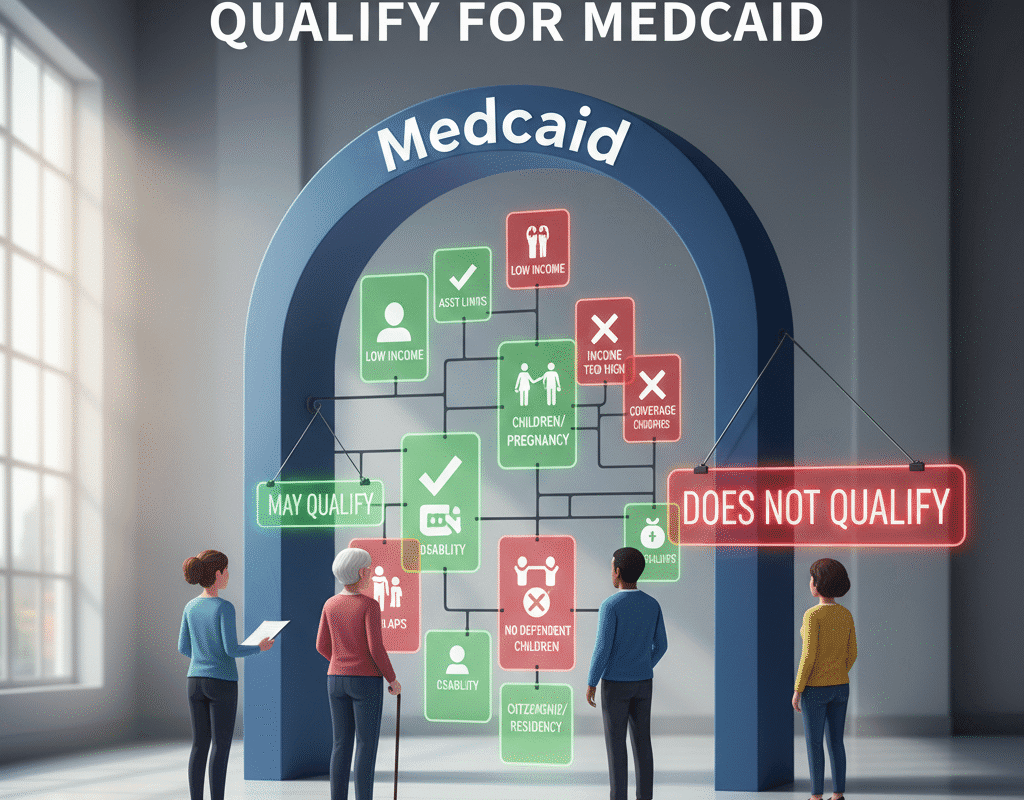

Why Some Americans Don’t Qualify for Medicaid?

Why Some Americans Don’t Qualify for Medicaid?

The U.S. health-insurance safety net is complex. For many low-income Americans, Medicaid offers a lifeline. Yet, perplexingly, numerous eligible-seeming individuals do not qualify.

Others earn too much for Medicaid but too little for private insurance subsidies, landing in limbo. Understanding why this happens requires peeling back layers of federal rules, state exceptions, work or asset tests, immigration status, and the legacy of the Affordable Care Act (ACA). In this feature, we’ll explore the major reasons Americans don’t qualify for Medicaid — and what that means in practice.

HSBC Cashback Credit Card 2025 – Benefits, Rewards & How to Apply?

Medicaid: What is it? A Brief Overview

Medicaid is a combined federal-state program that offers complete coverage to low-income people, some families, pregnant women, the elderly, and people with disabilities.

However—and this is crucial—each state manages its own Medicaid program in accordance with federal regulations, although being enabled by the federal government.

Because of its dual nature, eligibility, income thresholds, asset rules, and other conditions might vary greatly between states.

The Coverage Gap: Caught Between Two Worlds

One of the most striking issues is the “coverage gap.” In non-expansion states, some people have incomes too low to qualify for marketplace subsidies and too high (or in the wrong category) to qualify for Medicaid.

