The Role of Payroll Taxes in Social Security Funding:

The Role of Payroll Taxes in Social Security Funding:

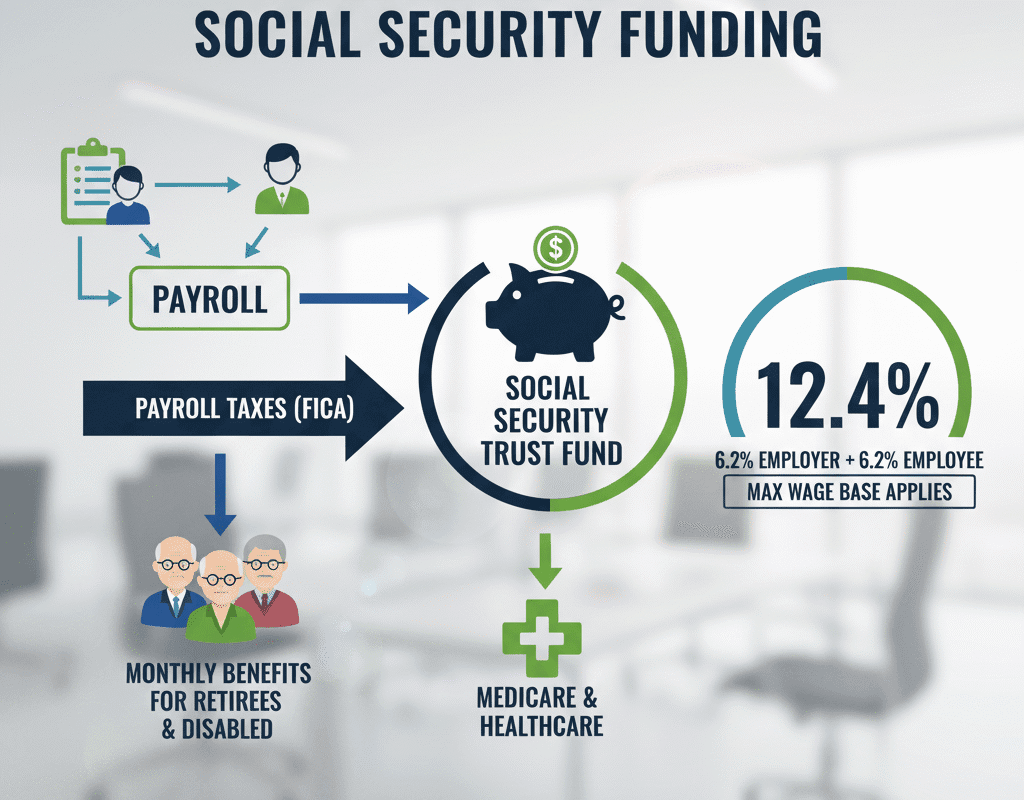

Payroll taxes are one of the most important financial mechanisms in the American social safety net. Every paycheck that crosses an employee’s hands has a portion withheld for the Federal Insurance Contributions Act (FICA) — the dual tax that fuels Social Security and Medicare.

For most workers, these deductions may feel routine, but they collectively fund one of the largest and most important federal programs in the United States.

Social Security is the foundation of retirement income for tens of millions of Americans, providing not only retirement benefits but also disability and survivor insurance.

HSBC Cashback Credit Card 2025 – Benefits, Rewards & How to Apply?

What Are Payroll Taxes? Understanding the Basics

Payroll taxes are mandatory contributions paid by both employees and employers to fund specific government programs. In the U.S., these taxes primarily support Social Security and Medicare, collectively known as FICA taxes.

- Social Security tax: 6.2% of wages paid by employees, matched by employers for a total of 12.4%.

- Medicare tax: 1.45% each from employees and employers, for a total of 2.9%.

- Additional Medicare tax: 0.9% for high-income earners (above $200,000 for individuals or $250,000 for couples).

In total, most workers pay 7.65% of their income toward these programs. Unlike income taxes, payroll taxes are earmarked exclusively for specific trust funds and cannot be diverted for general government spending.

How Payroll Taxes Fund Social Security

The Social Security system operates on a pay-as-you-go model. This means that the taxes collected from today’s workers are used to pay benefits to current retirees and beneficiaries.

When payroll taxes are collected:

- Funds go into the Old-Age and Survivors Insurance (OASI) and Disability Insurance (DI) trust funds.

- These trust funds are managed by the Social Security Administration (SSA).

- Surpluses are invested in U.S. Treasury securities, which earn interest and provide a reserve for future payouts.

In essence, today’s workforce supports today’s retirees, with the expectation that the next generation will do the same. This model has worked for decades, but shifting demographics are beginning to strain the system.

The Demographic Dilemma: Fewer Employees, More Retirees

The ratio of workers to beneficiaries has a significant impact on Social Security’s financial stability. In 1960, there were 5.1 workers for every retiree.

By 2025, that ratio has dropped to roughly 2.7 workers per retiree, and it is expected to decline further to 2.3 by 2035, according to projections by the Social Security Board of Trustees.

