability.

- Neobanks such as Chime or Varo leverage data analytics to offer overdraft protection and personalized lending products.

These innovations are reshaping the competitive landscape, forcing traditional banks to adopt similar technologies or risk falling behind.

Regulatory Challenges and Ethical Concerns

While big data offers opportunities, it also raises important questions:

- Privacy Issues: How much personal data should lenders have access to?

- Algorithmic Bias: If historical data reflects discrimination, AI models may replicate or even amplify biases.

- Transparency: Borrowers may not understand how decisions are made when algorithms are involved.

- Regulation: U.S. regulators like the Consumer Financial Protection Bureau (CFPB) are closely monitoring the use of big data in lending.

Striking a balance between innovation and consumer protection remains a critical challenge.

Case Studies: Big Data in Action

Case Study 1: Upstart

Upstart uses over 1,600 variables to assess borrowers, including education and employment data. The company reports that its AI-driven models approve 27% more borrowers than traditional models while cutting default rates.

Case Study 2: Kabbage

Kabbage, acquired by American Express, uses real-time cash flow data from small businesses to provide instant loans. Instead of relying solely on credit scores, it evaluates bank account activity, sales, and invoices.

Case Study 3: Zest AI

Zest AI develops machine learning models for credit unions and community banks, helping them lend more inclusively while managing risk effectively.

Future Trends in Big Data Lending

Looking ahead, big data will continue to transform lending in several ways:

- Integration with AI and Blockchain: Combining AI-driven analytics with blockchain’s transparency could create highly secure lending systems.

- Personalized Loan Products: Lenders may design offers tailored to individual borrowers’ spending patterns.

- Real-Time Credit Monitoring: Creditworthiness could be evaluated continuously, rather than updated monthly.

- Embedded Finance: Big data will allow lending services to be embedded in everyday platforms—from e-commerce checkout pages to ride-sharing apps.

The next decade may witness a seamless, data-driven credit ecosystem where loans are personalized, instant, and secure.

Balancing Innovation with Responsibility

As lenders embrace big data, they must also take responsibility for ethical AI use, consumer privacy, and transparent communication.

The promise of big data is undeniable: faster decisions, greater inclusion, and reduced risk. But without proper oversight, it could lead to exploitation or systemic risks.

Regulators, lenders, and technology companies must work together to create frameworks that harness the power of big data while protecting consumer rights.

In Conclusion

Big data has already reshaped how lending decisions are made in the U.S., and its influence will only grow stronger. From improving credit scoring to enabling instant approvals and expanding financial inclusion, the benefits are clear.

At the same time, challenges around privacy, bias, and regulation cannot be ignored. The future of lending will depend on striking a balance between innovation and responsibility, ensuring that big data serves both lenders and borrowers fairly.

As America moves deeper into the digital era, one thing is certain: big data is not just shaping lending decisions—it is redefining the very nature of credit itself.

Dollar-Cost Averaging vs Lump-Sum Investing: Which Strategy Wins in 2025?

Dollar-Cost Averaging vs Lump-Sum Investing: Which Strategy Wins in 2025?