This gap means they essentially have no affordable insurance option through either Medicaid or the exchanges.

This is especially common among non-elderly adults without dependent children in states that did not adopt the expansion.

Effects in the Real World: What Occurs When Individuals Are Not Eligible

There are serious repercussions when people are denied Medicaid coverage in spite of their obvious need:

- They might neglect necessary preventative care, which could result in future emergencies or increased expenses.

- They might be forced to use expensive emergency services, which could put a burden on public and hospital finances.

- They can have significant debt or out-of-pocket medical expenses.

- Growing health disparities may disproportionately impact low-income, minority, immigrant, or rural populations.

For instance, recent reports suggest that millions of Medicaid enrollees may lose coverage due to changes in paperwork and job requirements.

Why These Rules Exist: The Balance of Cost, Federalism & Policy

Why is Medicaid eligibility so complex and variable? Several factors:

- Federal vs State Roles: While federal rules set minimum standards, states have flexibility in eligibility, benefits, delivery, and provider payment.

- Technology of Eligibility: States must determine income, assets, household composition, disability status, and citizenship. These systems are administratively heavy.

- Budgetary Pressure: Medicaid is a big share of state budgets. According to one analysis, Medicaid accounts for one-fifth of U.S. health spending.

- Policy Trade-Offs & Politics: Some states opted not to expand Medicaid under the ACA due to concerns about cost, federal mandates, or political opposition.

Addressing the Myths & Misconceptions

- Myth: “Medicaid is the same everywhere.” — Wrong. Because each state runs its program differently, eligibility and coverage differ.

- Myth: “If you’re poor you automatically qualify.” — Not always. Many adults are excluded due to state rules, household composition, or because they fall in the coverage gap.

- Myth: “Just apply and you’re in.” — No. Paperwork, verification, renewal, work/training requirements in some states complicate access.

- Myth: “If I have Medicaid I don’t need to worry.” — While coverage helps, restrictions, benefits limits, and provider access still pose challenges.

The Human Cost: Narratives Behind the Statistics

There are actual individuals behind the eligibility rules. Consider someone earning slightly above the threshold in a non-expansion state: they’re working hard, making just enough to disqualify them, yet cannot afford private health insurance and miss out on subsidies.

Or a parent without children might qualify, but an adult sibling in the same household might not. Or an immigrant who meets income and disability criteria but is excluded because of citizenship status. These stories illustrate how technical rules translate into health risk, debt, and anxiety.

Looking Ahead: What to Watch

- Policy Changes to Work Requirements: Proposed or enacted work/training hours for Medicaid eligibility could shift who qualifies.

- State Decisions on Expansion: Monitor if non-expansion states choose to expand Medicaid and how eligibility thresholds evolve.

- Administration & Bureaucracy: Increased paperwork or verification requirements may lead to higher rates of unenrollment or denial.

- Coverage Quality: Being eligible is one thing — accessing providers, having services covered, and avoiding high out-of-pocket costs are equally vital.

- Healthcare Costs & Budget Pressures: States under budget strain may seek to tighten eligibility further, or reduce benefits, which could amplify gaps.

In conclusion: Why Some Americans Don’t Qualify for Medicaid?

While Medicaid is designed to help low-income, disabled, pregnant, and elderly Americans get health coverage, eligibility is far from universal. State variation, income thresholds, asset considerations, household make-up, citizenship/residency status, work/training demands, and administrative barriers all contribute to why some Americans don’t qualify.

For those left out, the consequences are serious: gaps in access, treatment delays, financial stress. As policy debates continue, both individuals and states need to engage: applying for coverage when possible, understanding state rules, and advocating for reforms that shrink the gaps. In a country where healthcare is tied to eligibility thresholds as much as need, clarity and action matter.

How Neobanks Are Challenging Traditional U.S. Banks: Digital Disruption & Competitive Strategies

How Neobanks Are Challenging Traditional U.S. Banks: Digital Disruption & Competitive Strategies