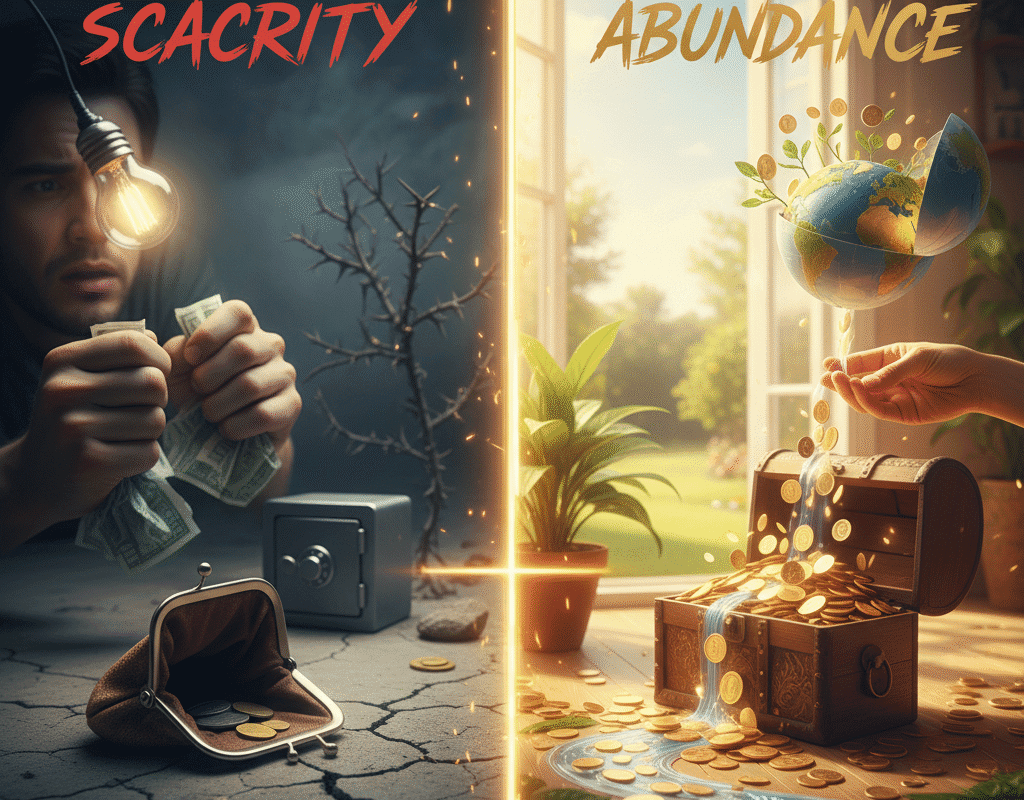

Money Mindset: Scarcity vs Abundance

Money Mindset: Scarcity vs Abundance

Money isn’t just about numbers in a bank account. It’s deeply tied to psychology, beliefs, and habits. Two people with the same income can experience entirely different financial realities—one constantly stressed about bills, the other steadily building wealth.

The difference often comes down to money mindset—the set of beliefs and attitudes you hold about money. Among the most influential frameworks is scarcity vs abundance thinking.

- A scarcity mindset sees money as limited, hard to get, and constantly slipping away.

- An abundance mindset views money as a tool, renewable resource, and opportunity generator.

This article explores scarcity vs abundance in detail, why it matters, and how to shift toward a healthier relationship with money.

HSBC Cashback Credit Card 2025 – Benefits, Rewards & How to Apply?

Section 1: What is a Money Mindset?

Your money mindset refers to the core beliefs you have about earning, saving, spending, and investing money. These beliefs often come from:

- Childhood experiences around money.

- Cultural or societal messages.

- Personal financial struggles or wins.

Examples of money mindset beliefs:

- “I’ll never have enough money.” (Scarcity)

- “Money flows to me when I create value.” (Abundance)

- “Rich people are greedy.” (Scarcity)

- “Wealth allows me to make a bigger impact.” (Abundance)

These beliefs often operate subconsciously, shaping daily decisions and long-term financial outcomes.

Section 2: An Explanation of the Scarcity Mindset

Fear and constraint are the foundations of a scarcity mindset. Those that embrace this way of thinking think:

- There is never enough money.

- Everyone can never have enough.

- It’s risky to gamble with money.

- Financial success is not for them; it is for others.

Typical Characteristics of the Scarcity Mindset:

- Spending is feared because it feels like a loss, even when it is required.

- An excessive focus on saving—holding onto money without making investments or expanding it.

- Opportunities are avoided because people are afraid of failing, which results in lost opportunities.

- Resentment against the financial prosperity of others stems from comparison and jealousy.

- Anxiety and stress: ongoing concern over finances and unforeseen expenses.

Section 3: An Explanation of the Abundance Mindset

Growth, opportunity, and long-term wealth building are all embraced by an abundance mindset. Those who have this perspective think:

- Cash is a resource that can be replenished.

- There are opportunities everywhere.

