Why the U.S. National Debt Keeps Growing?

Why the U.S. National Debt Keeps Growing?

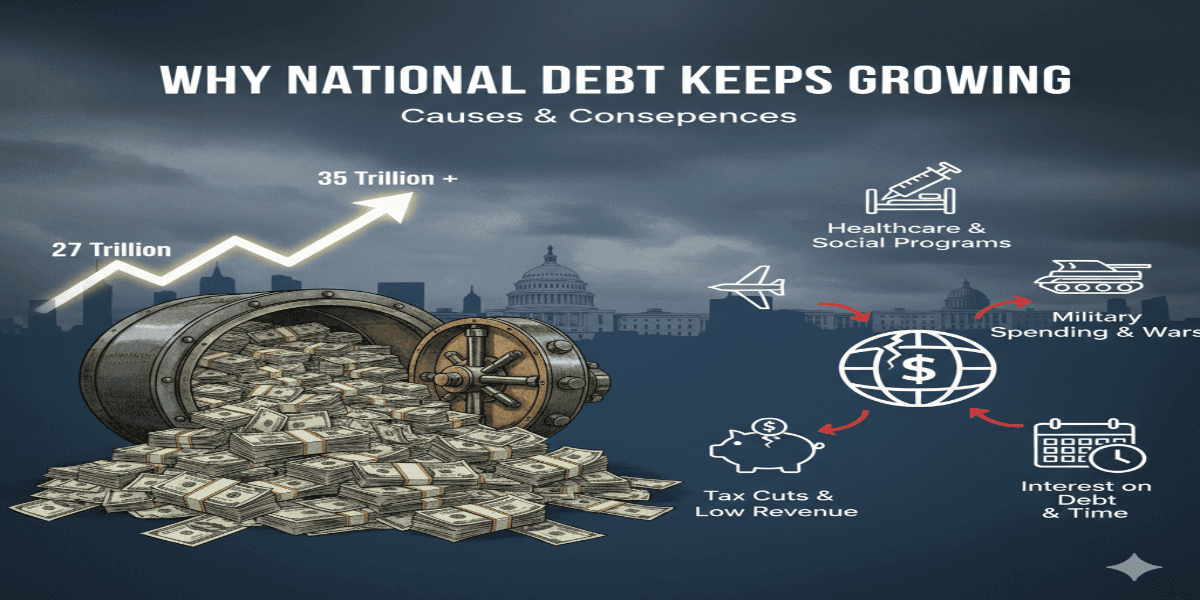

The US national debt has frequently made headlines in American politics, financial markets, and issues of the world economy. Debates concerning government spending, taxes, and the long-term viability of the American economy are being sparked by the debt’s current record ascent. However, why does the national debt continue to rise in spite of governments’ repeated pledges to reduce it?

HSBC Cashback Credit Card 2025 – Benefits, Rewards & How to Apply?

The national debt: what is it?

The entire amount of money owed to creditors by the federal government of the United States is known as the national debt. In essence, it is the accumulation of previous budget deficits, in which the government spends more than it takes in. The debt is funded through the issuance of Treasury securities such as bonds, notes, and bills, which are purchased by individuals, corporations, foreign governments, and the Federal Reserve.

The U.S. national debt is at its highest point ever, surpassing $34 trillion as of 2025. To put this in perspective, that figure is larger than the entire annual output of the U.S. economy, known as Gross Domestic Product (GDP).

The National Debt’s Principal Causes

Continuous deficits in the federal budget

The national debt is increased each year as the United States spends more than it takes in from taxes. Tax revenues frequently fall short of the amount spent on social programs, infrastructure, healthcare, and defense.

The U.S. budget deficit exceeded $1.7 trillion in fiscal year 2023.

This indicates that in only one year, the government borrowed around $1.7 trillion to close spending shortages.

Increasing Interest Rates

The costs of paying debt increase in tandem with its growth. One of the areas of federal spending that is expanding the fastest right now is interest payments. The Federal Reserve has raised interest rates in an effort to combat inflation, the government must allocate hundreds of billions of dollars each year just to pay interest on existing debt.

Spending on Entitlement

A sizable and increasing amount of federal spending goes toward programs like Social Security, Medicare, and Medicaid. Spending automatically rises as more Americans become eligible for these benefits as the population of the United States ages.

