How U.S. Mortgage Lenders Price Risk?

How U.S. Mortgage Lenders Price Risk?

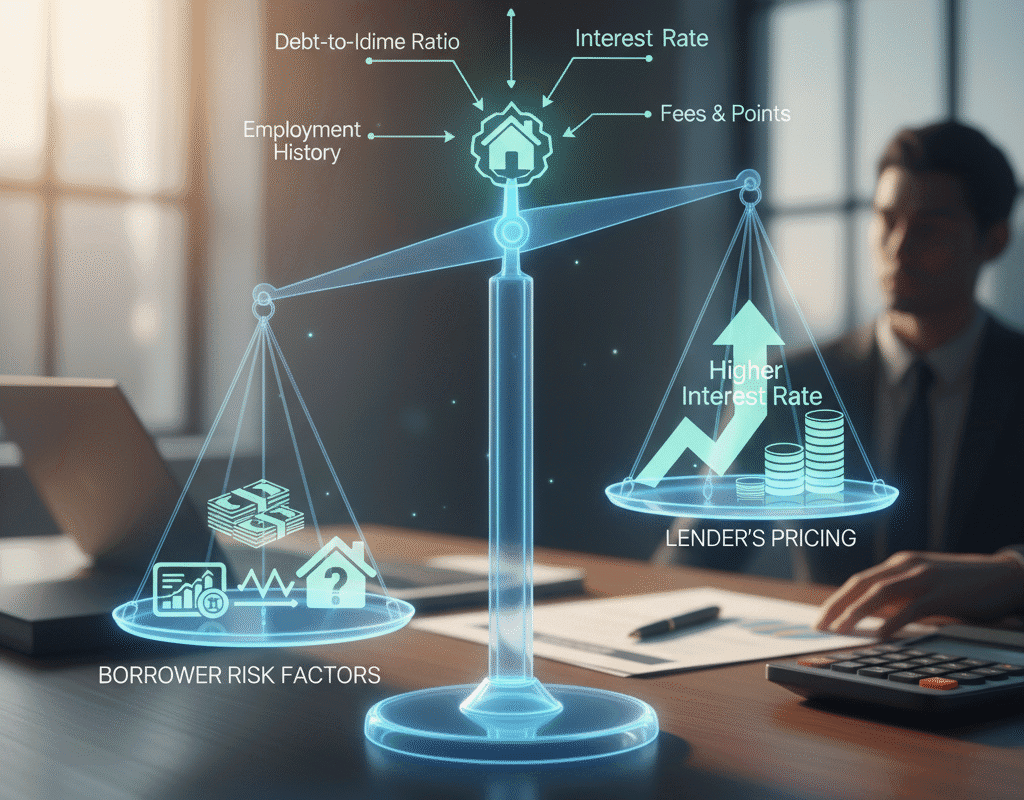

The mortgage sector in the United States is essential for promoting homeownership, bolstering the housing market, and maintaining economic stability. However, there are hazards associated with mortgage loans. To guarantee profitability and reduce the likelihood of borrower failure, lenders must carefully evaluate these risks and set prices appropriately. The elements affecting mortgage rates, underwriting choices, and general lending practices can be better understood by knowing how U.S. mortgage lenders price risk.

HSBC Cashback Credit Card 2025 – Benefits, Rewards & How to Apply?

Recognizing Mortgage Risk

Mortgage risk is the likelihood that a borrower won’t pay back their loan, which would result in a loss for the lender. There are several possible origins of this risk:

- Credit risk is the possibility that a borrower will default because of a bad credit record or unstable finances.

- Interest Rate Risk: Variations in market interest rates that may have an impact on a mortgage portfolio’s profitability.

- The possibility that the lender will find it difficult to sell mortgage-backed securities or other financial assets is known as liquidity risk.

- Operational Risk: Possible losses brought on by fraud, legal troubles, or internal breakdowns.

- Market Risk: More general economic circumstances that impact housing costs, joblessness, and borrower repayment capacity.

Mortgage Underwriting: The Risk Assessment Process

Mortgage underwriting is the formal process through which lenders evaluate the risk of lending to a borrower. It involves a detailed review of the borrower’s financial profile, property appraisal, and overall market conditions.

- Credit Evaluation: Lenders analyze credit reports to understand past payment behavior, outstanding debts, and credit utilization.

- Income Verification: Proof of income, employment stability, and tax returns help lenders assess repayment capacity.

- Property Appraisal: Independent appraisers evaluate the property’s market value to ensure the loan amount does not exceed asset value.

- Debt Analysis: Lenders examine the borrower’s debt-to-income ratio to determine financial strain.

- Automated Underwriting Systems: Many lenders use advanced algorithms and risk models to streamline underwriting while incorporating historical data and predictive analytics.

2025 Mortgage Risk Pricing Trends

The mortgage sector is still changing due to new market conditions and technological advancements. Key developments influencing risk pricing in 2025 include:

- Predictive analytics and artificial intelligence: AI models evaluate large datasets to more precisely determine loan risk.

- Climate and Environmental Risk: Risk premiums may be greater for properties located in areas vulnerable to natural disasters.

- Economic Uncertainty: Risk-based pricing is impacted by rising inflation and changes in interest rates.

- Demographic Shifts: Millennials and Gen Z entering the housing market may face different risk profiles than previous generations.

- Technological Integration: Digital lending platforms streamline risk assessment and underwriting, reducing operational costs.

Conclusion: How U.S. Mortgage Lenders Price Risk?

Pricing risk in mortgage lending is both an art and a science. U.S. mortgage lenders must navigate complex factors including borrower creditworthiness, economic conditions, and regulatory frameworks. Risk-based pricing allows lenders to manage potential losses while supporting homeownership and housing market growth.

As the mortgage landscape evolves with AI, climate considerations, and economic fluctuations, lenders will continue refining their risk models. For borrowers, understanding how lenders price risk empowers them to make informed decisions, improve their financial profiles, and secure more favorable mortgage terms.

In 2025, the interplay between risk, technology, and market dynamics will continue to define the U.S. mortgage industry, making risk-based pricing an essential mechanism for sustainable lending and economic stability.

Why “Right-to-Work” Laws Matter in U.S. States: Impact on Workers and the Economy

Why “Right-to-Work” Laws Matter in U.S. States: Impact on Workers and the Economy