The Impact of Interest-Rate Hikes on U.S.

The Impact of Interest-Rate Hikes on U.S.

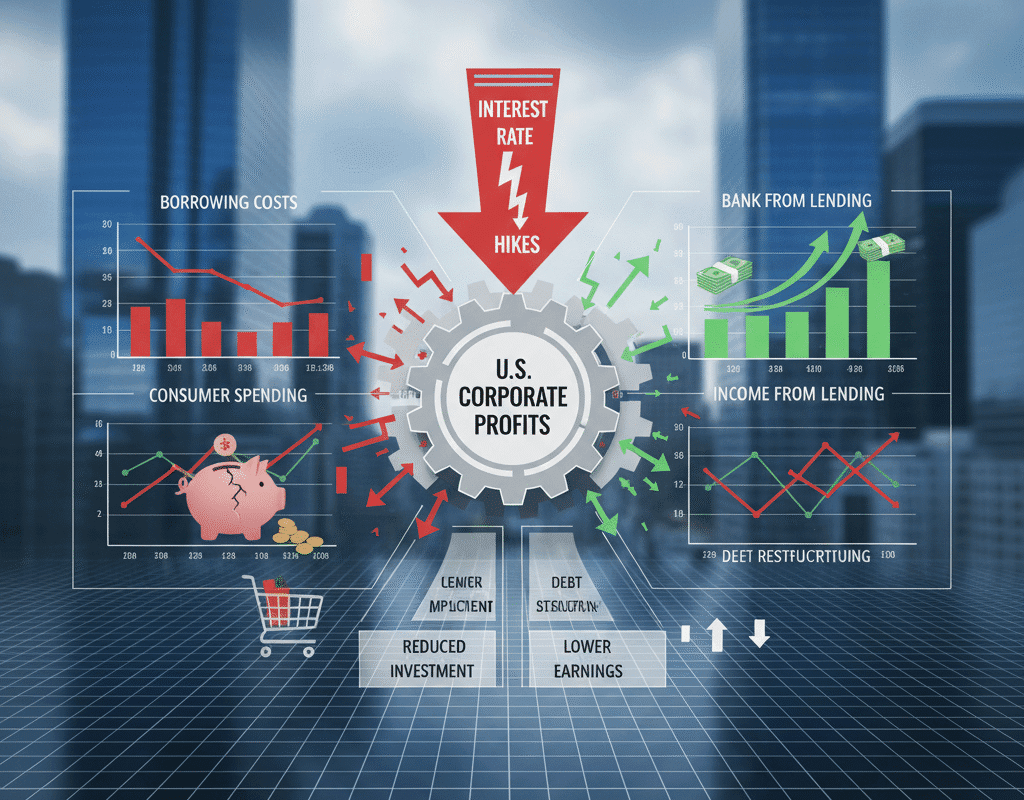

Interest rate choices made by the Federal Reserve have long been a pillar of American economic policy, impacting everything from corporate investment to consumer purchasing. The Fed has raised interest rates several times in recent years, especially in reaction to inflationary pressures.

These actions have a significant impact on U.S. corporate profitability, affecting everything from borrowing rates to shareholder returns, even though they are intended to stabilize the economy. Using information from financial data, economic theory, and professional comments, this article examines the complex effects of interest rate increases on American companies.

HSBC Cashback Credit Card 2025 – Benefits, Rewards & How to Apply?

Comprehending Interest-Rate Increases

The Federal Reserve’s decision to raise the benchmark rate, which impacts borrowing costs throughout the economy, is referred to as an interest-rate hike. Raising interest rates makes it more costly for businesses to fund operations, make investments in new ventures, or pay off debt. As loans and mortgages become more expensive, higher rates also tend to decrease consumer spending, which has an indirect effect on corporation earnings.

Reducing inflation is the main objective of these increases. Higher interest rates can assist stabilize the economy by promoting saving and discouraging excessive consumption in a setting where prices are rising quickly. A possible slowdown in corporate profitability is the trade-off, though, especially for highly leveraged businesses or industries that rely heavily on consumer spending.

Profit margins and financial metrics

Important financial indicators including net income, return on equity, and profit margins are impacted by rising interest rates. Due to increased interest costs, businesses with high debt-to-equity ratios may see a decline in net income. When sales decline and operating expenses rise, profit margins may get smaller. Since monetary policy decisions have a direct impact on earnings reports, investors frequently keep a careful eye on these developments.

Historical Background

Historically, U.S. interest-rate hikes have had mixed effects on corporate profits. During the 1980s, aggressive rate hikes successfully curbed inflation but led to temporary profit declines for highly leveraged industries. In the post-2008 financial crisis era, moderate rate increases were absorbed more smoothly, reflecting a more resilient corporate sector. Understanding these patterns can help businesses and investors anticipate potential outcomes of current and future rate hikes.

Investor Perspective

For investors, interest-rate hikes create both challenges and opportunities. Companies with strong balance sheets, low debt, and consistent cash flow tend to weather rate hikes better. On the other hand, growth-oriented or highly leveraged firms may see stock price volatility. Understanding sector-specific risks and strategies can help investors make informed decisions.

Economic Outlook

Looking ahead, economists predict that moderate rate hikes will continue until inflation stabilizes, potentially limiting rapid profit growth for certain industries. However, companies that proactively manage debt and operational efficiency may maintain profitability despite rising borrowing costs. The overall U.S. corporate landscape may see a shift toward more conservative investment strategies and a focus on sustainable growth.

In conclusion: The Impact of Interest-Rate Hikes on U.S.

Interest-rate hikes are a critical tool of U.S. monetary policy, designed to balance inflation and economic growth. For corporations, these hikes present both challenges and opportunities, impacting borrowing costs, consumer demand, and overall profitability. Businesses that adapt strategically—through debt management, cost control, and market diversification—can navigate these changes successfully. Investors and stakeholders must remain vigilant, assessing both risks and opportunities in an evolving economic environment.

The interplay between interest rates and corporate profits highlights the delicate balance between monetary policy and business strategy, emphasizing the importance of resilience, innovation, and adaptability in today’s dynamic financial landscape.

How Digital-Only Banks Are Winning Over Gen Z Customers in the USA

How Digital-Only Banks Are Winning Over Gen Z Customers in the USA