Why Overdraft Protection Isn’t Always a Good Deal?

Why Overdraft Protection Isn’t Always a Good Deal?

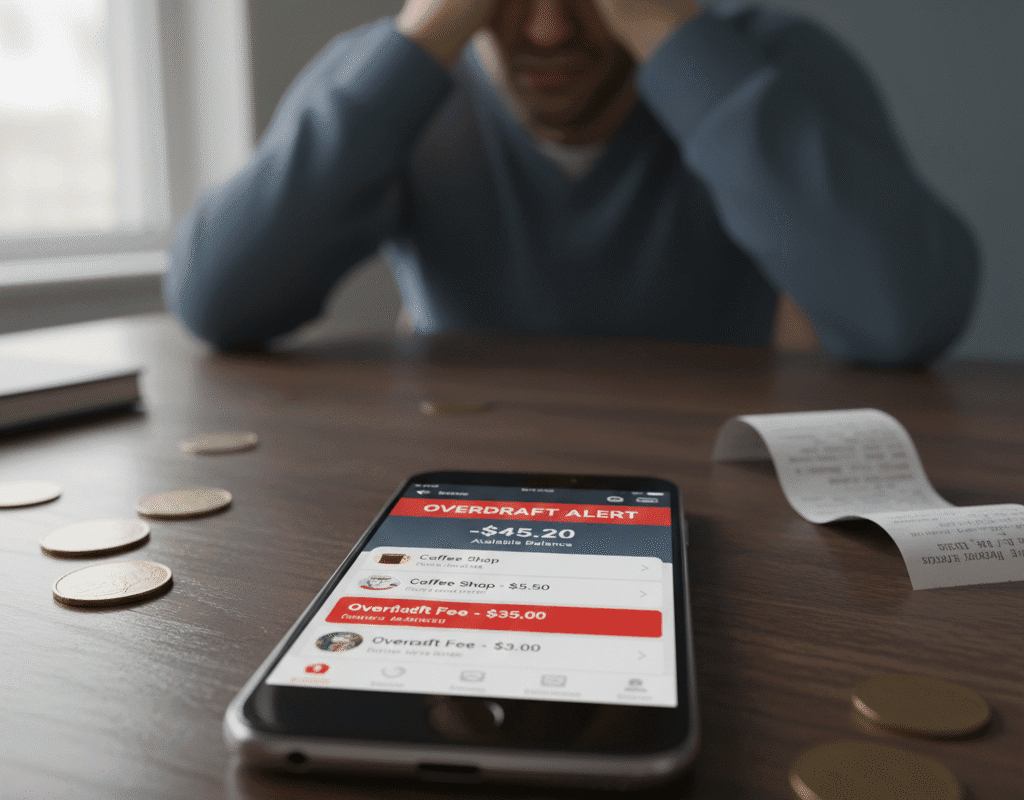

Overdraft protection has long been marketed as a convenient safety net for bank account holders. It promises to cover transactions when your account balance falls below zero, preventing declined payments or embarrassing bounced checks. At first glance, this might seem like a lifesaver. But when you dig deeper, overdraft protection may not always be the financial benefit it appears to be.

HSBC Cashback Credit Card 2025 – Benefits, Rewards & How to Apply?

Overdraft Protection: What Is It?

Banks and credit unions provide a feature called overdraft protection, which permits transactions to proceed even if there aren’t enough funds in your account. In essence, the bank “lends” you the money needed to complete the transaction, which you later pay back—often with penalties and interest.

Overdraft protection comes in two primary forms:

Coverage for Overdrafts Associated with Another Account

You can connect your checking account to another account, like a savings account, credit card, or line of credit, with many banks. Money is automatically moved from the associated account to make up for any shortfall in your checking account balance.

Overdraft Privilege or Courtesy Overdraft

Banks may allow a short-term loan without a linked account. This is often called overdraft privilege or courtesy overdraft, and it usually comes with high fees—sometimes $35 or more per transaction.

Overdraft Protection’s Psychological Effects

Additionally, overdraft protection may have small but important effects on your spending patterns.

Promotes Risky Expenditure

Some account holders may be less cautious with their money when they know the bank will pay transactions. Overspending could result from this “safety net” mentality, particularly if you are living paycheck to paycheck.

Diminishes Knowledge of Finance

You may get disconnected from your actual account balance if you frequently rely on overdraft protection. This lowers your awareness of your spending patterns and restricts your ability to properly manage your budget.

Who Is Most Affected by Overdraft Fees?

Overdraft fees disproportionately affect low- and middle-income families, who are more likely to have low account balances and rely on checking accounts for day-to-day transactions. According to a 2022 report, households earning under $50,000 per year pay a disproportionately high percentage of all overdraft fees.

College students, young professionals, and anyone living paycheck to paycheck are also particularly vulnerable. Overdraft fees can push already tight budgets into crisis mode.

Banks’ Incentives: Why Overdraft Fees Persist

Overdraft fees are a significant revenue stream for banks. According to industry data, U.S. banks collect billions annually from overdraft charges. This profit motive explains why banks aggressively market overdraft protection as a convenience rather than a potential financial burden.

It’s essential for consumers to recognize that overdraft protection is not purely a helpful service—it’s also a business strategy that benefits the bank more than the account holder.

Important Lessons

- Overdraft protection isn’t free. High fees and interest rates can outweigh the convenience.

- It can encourage poor spending habits. Relying on overdraft protection may reduce awareness of your finances.

- Some consumers are more vulnerable. Low-income households and young adults are disproportionately affected.

- There are better alternatives. Linked savings, low-fee accounts, and budgeting tools can provide safer protection.

- Banks profit from overdraft fees. Understanding the incentives behind overdraft services can help you make smarter financial choices.

In conclusion: Why Overdraft Protection Isn’t Always a Good Deal?

While overdraft protection might seem like a convenient financial safety net, it is not always the best deal for consumers. Hidden fees, interest charges, and the potential for poor spending habits make it a costly option for many.

By exploring alternatives such as linked savings accounts, low-fee banking, and careful budgeting, you can protect your finances without giving banks an unnecessary revenue boost.

Being informed and proactive is the key to avoiding the hidden pitfalls of overdraft protection. Your financial health depends not just on convenience, but on smart, conscious money management.

Why Many Americans Are Delaying Retirement: Unpacking the Trends, Pressures & Impacts

Why Many Americans Are Delaying Retirement: Unpacking the Trends, Pressures & Impacts