Climate Risk and Its Growing Impact on the U.S.

Climate Risk and Its Growing Impact on the U.S.

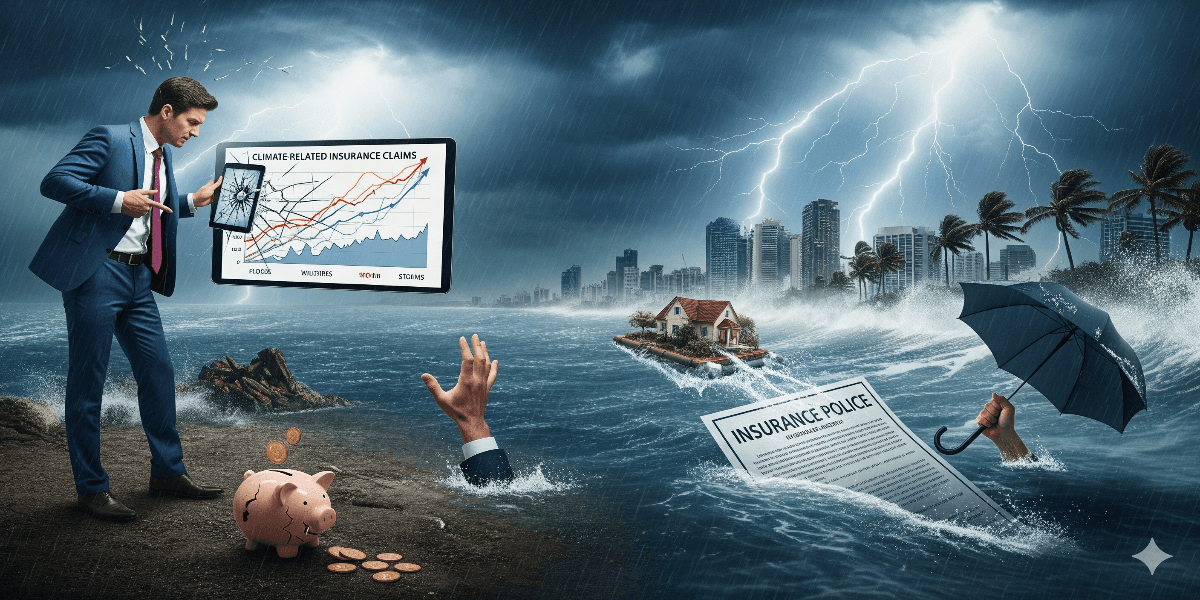

Climate change is a current fact rather than a far-off potential. Hurricanes, wildfires, floods, and other extreme weather phenomena are occurring increasingly frequently in the United States, and they all have significant financial repercussions. The insurance industry, which is at the nexus of financial risk, public policy, and climate science, is among the most impacted. Insurers are compelled to increase rates, limit coverage, or even leave high-risk markets as climate threats increase, making it difficult for businesses and homeowners to obtain reasonably priced insurance.

In this comprehensive research, we look at how climate risk is changing the insurance market in the United States, the financial effects on both consumers and insurers, and the long-term plans being formed to deal with this escalating catastrophe.

HSBC Cashback Credit Card 2025 – Benefits, Rewards & How to Apply?

1. Understanding Climate Risk in Insurance

Climate risk refers to the financial, operational, and systemic risks associated with climate change. For the insurance industry, climate risk translates directly into:

- Physical risks: Increased frequency and severity of extreme weather events causing property damage.

- Transition risks: Policy, regulatory, and market shifts as the economy moves toward low-carbon alternatives.

- Liability risks: Legal actions against companies for failing to prepare or disclose climate-related threats.

According to the National Oceanic and Atmospheric Administration (NOAA), the U.S. experienced 28 separate billion-dollar weather and climate disasters in 2023 alone, setting a new record. For insurers, this means unprecedented claim payouts and a fundamental rethinking of their risk models.

2. The Growing Expenses of Disasters Caused by Climate Change

The cost of climate disasters has been increasing over time. Extreme weather events have cost the United States more than $2.6 trillion in damages since 1980. A significant amount of these losses are being borne by insurance firms, but there are still repercussions for customers.

- Wildfires: Insurance companies have pulled out of high-risk wildfire areas in California, leaving thousands of people without coverage.

- Flooding: FEMA estimates that flood risk is underestimated, with millions of homeowners outside designated flood zones still vulnerable.

- Hurricanes: As a result of frequent storm losses, homeowners’ insurance costs in states like Florida and Louisiana are increasing.

This results in increased premiums, less coverage, and in certain situations, complete loss of insurability for policyholders.

3. The Cost and Availability of Insurance in States with High Risk

Insurance premiums are rising at the fastest rates in states most at risk from climate change.