- Greater profits can result from taking calculated risks.

- Everyone benefits from kindness and teamwork.

Typical Abundance Mindset Characteristics:

- Belief that income can rise is a sign of financial growth confidence.

- Spending on growth (education, business, investments) is known as strategic spending.

- Generosity is the belief that wealth flows back to the giver.

- Goal-oriented: Preoccupied with achieving long-term financial independence.

- Optimism: Seeing mistakes as teaching moments rather than irreversible failures.

Section 4: Scarcity vs Abundance Mindset – Key Differences

| Aspect | Scarcity Mindset | Abundance Mindset |

| View of Money | Limited & scarce | Renewable & abundant |

| Spending Habits | Fearful, restrictive | Strategic, growth-oriented |

| Investing | Avoided due to risk | Embraced for long-term growth |

| Emotional State | Anxiety, stress, envy | Confidence, optimism, gratitude |

| Wealth Creation | Seen as unattainable | Seen as achievable with effort |

| Relationships | Competitive, jealous | Collaborative, supportive |

Section 5: The Negative Impact of a Scarcity Mindset on Financial Achievement

A scarcity-driven strategy frequently results in:

- Missed opportunities include passing up business ventures, investments, and job changes.

- Spending on instant gratification because “money won’t last anyway” is self-defeating.

- Storing money without increasing it is known as financial stagnation.

- Making decisions under stress: Selecting immediate survival above long-term development.

People are kept in cycles of debt, living paycheck to paycheck, or persistent discontent because of scarcity.

Section 6: How the Abundance Mindset Promotes the Development of Wealth

An abundance-driven strategy frequently results in:

- Seeing money as a tool to increase wealth is known as smart investing.

- Thinking like an entrepreneur means looking for opportunities rather than problems.

- Creating investments, savings, and passive income sources will lead to financial freedom.

- Aligning finances with beliefs and purpose is fulfillment.

Because they aren’t held back by fear, abundance thinkers frequently accomplish more.

Section 7: Money Mindset’s Psychological Foundations

The contrast between wealth and scarcity is psychological as well as economical. Behavioral economics research demonstrates:

- People with a scarcity mindset lose focus and become fixated on short-term issues while passing up larger opportunities.

- Perspective is widened by an abundance mindset, which promotes long-term planning and innovative problem-solving.

This explains why mentality is so important to financial development.

Section 8: How to Shift from Scarcity to Abundance Mindset

Knowledge of Limiting Thoughts

Recognize scarcity-driven thoughts like:

- “That is beyond my means.”

- “Making money is too difficult.”

Reframe to abundance-driven beliefs instead:

- “How am I going to pay for that?”

- “Money flows when I create value.”

Practice Gratitude

List 3 financial blessings daily (steady job, supportive network, skills). Gratitude rewires the brain toward abundance.

Focus on Growth, Not Fear

Instead of avoiding investments, educate yourself. Replace fear with knowledge.

Surround Yourself with Abundance Thinkers

Your network influences your mindset. Learn from financially successful and positive people.

Take Calculated Risks

Whether starting a side hustle or investing in the stock market, abundance thrives on growth opportunities.

Invest in Financial Education

Books, podcasts, and courses shift thinking from scarcity to strategic abundance.

Section 9: Useful Financial Practices for Plenty

- Budget with purpose: Spend money on happiness and development rather than just bills.

- Invest frequently: Compound interest builds wealth.

- Diversify income streams: Side hustles, investments, or entrepreneurship.

- Give back: Generosity strengthens abundance thinking.

- Set financial goals: Clear direction leads to focused action.

Part 10: Practical Illustrations of Abundance Transformation

Case Study 1: Getting Rich After Debt

Maria’s debt totaled $30,000. Thinking about scarcity made her feel stuck. Following her transition to abundance, she began a side business as a freelancer, made modest investments, and paid off debt and saved $50,000 in under five years.

Case Study 2: Transitioning from Employee to Business Owner

James had a corporate career, but he felt there weren’t many opportunities. He began a consultancy firm after embracing an abundance attitude. He became financially independent after doubling his income in just three years.

Section 11: The Financial Culture of America Adopts an Abundance Mindset

Scarcity vs. abundance is particularly pertinent in the United States:

- Fear of shortage is a result of rising inflation.

- Technology and entrepreneurship create a wealth of opportunities.

- Financial results are influenced by cultural messaging regarding “not enough” versus “limitless possibilities.”

Americans must comprehend and change their thinking in order to navigate economic volatility.

Section 12: Concluding Remarks

Scarcity vs. abundance in the money mindset is more than just theory. It’s what separates achieving financial freedom from living paycheck to paycheck.

Anyone may move from scarcity to abundance by identifying limiting beliefs, cultivating gratitude, taking calculated risks, and making growth investments.

Wealth is about thinking, not simply numbers.

The Next Financial Crisis: Where Could It Start and How to Prepare

The Next Financial Crisis: Where Could It Start and How to Prepare