Why U.S. Credit Card APRs Are So High?

Why U.S. Credit Card APRs Are So High?

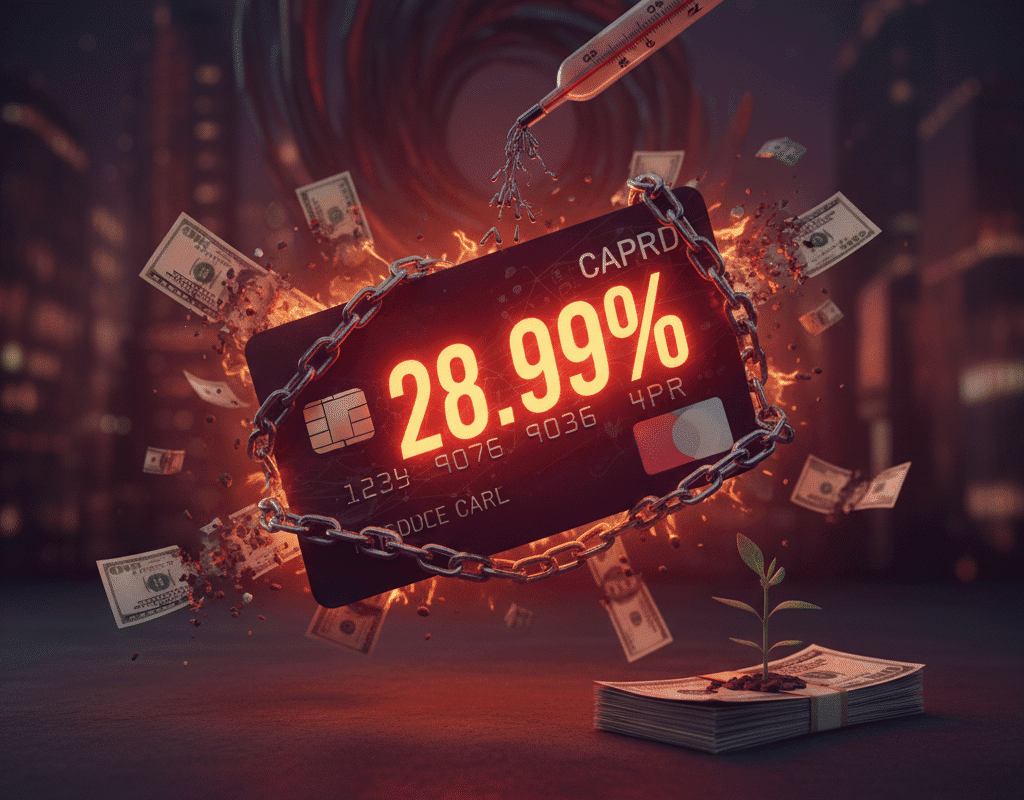

As they carry balances from month to month, many customers are acutely aware of the fact that credit card interest rates (APR = Annual Percentage Rate) have risen to unprecedented levels in the United States. But why are these rates so high? This article examines the ramifications for American households, breaks down the various factors that have contributed to the rise in credit card annual percentage rates, and suggests ways that customers might cope with this situation.

HSBC Cashback Credit Card 2025 – Benefits, Rewards & How to Apply?

The state of affairs as indicated by the figures

Let’s assess the situation before delving into the causes.

- As of October 2025, the average annual percentage rate (APR) on new credit card offers in the United States was approximately 24.19%, according to recent data.

- In one recent quarter, the average annual percentage rate (APR) for accounts with balances—that is, accounts that were assessed interest—went from 22.25% to 22.83%.

- The average APR margin, or the amount over and above benchmark rates, has hit an all-time high, according to the Consumer Financial Protection Bureau (CFPB) and other regulators.

- The percentage of credit card debt that is 90 days or more past due increased to 7.18% by the end of 2024, indicating that cardholders are becoming more vulnerable to delinquency and default.

Key drivers of high credit card APRs

There is no single reason; rather, a constellation of factors explains the elevated rates. Below are the major contributing causes, some of which overlap.

Benchmark rates and the influence of the Federal Reserve

One of the most straightforward drivers: credit cards are typically variable-rate products, with APRs tied to benchmark interest rates (for example the prime rate, which itself is influenced by the Fed funds rate).