Protection and Safety

The world’s greatest military budget is maintained by the United States. A sizable portion of the federal budget is constantly allocated to defense spending, especially during unstable international periods.

Tax Cuts Without Reductions in Spending

Over the years, tax cuts have been implemented by both Democratic and Republican administrations to promote growth. Despite their popularity, these cuts frequently result in lower federal revenue without matching spending cuts, which increases the deficit.

Emergency Spending and Crises

Natural disasters, wars, and economic downturns often trigger sudden bursts of federal spending. The COVID-19 pandemic, for example, led to trillions in relief programs, stimulus checks, and business support.

The Debt Ceiling and Political Deadlock

Political impasse is another factor contributing to the debt’s ongoing growth. The legal cap on government borrowing, known as the debt ceiling, is a point of contention for Congress every few years. Although the limit is typically lifted to prevent default, significant long-term reforms are rarely the outcome of the discussions.

It is challenging to reach consensus on measures like tax increases, entitlement program reforms, or spending cuts when there is political polarization. Short-term solutions thus take precedence, and the debt continues to rise.

Effects of a Growing National Debt on the Economy

The mounting debt has actual economic ramifications and is not merely a reflection on balance sheets.

Increased Cost of Borrowing

U.S. Treasury yields increase as investors seek more profits to offset risk. This may raise the cost of borrowing money for everything from company loans to mortgages.

Displacement of Private Investment

The government faces competition from the private sector for cash when it borrows a lot of money. Private investment in sectors including manufacturing, infrastructure, and technology may decline as a result.

Inflationary Pressures

Excessive borrowing can raise prices if it increases the amount of money in circulation within the economy, even though debt by itself does not generate inflation.

Less Financial Adaptability

The government’s capacity to handle future crises is hampered by high debt. Less money is available for new projects or unexpected expenses because so much of it is used to pay interest.

Dangers to International Trust

America enjoys special borrowing benefits since the US dollar continues to be the world’s reserve currency. However, if investors lose confidence in Washington’s ability to manage debt, global markets could be destabilized.

Why Despite Warnings, the Debt Continues to Increase

It may seem inexplicable that the debt keeps growing in spite of economists’ repeated warnings. A confluence of structural, political, and economic forces determines the reality:

- Short-term politics over long-term policy: Politicians give priority to short-term benefits, such as tax breaks or new initiatives, over challenging spending reductions.

- Expectations of voters: Americans desire low taxes and robust social programs, which invariably lead to deficits.

- Demand for US Treasuries worldwide: Investors continue to consider US debt to be among the safest investments, allowing for further borrowing.

- Low readiness to reach a bipartisan agreement: Progress is halted by deep divisions over military spending, entitlement reform, and taxes.

Historical Lessons

In the past, the Great Recession, World War II, the Civil War, and the COVID-19 epidemic have all seen increases in the amount of U.S. debt. In each case, debt levels increased significantly before subsequently declining as the economy expanded.

The current issue is different, though, as the United States continues to run significant deficits even in periods of economic expansion, which means that debt is rising independently of an external crisis.

Potential Remedies for the Debt Issue

Although there is no easy solution, politicians and economists suggest a number of tactics to stabilize or lower the debt:

Reforms to the Tax Code

Broaden the tax base, close loopholes, and consider moderate increases in rates.

Entitlement Reforms

Adjust Social Security retirement ages, reform Medicare costs, and ensure sustainability of benefits.

Targeted Spending Cuts

Reduce wasteful programs, streamline bureaucracy, and focus resources on essential areas.

Economic Growth Initiatives

Stronger growth leads to higher tax revenues without raising rates. Investments in infrastructure, education, and technology can support this.

Bipartisan Compromise

Sustainable reform requires both parties to balance spending priorities with fiscal responsibility.

In Conclusion

The U.S. national debt continues to grow because of structural budget deficits, rising entitlement costs, political gridlock, and economic crises. While the debt does not pose an immediate existential threat, it carries significant long-term risks for the economy and future generations.

Addressing the issue requires a combination of fiscal discipline, smart reforms, and political courage — a tall order in today’s divided climate. But the stakes are high, and the future of America’s economic leadership may well depend on how this challenge is managed.

The Impact of Inflation on Small Businesses in the U.S. – Challenges and Survival Strategies

The Impact of Inflation on Small Businesses in the U.S. – Challenges and Survival Strategies