Why Billionaires Pay Lower Effective Tax Rates?

Why Billionaires Pay Lower Effective Tax Rates?

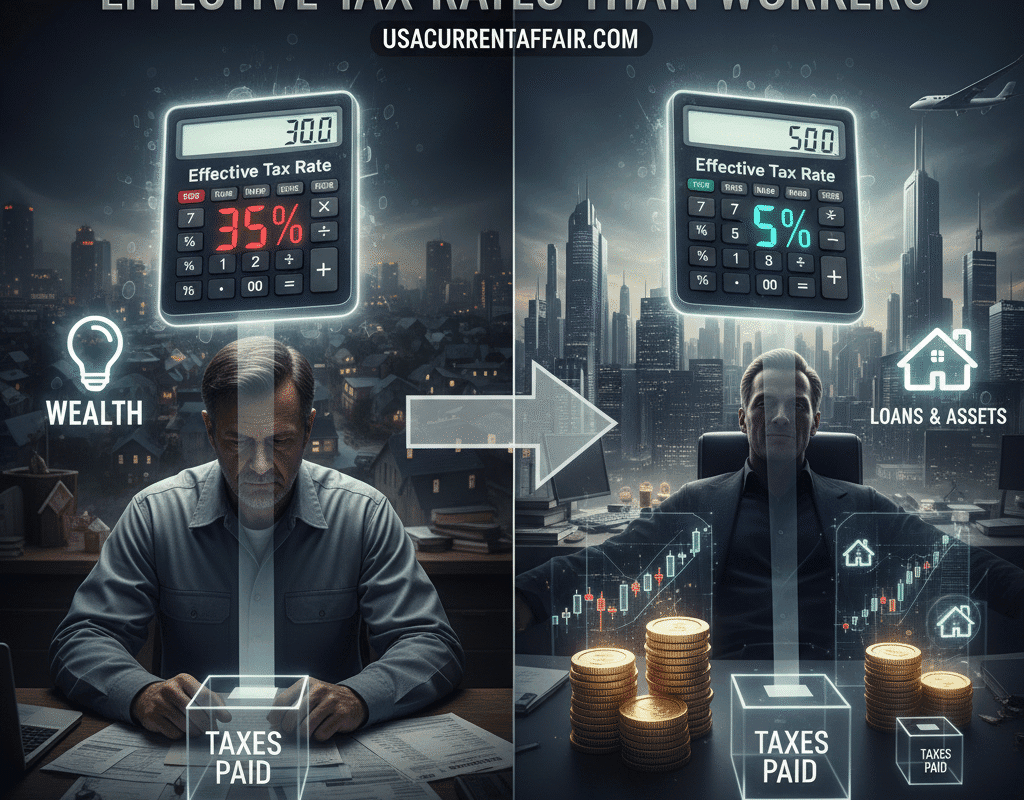

Few subjects spark as much discussion as the assertion that billionaires pay lower effective tax rates than regular workers, despite the fact that the American tax system has long been a contentious matter. The thought that the wealthiest people, some of whom earn more in a day than many workers earn in a year, may be subject to reduced tax rates seems fundamentally unjust to millions of Americans who pay taxes out of every paycheck.

However, the same pattern is constantly shown by data from research institutions, IRS statistics, and economists: ultra-high net worth individuals frequently pay far lower effective tax rates than wage-earning Americans. This is not the result of tax avoidance; rather, it is the result of a complex interplay between legal loopholes, tax structure, and the distinctive methods the wealthy produce and store

HSBC Cashback Credit Card 2025 – Benefits, Rewards & How to Apply?

Payroll Taxes Affect Employees, Not Billionaires

Payroll taxes account for a significant amount of what employees pay annually, even though income tax receives the most attention.

Employees have to pay:

- Social Security tax of 6.2%

- Medicare tax of 1.45%

- These payments are matched by employers.

However, billionaires frequently completely dodge payroll taxes due to:

- Only the first about $168,600 of wages are subject to Social Security tax.

- Income from investments is excluded.

This results in a striking disparity.

Trusts, Foundations, and Complex Wealth Vehicles Are Used by Billionaires

Elevated wealth To reduce their taxes, people frequently rely on complex legal frameworks. Among them are:

Annuity Trusts Retained by Grantors (GRATs)

- Tech and business titans use it

- transfers money to heirs with little to no taxes

Foundations for Charity

Permit contributors to:

- Obtain tax deductions

- maintain control over foundation expenditures

- Donate stock to avoid paying capital gains tax.

FLPs, or family limited partnerships

Lower the transferred assets’ taxable value

Offshore Organizations

Legal procedures for postponing foreign income taxes

For billionaires, capital gains from investments are a greater source of income.

Traditional paychecks are not given to the richest Americans. An analysis of billionaire wealth reveals:

- <5% comes from wages

- 95%+ comes from investment growth and capital gains

This is why capital gains tax rates matter far more to the wealthy than income tax rates.

Ordinary Americans cannot replicate this system because they rely on wages that are automatically taxed.

Political Power and Lobbying Affect Tax Policy

Corporations and billionaires spend a lot of money on lobbying to change tax legislation.

- Wealthy donors contribute to election campaigns

- Lobbyists draft tax loopholes

- Industries push for favorable tax treatment

This political influence ensures that many wealth-friendly provisions remain intact.

IRS Enforcement Gaps Benefit the Wealthy

For years, the IRS has been underfunded, making it easier for high-income individuals to avoid audits.

Statistics from government oversight reports:

- Audit rates for millionaires have plummeted over the past decade

- The IRS lacks the personnel and technology to examine complex tax returns

- Lower-income taxpayers are audited more frequently because it is simpler

Budget increases for IRS enforcement remain politically contentious, allowing wealthy Americans to maintain a system with limited oversight.

In conclusion: Why Billionaires Pay Lower Effective Tax Rates?

Billionaires pay lower effective tax rates than workers not because they cheat the system, but because the system is built in ways that benefit wealth over wages. From lower capital gains rates to unrealized gains, legal loopholes, borrowing strategies, and political influence, the ultra-rich navigate a tax code fundamentally different from the one that governs everyday workers.

As the debate over tax fairness continues, America faces a critical question: Should taxes reflect income alone — or overall wealth and ability to pay?

This issue will remain at the center of U.S. policy discussions, election debates, and the future direction of economic fairness in the country.