The Envelope System: Old but Effective Way to Budget

The Envelope System: Old but Effective Way to Budget

In a world dominated by digital wallets, instant bank transfers, and financial apps, one of the oldest budgeting methods—the envelope system—is making a surprising comeback. With rising inflation, household debt, and the overwhelming complexity of modern financial tools, many Americans are asking a simple question: Does going back to basics with cash really work better than technology?

This article takes a deep dive into the envelope system, its origins, how it works, the advantages and limitations, and whether this decades-old approach still has a place in 2025.

HSBC Cashback Credit Card 2025 – Benefits, Rewards & How to Apply?

The envelope system: what is it?

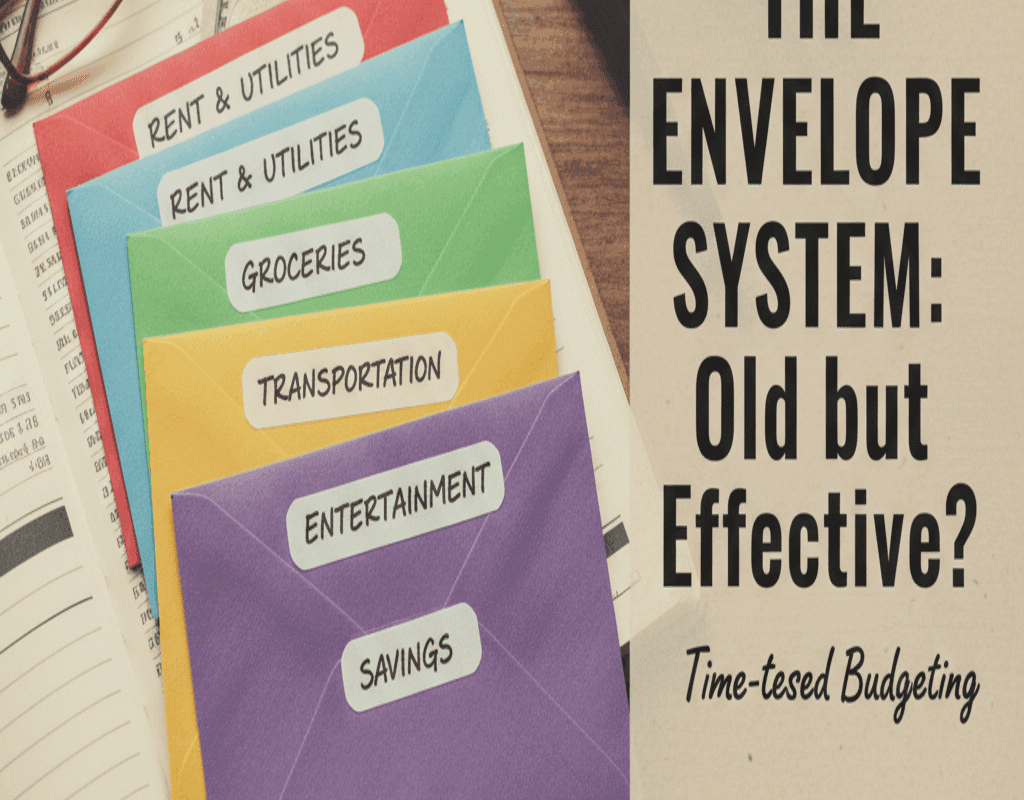

As a cash-based budgeting technique, the envelope system involves people physically separating their funds into envelopes marked with particular expenditure categories, including food, rent, entertainment, gas, or eating out.

This is how it functions in real life:

- Establish a budget by determining your monthly income and allocating spending caps to several areas.

- Label Envelopes: Put labels on envelopes such as “Dining Out,” “Utilities,” or “Groceries.”

- Fill with Cash: Put the designated sum of money into each envelope.

- Spend Only from Envelopes – If the “Dining Out” envelope is empty, that means no more restaurant meals until the next month.

- Avoid borrowing from one envelope to another. Discipline comes from respecting each envelope’s limit.

While simple, this tactile method forces discipline, accountability, and awareness of spending habits.

The History of the Envelope System

The envelope system isn’t new—it dates back over a century. Before the rise of credit cards and mobile banking, households often used envelopes or jars to manage limited cash.

- Early 1900s: Factory workers and farmers’ families set aside weekly wages into envelopes for rent, food, and savings.

- Post-WWII: With suburban growth and household budgeting concerns, the system became a go-to method for frugal families.