- Florida: Because of the storm danger, homeowners’ insurance rates have increased threefold over the last five years. A few insurers have completely departed the state.

- California: In some areas, insurers have been obliged to stop offering new coverage due to wildfires. As a final alternative for homeowners, the state implemented the “Fair Access to Insurance Requirements (FAIR)” scheme.

- Louisiana and Texas: Both commercial insurers and state-sponsored insurance programs are under stress due to the frequent storm and flood damage.

The circumstance draws attention to a risky trend: a problem in insurance affordability is being fueled by climate risk.

4. Reinsurance and Its Effects on the World Economy

Reinsurers are international corporations that offer backup coverage for catastrophic losses, and insurance companies frequently rely on them. However, reinsurers are being forced to increase their rates or restrict the availability of coverage due to climate concerns.

There are repercussions from this:

- Costs are passed on to customers by primary insurers.

- Securities linked to insurance are volatile for investors.

- Without dependable insurance, municipalities find it difficult to pay for catastrophe recovery.

According to the Swiss Re Institute, the insurance industry could bear the brunt of $23 trillion in worldwide economic losses by 2050 as a result of climate change.

5. How Insurers Are Responding to Climate Risk

Insurers are adopting multiple strategies to adapt to the new reality:

- Revising Risk Models – Incorporating advanced climate data, AI, and predictive modeling.

- Raising Premiums – Especially in disaster-prone regions.

- Exiting High-Risk Markets – Some insurers are refusing to renew policies in climate-vulnerable zones.

- Investing in Resilience – Partnering with governments to strengthen infrastructure and reduce long-term claims.

Green Finance & ESG Initiatives – Aligning investments with climate goals to reduce exposure to carbon-intensive industries.

6. The Human Impact: Homeowners and Businesses Struggle

While the insurance industry adjusts to manage risk, everyday Americans face a growing financial burden.

- Uninsured Homes: Rising premiums make insurance unaffordable, leaving families vulnerable.

- Mortgage Challenges: Banks often require insurance as a condition for loans—without it, property values decline.

- Business Disruptions: Small businesses in flood- or fire-prone areas face higher operational risks and may struggle to reopen after disasters.

This creates a cycle of economic instability, where climate risk affects not just insurance but also housing affordability, local economies, and financial stability.

7. Policy and Regulatory Response

Governments are stepping in to stabilize the market.

- Federal Insurance Programs: FEMA’s National Flood Insurance Program (NFIP) has been overhauled with Risk Rating 2.0 to better reflect real flood risk.

- State FAIR Plans: Emergency insurance pools provide last-resort coverage in high-risk areas.

- Climate Risk Disclosure: The SEC (Securities and Exchange Commission) is pushing for mandatory climate-related disclosures from insurers and financial institutions.

Yet, these measures are reactive rather than proactive. Experts argue that more investment in climate resilience infrastructure is necessary to reduce risks at the root.

8. The Future of Insurance in a Warming World

Looking ahead, climate risk will continue to shape the insurance industry in profound ways:

- Technology Integration: AI-driven climate modeling will help insurers predict risks more accurately.

- Parametric Insurance: Payouts triggered by specific climate events (e.g., rainfall levels, wind speeds) may become more common.

- Public-Private Partnerships: Governments and insurers will need to collaborate on resilience projects.

- Sustainability Mandates: Insurers will increasingly align with net-zero commitments, influencing investment portfolios.

The industry’s ability to adapt will determine not only its financial health but also the stability of the broader U.S. economy.

9. Professional Opinions

Economists and climate scientists warn that without intervention, climate risk could make certain parts of the U.S. “uninsurable.”

- The Insurance Information Institute warns that affordability will be the greatest challenge for homeowners.

- The IPCC (Intergovernmental Panel on Climate Change) highlights that the frequency of billion-dollar disasters is expected to rise dramatically.

- Industry leaders are calling for federal reinsurance programs to spread risk more equitably across states.

10. Final thoughts

Climate risk is redefining the future of insurance in the United States. The combination of rising premiums, shrinking coverage, and insurer withdrawals from high-risk markets highlights the urgency of addressing climate change not only as an environmental issue but as a financial stability challenge.

For consumers, it means higher costs and difficult choices. For insurers, it demands new risk models and business strategies. And for policymakers, it requires bold action to strengthen resilience and protect vulnerable communities.

The insurance industry is a barometer for climate change: as risks escalate, so too will the costs of protection. The question now is whether society can adapt quickly enough to ensure financial stability in the face of an unpredictable climate future.

Understanding Business Cash Flow: A Complete Guide for US Businesses

Understanding Business Cash Flow: A Complete Guide for US Businesses