When the Fed raises its benchmark rate to combat inflation, borrowing costs for credit card issuers go up — and they often pass some of that on to consumers.

Risk premiums, default losses, and unsecured lending

Unlike mortgages, vehicle loans, and secured personal loans, credit card debt is unsecured, meaning that there is no security to support the balances. For issuers, that inevitably increases risk.

For instance, one study discovered that although credit card borrowers’ default (net charge-off) rates certainly play a role in high APR spreads, they do not entirely account for them.

Even after taking default losses into account, the same analysis revealed an average interest-spread (i.e., APR margin above benchmark) of almost 14.5 percentage points. The margin was still more than 7% for borrowers with a FICO score of 850.

Therefore, while the “risk compensation” element is present, it is insufficient to fully explain the extent of high APRs.

Issuer economics, marketing, and operating expenses

The cost structure and business strategy of credit card issuing are another significant but less evident influence.

Credit card operations are especially costly; according to research, operating costs can account for 4-5% of balances each year.

According to one survey, card issuers spend between 1% and 2% of their assets on marketing each year, which is around ten times more than other banks spend.

The APRs indicate the financial burden of these expenses, which must be covered. The formula is as follows: operating costs + risk premium + markup for profit/market power + cost of capital (which we’ll talk about next).

Why aren’t APRs declining more quickly?

Here’s why consumers might not see an immediate advantage even if benchmark rates are lowered or inflation moderates:

Rate reduction may be postponed by issuers: Card issuers may wait for the Fed to start lowering rates in the hopes that things will stay unclear or to preserve margins.

Independent of benchmark rates, the “margin” component of APRs has been increasing. For instance, the average APR margin (above prime rate) increased from approximately 9.6 percentage points in 2013 to 14.3 in 2023.

Issuers may incorporate premiums now in anticipation of future risk (economic downturns), so incorporating “insurance” through higher rates.

Customers themselves: The pricing situation is still difficult if a significant portion of cards have balances, use is high, and delinquency risk is elevated.

Implications for U.S. consumers

High credit-card APRs have real consequences for households and the economy. Some important effects:

Larger interest burdens for cardholders

Carrying balances at a 20–25% APR means a lot of interest accrues every month. For example: somewhere around 22.8% average for accounts assessed interest.

Debt accumulation and rollover risk

When APRs are high and payments minimum, balances may not go down — or may even rise. This can push consumers into a cycle of rollover debt and higher risk of delinquency or default.

Impact on low- and moderate-income households

Households with tighter budgets, higher utilisation, or less room for savings are particularly vulnerable. As cost of living rises, reliance on revolving credit increases, raising risk and limiting flexibility.

What are the options for consumers?

Here are some useful tactics to use if you have credit card debt and high annual percentage rates:

Pay more than what is required.

Over time, even modest additional payments can help lower debt and interest. Interest rates decrease as balance is decreased.

Reduced credit-utilization ratio:

To indicate to issuers that you are a lesser risk, try to keep credit card balances considerably below the limit, such as under 20–30%.

Take advantage of 0% introductory APR or balance-transfer incentives.

Transferring balances to a lower-rate program might minimize interest costs if your credit is good (but be mindful of fees, transfer terms, and expiry).

Ask for a rate reduction from your issuer

If you have a strong credit history; statistics show that many cardholders who do so are successful.

In conclusion: Why U.S. Credit Card APRs Are So High?

The high annual percentage rate (APR) on credit cards in the United States is not a coincidence. The macro-monetary environment (benchmark rates), the risk associated with unsecured lending, the high operating and marketing expenses of credit card issuance, structural funding disadvantages, issuer pricing power, reward and incentive programs, and difficult consumer and economic conditions are all interrelated factors that are reflected in them.

Higher interest rates, slower debt repayment, and more financial risk are all consequences of a high APR for customers. However, cardholders can lessen the harm by being aware of what’s going on and by employing the appropriate tactics.

The current situation of credit-card annual percentage rates (APRs) creates concerns for consumer finance observers regarding regulatory control, competitiveness, and the long-term viability of consumer credit systems.

How the U.S. Stock Market Influences Global Markets: Trends, Impacts & Insights

How the U.S. Stock Market Influences Global Markets: Trends, Impacts & Insights