- Late 20th Century: The rise of credit cards in the 1980s and 1990s shifted people away from cash, but financial educators like Dave Ramsey re-popularized the envelope system as part of his “Financial Peace University” program.

Why is the Envelope System Trending in 2025?

The comeback of the envelope system can be attributed to several modern factors:

Rising Consumer Debt

According to Federal Reserve data, U.S. household debt surpassed $17 trillion in 2024. With high-interest credit card balances, people are looking for ways to avoid swiping plastic and incurring new debt.

Psychological Impact of Cash

Studies show that people spend 15–20% less when using cash compared to cards or digital payments. The “pain of paying” is more real when handing over bills.

Simplicity in a Complex World

With budgeting apps, spreadsheets, and AI-driven financial tools, many consumers feel overwhelmed. Envelopes cut through the noise with a no-tech, low-stress approach.

Inflation and Economic Uncertainty

In times of inflation, controlling daily expenses becomes critical. Cash envelopes provide visible limits, making it harder to overspend.

Digital Detox Movement

As more people seek balance away from screens, even financial management is getting a retro revival.

Benefits of the Envelope System

Despite its simplicity, the system’s efficacy is what makes it appealing. Here are some key advantages:

Eliminates Overspending

When an envelope is empty, you must stop spending. Unlike credit cards, there’s no borrowing against future income.

Creates Awareness

Physically handling money makes you conscious of every dollar spent.

Works for Any Income Level

Whether you earn $2,000 a month or $20,000, the principle remains the same.

Encourages Savings

By allocating envelopes for “Emergency Fund” or “Vacation,” saving becomes a habit.

Reduces Stress

Many users report less financial anxiety because they know exactly where their money is going.

Downsides and Limitations

Despite its strengths, the envelope system has some drawbacks:

- Impractical in a Cashless Society – Many businesses, especially online services, don’t accept cash.

- Security Risks – Carrying envelopes full of money can be risky.

- No Credit History Building – Using only cash won’t improve your credit score.

- Inconvenience – Constant ATM visits and cash handling may feel outdated.

- Temptation to Borrow from Envelopes – Discipline is key, but not everyone sticks to it.

Modern Adaptations of the Envelope System

Recognizing the digital shift, many fintech companies have created virtual envelope systems within budgeting apps. These allow you to allocate funds digitally without losing the category-based discipline.

Popular apps like Goodbudget, Mvelopes, and EveryDollar simulate the traditional method by letting users “stuff” digital envelopes with money from their bank accounts.

Even banks and neobanks are catching on—offering “spending buckets” or “sub-accounts” that mimic envelopes.

Envelope System vs. Budgeting Apps: Which Works Better?

Both approaches have merit.

- Envelope System: Best for people who struggle with overspending, want a hands-on method, or prefer cash-based living.

- Digital Apps: Best for tech-savvy users, online bill payers, and those seeking automation.

In practice, many households adopt a hybrid approach—cash envelopes for categories prone to overspending (like dining out or entertainment) and digital tracking for fixed expenses (like rent and utilities).

Professional Views

Financial experts remain divided.

- Dave Ramsey, personal finance guru, continues to champion the envelope system for building discipline and debt-free habits.

- Suze Orman has suggested that while cash-based methods can be powerful, digital tracking tools offer more long-term practicality.

- Behavioral economists argue that the envelope system’s strength lies in its behavioral psychology, not financial efficiency.

Envelope System in 2025: Old but Effective?

So, is the envelope system old-fashioned or timeless?

The truth is, it’s both. The method itself is old, but its effectiveness in curbing overspending and building financial discipline is undeniable. In a digital-first economy, the physical envelope system may not be practical for every transaction, but its principles remain powerful.

For Americans struggling with debt, impulsive spending, or financial anxiety, the envelope system offers a refreshing back-to-basics solution. Even if you adapt it digitally, the core idea—spend only what you have—is a lesson that never goes out of style.

In Conclusion

The envelope system may look outdated in 2025, but its psychological power and simplicity make it one of the most effective budgeting strategies available.

In an era of apps, credit cards, and instant transfers, sometimes the best financial advice is the simplest: put money in an envelope, and don’t spend more than what’s inside.

For many Americans, the old system might just be the key to a financially secure future.

Pet Insurance: Is It Worth the Cost in 2025? Coverage, Benefits & Drawbacks

Pet Insurance: Is It Worth the Cost in 2025? Coverage, Benefits & Drawbacks