Why Credit Utilization Matters Most?

Why Credit Utilization Matters Most?

Many Americans believe that timely bill payment is the best indicator of responsibility when considering credit scores. Experts stress that although payment history is important, credit utilization—the ratio of your credit card balances to your credit limits—often has a greater impact on your score.

With inflation, interest rates, and family debt reaching all-time highs in 2025, credit utilization is more crucial than ever. In certain industries, this financial indicator subtly affects mortgage eligibility, interest rates, loan approvals, and even employment applications.

HSBC Cashback Credit Card 2025 – Benefits, Rewards & How to Apply?

Credit Utilization: What is It?

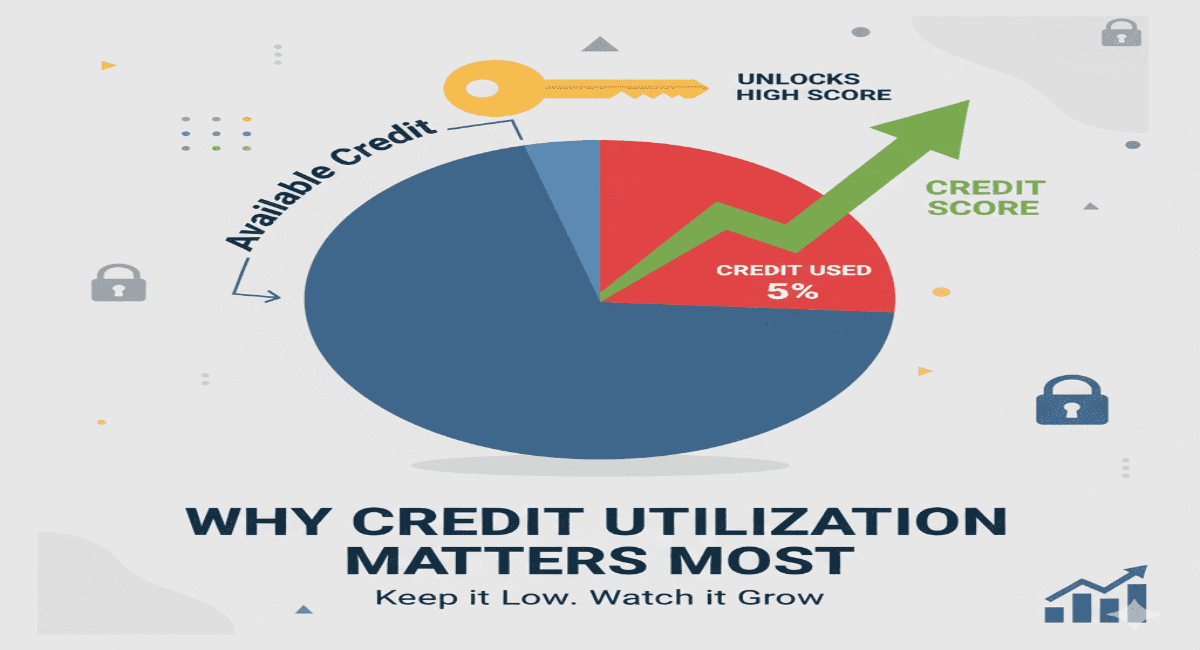

The percentage of your available credit that you are now using is known as credit utilization, or the debt-to-credit ratio.

For instance:

- Your usage rate is 25% if you owe $2,500 and have a $10,000 credit limit overall.

Although it seems straightforward, the repercussions are significant. Utilization is viewed by banks, lenders, and credit scoring algorithms as an indicator of your debt management skills. A low utilization rate conveys responsibility and management, whereas a high rate indicates financial stress or excessive spending.

Why Credit Use Is More Important Than You May Think

It ranks as the second-most important component in credit scoring.

Credit utilization is a significant factor in both FICO and VantageScore, the two most used credit scoring models in the United States:

- History of Payment: ~35%

- Use of Credit (Amounts Due): about 30%

- Credit History Length: about 15%

- Mix of Credit: ~10%

- About 10% of new credit inquiries

This indicates that credit use is almost as significant as payment history. Your credit score will still suffer if you routinely max out your credit cards even if you pay your bills on time each month.

