Understanding Price vs Value in Stocks:

Understanding Price vs Value in Stocks:

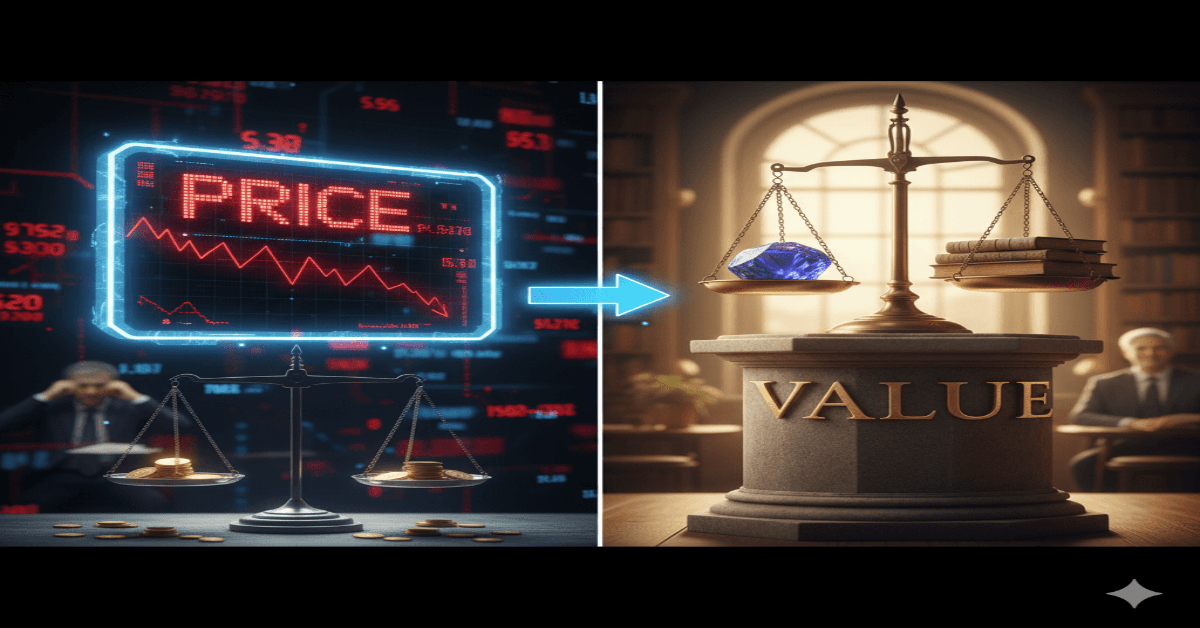

The distinction between stock price and value is one of the most contested and misinterpreted ideas in the ever-changing world of investing. Even though the two terms are frequently used synonymously, experienced investors are aware that they mean very different things.

The market determines a stock’s price at any particular time, but a stock’s value is determined by its intrinsic worth, which includes factors like earnings, assets, growth potential, and overall financial health.

Legendary investors like Benjamin Graham and Warren Buffett, as well as contemporary hedge fund managers that prioritize value investing techniques, have been guided by this distinction. Long-term wealth creation in a market dominated by trends, emotions, and speculative trading depends on an awareness of this distinction.

HSBC Cashback Credit Card 2025 – Benefits, Rewards & How to Apply?

The market’s vote on price in the stock market

Simply put, the price that buyers and sellers agree upon at any particular time is the stock price. It is impacted by:

- Supply and Demand: Prices increase if there are more buyers than sellers. Prices drop if the opposite occurs.

- Market Sentiment: Short-term price fluctuations are frequently influenced by news headlines, investor psychology, and social media activity.

- Macroeconomic Factors: Market perception is influenced by interest rates, inflation statistics, jobless reports, and geopolitical developments.

- Earnings Announcements: When investors react to whether companies meet or exceed their expectations, quarterly earnings releases frequently result in significant price movements.

Stock Market Value: The Investor’s Opinion

A stock’s intrinsic value is established by examining its financials, growth potential, and market conditions. Value, in contrast to price, must be carefully calculated and is not displayed on a ticker screen.

