The Effect of Inflation Indexing on U.S. Tax Brackets

The Effect of Inflation Indexing on U.S. Tax Brackets

Almost every facet of American society is impacted by the economic reality of inflation. Millions of Americans’ everyday financial experiences are shaped by inflation, from the price of groceries to the cost of housing.

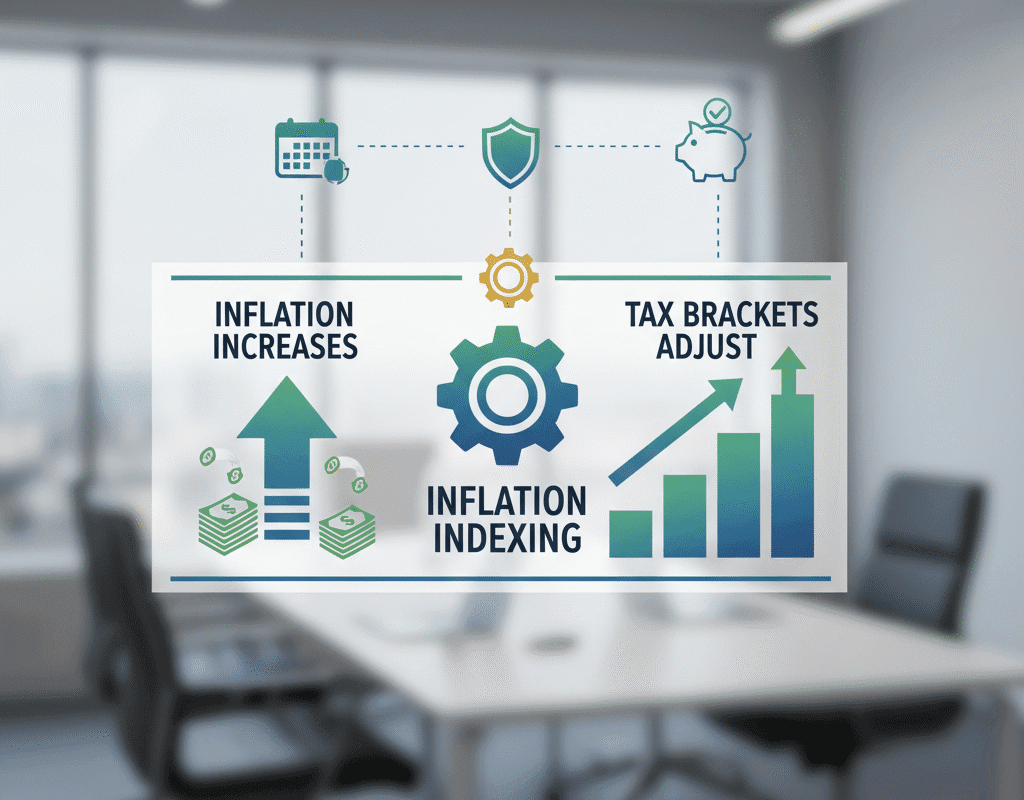

The federal tax system is one area where inflation has a very noticeable—though sometimes disregarded—impact. In particular, U.S. tax rates and, thus, taxpayer obligations are determined in large part by the inflation indexing method. American taxpayers and financial planners must comprehend this dynamic, particularly as inflation rates and economic conditions change.

HSBC Cashback Credit Card 2025 – Benefits, Rewards & How to Apply?

Comprehending Inflation Indexing

Inflation indexing, also known as “indexing for inflation” or “cost-of-living adjustments (COLA),” is a process by which the federal government adjusts various financial figures to account for changes in the purchasing power of money. In the context of U.S. taxes, inflation indexing primarily affects tax brackets, the standard deduction, and other key figures in the Internal Revenue Service (IRS) tax tables.

The primary goal of inflation indexing is to prevent “bracket creep,” a phenomenon where taxpayers are pushed into higher tax brackets solely due to inflation, rather than an actual increase in real income. For example, if an individual earns a salary of $50,000 in a year with 5% inflation, a strict, non-indexed tax system would move them into a higher tax bracket despite their purchasing power remaining effectively unchanged.

The Historical Context of Inflation Indexing in the U.S.

During the Reagan administration, inflation indexing for tax purposes was first implemented in the early 1980s. Prior to indexing, inflation during the 1970s led to significant bracket creep, increasing the tax burden on middle-class Americans even when their real income had not grown.

In 1981, Congress passed legislation that indexed the federal income tax brackets to inflation starting in 1985. This historic decision significantly altered the landscape of U.S. taxation, ensuring that inflation no longer automatically increased a taxpayer’s marginal rate. Since then, annual adjustments have become standard, with the IRS announcing changes in late October for the following tax year.

The Effects of Bracket Creep

Bracket creep would cause the tax system to progressively reduce the value of wages in the absence of inflation indexing. Consider a worker who makes $60,000 a year in 2020 with an annual inflation rate of 4%. Because of inflation alone, their nominal income might increase to $72,993 by 2025. In the absence of indexing, the employee’s purchasing power might not change, but they might enter a higher tax bracket and pay much more in federal taxes.

In addition to raising tax obligations, bracket creep has the potential to skew economic behavior. If incremental gains are disproportionately taxed, people might be less likely to invest in long-term financial planning or seek raises.

Wider Economic Consequences

Inflation indexing of tax brackets does not merely affect individual taxpayers; it also has macroeconomic consequences. By stabilizing tax liabilities, indexing contributes to predictable government revenues and supports consumer spending, as households retain more of their real income.

Conversely, without indexing, bracket creep could reduce disposable income, dampen economic growth, and exacerbate income inequality. Policymakers rely on indexing to strike a balance between revenue generation and economic fairness.

The Future of Inflation Indexing

Looking ahead, inflation indexing will continue to play a critical role in maintaining fairness in the U.S. tax system. As economic conditions evolve, policymakers may explore additional refinements, such as:

- Enhanced measures of inflation: Incorporating alternative indices that better reflect household expenses.

- Dynamic indexing for capital gains and dividends: Expanding the benefits beyond standard income tax brackets.

- Digital tools for real-time adjustments: Utilizing AI and automated systems to inform taxpayers of their effective tax brackets continuously.

By adapting to economic realities, the federal government can ensure that taxation remains equitable, predictable, and responsive to inflationary pressures.

In conclusion: The Effect of Inflation Indexing on U.S. Tax Brackets

Inflation indexing of U.S. tax brackets is a cornerstone of a fair and efficient tax system. It prevents bracket creep, preserves purchasing power, and ensures that taxpayers are not penalized for inflation-driven increases in nominal income. For American households, understanding these adjustments is essential for sound financial planning, while policymakers rely on indexing to maintain balanced and progressive taxation.

As 2025 unfolds, inflation indexing continues to protect millions of Americans from unintended tax burdens, offering a stabilizing force amid economic uncertainty. By staying informed and planning strategically, taxpayers can maximize the benefits of this crucial financial mechanism and navigate the complexities of the U.S. tax system with confidence.

The Role of Community Reinvestment Laws in U.S. Banking: Impact, Challenges, and Opportunities

The Role of Community Reinvestment Laws in U.S. Banking: Impact, Challenges, and Opportunities