It Has a Direct Effect on Loan Approvals

Credit scores are used by personal loan providers, auto financiers, and mortgage lenders to evaluate risk. A borrower with 20% utilization may qualify for lower rates than someone with 70%, even if their payment history is identical.

It Reflects Real-Time Financial Behavior

Unlike payment history, which builds over years, credit utilization is a snapshot. Your usage today can immediately impact your score tomorrow. That’s why many financial advisors recommend monitoring it closely, especially before applying for new credit.

How Much Credit Utilization Is Too Much?

Experts generally recommend keeping your utilization rate below 30%, but the best results often come from staying under 10%.

- Under 10%: Excellent – lenders see this as very responsible.

- 10% – 29%: Good – still considered safe.

- 30% – 49%: Risk zone – may lower your score.

- 50% – 74%: Dangerous – signals financial stress.

- 75%+: Critical – may lead to rejections and high interest rates.

In 2025, with rising credit card APRs averaging over 21%, keeping balances low has become not just about credit score health, but also about avoiding crippling interest payments.

The Average American Household and Credit Use

The Federal Reserve’s 2024 Consumer Credit Report states that:

- The average U.S. credit card balance is $7,951.

- Across all cards, the average credit limit is almost $22,000.

- This translates to a national average utilization rate of 36%—well above the recommended 30% threshold.

For millions of households, this means credit scores are being held back not because of late payments, but because of high usage.

How Credit Utilization Affects Different Groups

Young Adults & Students

- Often have low credit limits ($500 – $2,000).

- Even small purchases can push utilization above 50%.

- Need to be extra careful, since early credit history sets the foundation for years.

Middle-Class Families

- Tend to rely on credit cards for everyday expenses.

- Inflation in housing, food, and healthcare has pushed many into higher balances.

- Risk: “good payers” who always make minimum payments but unknowingly damage their scores with high utilization.

Retirees

- Many live on fixed incomes and may use credit as a backup.

- A sudden medical bill or emergency purchase can spike utilization rates, lowering credit scores just when stability is needed most.

Methods for Reducing Credit Use in 2025

Make Over the Minimum Payment

Minimum payments do little to lower balances but keep accounts active. Quicker payments reduce utilization.

Distribute Purchases Among Several Cards

Spread out your spending rather than using all of your cards at once. Three cards at 30% usage each appear better than a single card at 90% utilization.

Request an Increase in Your Credit Limit

If you have a track record of making your payments on time, many banks will increase your limit. Setting a higher restriction immediately reduces utilization without lowering spending.

Make Appropriate Payment Times

At the conclusion of billing cycles, credit card companies report balances. You can lessen the amount that shows up on your credit report by making your payment before the closing date.

Think About Balance Transfers

Shifting debt to a lower-interest card can reduce utilization on one account and give breathing room, though fees and discipline are essential.

The Reasons Credit Use Is a National Economic Concern

By 2025, credit consumption is a national issue rather than merely a personal finance one. Policymakers are concerned about the financial soundness of households, and rising credit card debt has become a political talking issue.

- In the event that the economy deteriorates, high utilization rates may result in more defaults.

- Younger borrowers burdened with student loans face additional pressure from high credit card usage.

- Mortgage market risks grow as more Americans struggle to qualify for affordable rates due to utilization issues.

Financial institutions and regulators increasingly see credit utilization as a bellwether of economic resilience.

Credit Utilization’s Prospects in 2025 and Beyond

AI and Real-Time Scoring: Real-time transaction data is being used by credit bureaus more and more. Utilization may be even more important in models of “dynamic” credit scoring.

Alternative Lending: Fintech companies are exploring new ways to measure financial health, but utilization remains a core metric.

Policy Discussions: Lawmakers are considering reforms to help consumers avoid punitive interest rates when utilization spikes.

Last Thought: Why It Is Most Important

Credit utilization is more than just a percentage—it’s a financial signal. It tells lenders, insurers, and even potential employers whether you’re in control of your finances.

In 2025, when debt levels are rising and credit is tighter, this single factor may determine whether Americans can buy a home, refinance loans, or secure emergency financing.

Bottom line: Keep utilization low, monitor it closely, and treat it as one of the most powerful levers of financial success.

Dividend Reinvestment Plans (DRIPs) Explained: How They Work, Benefits & Risks

Dividend Reinvestment Plans (DRIPs) Explained: How They Work, Benefits & Risks