Among the elements affecting intrinsic value are:

- Earnings and Cash Flow: Consistent free cash flow and robust sales growth point to increased intrinsic value.

- Assets & Liabilities – A company with low debt and high-quality assets may be undervalued if the market ignores it.

- Growth Potential – Future innovations, market expansion, or acquisitions increase value.

- Management Quality – Skilled leadership adds intangible value to a business.

- Economic Moat – A company with a competitive advantage (e.g., Coca-Cola’s brand, Google’s search dominance) has higher intrinsic value.

Value vs. Price: The Reason for the Difference

The efficiency of markets is not flawless. This indicates that stock prices frequently diverge from their inherent worth.

The following are some causes of the price-value discrepancy:

- Short-Term Speculation: Traders use momentum rather than fundamentals when making purchases or sales.

- Market Panic or Euphoria: Irrational conduct is fueled by fear and greed, which leads to bubbles and crashes.

- Information Gaps: Research and insights are not equally accessible to all investors.

- Macroeconomic Uncertainty: Valuations are distorted by changes in policy, interest rates, and inflation.

Value investors profit from this discrepancy by purchasing cheap stocks and then selling them when the market finally corrects the price.

The Philosophy of Warren Buffett: Value is What You Get, Price is What You Pay

Buffett highlights that although the market may undervalue businesses in the near term, value always wins out in the long term. Benjamin Graham, his mentor, employed the concept of “Mr. Market,” a gloomy figure who provides daily stock values that might or might not represent actual value.

Important Takeaway:

Understanding the difference between price and value helps investors take advantage of opportunities when quality stocks are undervalued and avoid overpaying during market hysteria.

Methods for Calculating Intrinsic Value

Investors can determine a stock’s intrinsic value in a number of ways:

Analysis of Discounted Cash Flow (DCF)

This approach forecasts future cash flows for a business and uses a discount rate to reduce them to present value.

The Ratio of Price to Earnings (P/E)

Evaluates earnings per share in relation to the stock price. When compared to peers, a low P/E could indicate undervaluation.

The P/B (price-to-book) ratio

Compares the book value and the stock price. A stock may be undervalued if it is trading below book value.

The DDM, or Dividend Discount Model

This approach calculates value based on anticipated dividend payments and is applied to corporations that pay dividends.

Analysis of Comparable Companies

Evaluates and contrasts the valuation metrics of comparable businesses in the same sector.

Why It’s Important for Investors to Understand Price vs. Value

- Preventing Overpayment: When markets correct, purchasing overhyped stocks at exorbitant prices may result in losses.

- Finding Deals: Long-term returns may be possible with cheap stocks.

- Risk management: By emphasizing the fundamentals, value-based investing lowers exposure to market volatility.

- Building Wealth: When you purchase high-quality businesses at reasonable prices, compounding returns perform best.

2025 Price vs. Value: Market Prospects

The price vs. value argument is more pertinent than ever due to growing interest rates, worries about inflation, and technological advancements.

- Only a small percentage of tech stocks may provide long-term value, but some are priced for perfection.

- The energy sector is sometimes disregarded, yet growing worldwide demand points to potential prospects.

- Automation & AI: AI-related stocks are experiencing rapid price increases, but are they reasonably priced?

How This Information Can Be Used by Investors

- Complete your homework by examining financial statements rather than merely stock charts.

- Be Patient: Waiting for the appropriate opportunity is a necessary part of value investing.

- To balance risks, diversify your investments by distributing them among other industries.

- Consider the Long Term: Don’t allow temporary price fluctuations to divert your attention from the development of long-term worth.

Conclusion: Price and Value Alignment

In the short term, the stock market is frequently irrational, yet history demonstrates that value eventually emerges. Understanding the difference between price and value is essential for investors to steer clear of expensive blunders and create long-term riches.

How to Build a Sustainable Spending Plan: Smart Money Management for Long-Term Financial Health

How to Build a Sustainable Spending Plan: Smart Money Management for Long-Term Financial Health