Several factors contribute to this imbalance:

- The baby boomer generation entering retirement age.

- Longer life expectancies, leading to longer benefit periods.

- Declining birth rates, meaning fewer workers entering the system.

- Wage stagnation, which limits payroll tax growth.

The Significance of the Payroll Tax Cap

The income cap, which restricts how much of an individual’s income is due to the tax, is a crucial component of the Social Security payroll tax. The limit is $168,600 in 2025. The 6.2% Social Security tax is not applied to any income that exceeds that amount.

This implies that compared to workers with lower and moderate incomes, high earners contribute a smaller portion of their overall income to Social Security.

Removing this ceiling, according to advocates, could distort the program’s social insurance framework and increase effective tax burdens on higher earners, while critics contend that it limits revenue and adds to the financing shortage.

One of the most contentious reform proposals in Washington is the elimination or increase of the payroll tax cap.

A Misunderstood Relationship Between the Trust Fund and the Surplus

Social Security generated significant surpluses between the 1980s and the early 2010s because it collected more payroll taxes than it disbursed in payments. The Social Security Trust Fund was created by investing these cash in special U.S. Treasury bonds, which generated income.

However, the system has been experiencing a cash flow deficit since 2021, which means that all benefit obligations are no longer covered by current payroll taxes. To make up the gap, the SSA has started redeeming trust fund bonds.

The system will only rely on real-time payroll tax revenues if those reserves are exhausted.

The Link Between Payroll Taxes and Medicare

While this article focuses on Social Security, it’s important to note that Medicare — the health insurance program for older Americans — also relies on payroll taxes. The Medicare Hospital Insurance (HI) Trust Fund, funded by the 1.45% tax, faces similar solvency challenges.

Together, Social Security and Medicare account for more than one-third of federal spending, highlighting the critical importance of payroll tax revenues to overall fiscal stability.

What Will Become of Social Security’s Impending Shortfall?

The 2025 Trustees Report states that in the absence of any modifications:

- Around 2033, the OASI Trust Fund will run out.

- It is anticipated that the DI Trust Fund will stay solvent for a little while longer.

- After that period, Social Security would only be able to provide roughly 77% of the payments that were guaranteed.

This implies that unless Congress passes improvements, future retirees may automatically have their benefits reduced. The potential impact is enormous because more than 90% of American workers contribute to the system.

Historical Context: How Payroll Taxes Built the Safety Net

Social Security was established in 1935, during the Great Depression, under President Franklin D. Roosevelt’s New Deal. The idea was revolutionary: a guaranteed source of income for retirees funded by workers themselves through payroll contributions.

At the time, Roosevelt argued that linking benefits to payroll taxes would make Social Security “earned, not given”, ensuring its political durability. That logic has held for nearly a century — few government programs command such broad, bipartisan support.

Over the decades, Congress has adjusted payroll tax rates and income caps multiple times to maintain balance between revenues and obligations. However, modern demographic and economic conditions have pushed the system to its limits.

The Political Debate: Tax Increases vs. Benefit Cuts

In Washington, the debate over how to fix Social Security often falls along partisan lines:

- Democrats generally favor raising or eliminating the payroll tax cap to boost revenue.

- Republicans tend to advocate for controlling spending through gradual benefit reforms.

Despite these differences, both parties recognize that inaction would lead to automatic benefit reductions — an outcome neither side wants to own politically. The challenge lies in finding a sustainable, bipartisan compromise.

Payroll Taxes’ Contribution to Economic Equity

Payroll taxes create problems regarding revenue distribution in addition to financial issues. Payroll taxes are regressive, meaning they take a higher portion of the income from low- and middle-class workers than from the wealthy, due to the income cap and flat rate structure.

In addition, the payout structure of Social Security benefits is progressive, meaning that lower earnings receive a larger replacement rate of their pre-retirement income. Because of this equilibrium, the system serves as a minor equalizer in retirement security as well as an insurance mechanism.

Public Perception and Knowledge

According to surveys, Americans support attempts to maintain Social Security and place a high value on it. However, a lot of people are unaware of how it is financed. Only 45% of individuals correctly recognized payroll taxes as the main source of funding, according to a 2024 Pew Research Center research.

Discussions about policy are made more difficult by this knowledge gap. It is more difficult to reach a consensus for the essential reforms if the relationship between payroll taxes and benefits is not well understood.

Conclusion: The Role of Payroll Taxes in Social Security Funding

Payroll taxes are the foundation of America’s most beloved social services, not just another line on a paycheck. They provide retirees, the disabled, and survivors with the assurance of financial security. However, that promise is currently at a turning point.

The Social Security system will face lower payments and more stress in the future if reform is not implemented in a timely manner. However, payroll taxes can sustain this vital program for future generations with careful legislation and public understanding.

The discussion surrounding Social Security’s future involves more than simply statistics; it also involves principles, justice, and the shared accountability that characterizes the American social compact.