Why U.S. Capital Gains Taxes Significantly Influence?

Why U.S. Capital Gains Taxes Significantly Influence?

Capital gains taxes have long been a pivotal element of U.S. tax policy, influencing the financial decisions of millions of Americans. While often discussed in the context of government revenue, the broader implications of these taxes extend far beyond Washington D.C.

They play a crucial role in shaping investor behavior, affecting everything from stock market trends to long-term financial planning. Understanding the nuances of U.S. capital gains taxes is therefore essential not only for investors but also for policymakers, economists, and the general public.

HSBC Cashback Credit Card 2025 – Benefits, Rewards & How to Apply?

Capital Gains Taxes: What Are They?

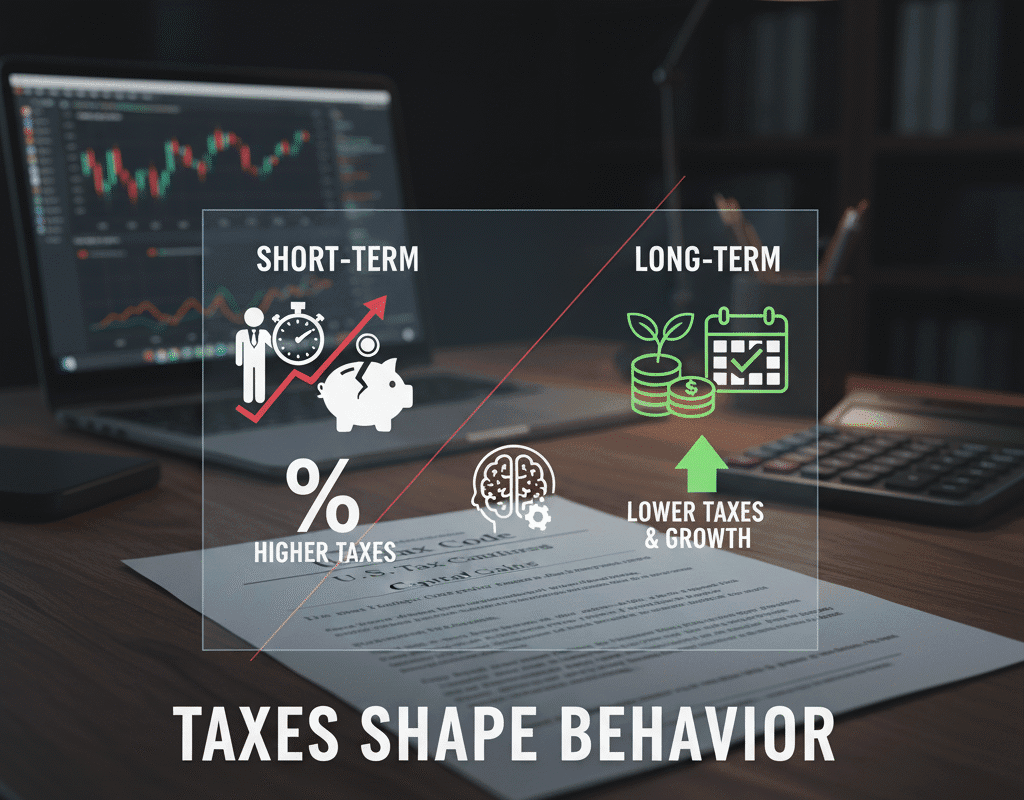

Profits from the sale of assets like stocks, bonds, real estate, or other investments are subject to capital gains taxes. Short-term and long-term capital gains are distinguished under the U.S. tax code:

- Short-term capital gains are subject to ordinary income tax rates, which can reach 37% based on income level, and are applicable to assets held for a year or less.

- Long-term capital gains apply to assets held for more than one year and enjoy lower tax rates, typically 0%, 15%, or 20%, based on income brackets.

This distinction incentivizes investors to hold onto assets longer, creating a direct link between taxation and investment behavior.

Historical Context of Capital Gains Taxes

Capital gains taxes have evolved over the decades, reflecting shifts in political priorities and economic strategies. In the 1920s and 1930s, rates were significantly lower, but during World War II and subsequent economic booms, the rates increased to generate federal revenue. By the 1980s, under the Reagan administration, capital gains tax rates were reduced again to encourage investment and economic growth.

Today, debates over capital gains taxes often center on two major questions: How high should the rates be, and what effect do they have on investment decisions?

Behavioral Economics and Tax Policy

Behavioral economics offers a lens through which to understand the influence of capital gains taxes on investor psychology. Studies show that investors are not purely rational actors; they are influenced by perceived gains, losses, and tax implications.

- Loss Aversion: Investors may avoid selling assets at a loss, even when it is financially prudent, to prevent realizing a taxable event.

- Mental Accounting: Taxes shape how investors perceive profits. Long-term gains feel more favorable because they are taxed less, which encourages retention of profitable assets.

- Framing Effects: Government communication about tax policy can influence perception. For example, highlighting a “20% tax rate on gains” versus a “80% retention of profits” can subtly affect investor sentiment.

Impact on the Stock Market

The stock market is highly responsive to changes in capital gains taxes. When rates rise, investors often accelerate asset sales before the increase, a phenomenon known as “tax-loss harvesting.” Conversely, anticipated tax reductions can trigger a surge in buying, as investors reposition portfolios to capitalize on lower rates.

Market analysts often track capital gains tax announcements as part of their investment strategy, making these policies a key driver of short-term market volatility. Over the long term, tax policy shapes the composition of stock ownership, liquidity levels, and even corporate decision-making related to mergers, acquisitions, and dividend payouts.

In conclusion: Why U.S. Capital Gains Taxes Significantly Influence?

U.S. capital gains taxes are more than a line item on a tax return—they are powerful levers shaping investor behavior, influencing the stock market, and guiding long-term financial planning. By understanding the interplay between taxation and investment, both individual investors and policymakers can make more informed decisions. Whether through holding assets longer, strategically timing sales, or adopting sophisticated wealth management strategies, the impact of capital gains taxes on economic behavior is profound and enduring.

For Americans navigating investment decisions, staying attuned to capital gains tax policy is essential. The choices made today, influenced by taxation, will resonate across portfolios, markets, and the broader economy for years to come.

How Tokenized U.S. Treasuries Could Revolutionize Global Investing

How Tokenized U.S. Treasuries Could Revolutionize Global Investing