Why Americans File Taxes Every Year?

Why Americans File Taxes Every Year?

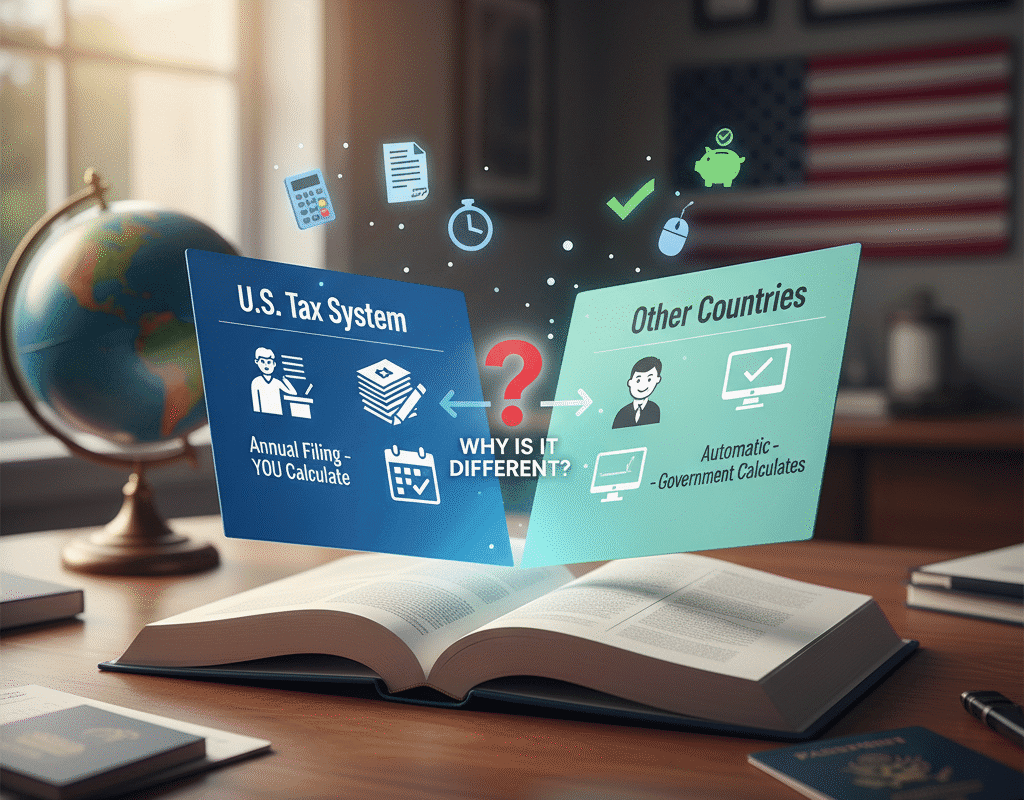

When the clock strikes midnight on December 31st, millions of Americans prepare for one of the most annual rituals in the United States: filing taxes. Unlike most countries, the United States mandates that its citizens, regardless of whether they live inside or outside the country, submit annual tax returns. This annual obligation is unique in the global context and often puzzles foreigners. But why do Americans file taxes every year, and what sets the U.S. tax system apart from the rest of the world?

HSBC Cashback Credit Card 2025 – Benefits, Rewards & How to Apply?

A Unique Approach: The U.S. Tax System

Unlike countries such as the United Kingdom, Germany, or Japan, where tax authorities often calculate your tax automatically based on income reported by employers, the United States follows a self-reporting model. The Internal Revenue Service (IRS) relies on individuals to calculate and declare their income, exemptions, deductions, and credits.

In countries with automatic taxation systems, employers typically withhold taxes and submit them directly to the government. Citizens rarely have to fill out a comprehensive annual tax return unless they have additional income or specific deductions. The U.S., however, places the responsibility on the taxpayer, which has created a culture of annual tax filing.

Historical Roots of American Tax Filing

The practice of annual tax filing in the United States has deep historical roots. The federal income tax was first introduced in 1861 to fund the Civil War. However, it became more formalized with the ratification of the 16th Amendment in 1913, which granted Congress the authority to levy income taxes directly on individuals.

The annual filing requirement arose as a way to ensure compliance and proper calculation of taxes owed. The IRS wanted a standardized method for collecting revenue, so the government required citizens to report their income yearly. This process also allowed the U.S. to implement a progressive tax system, where individuals with higher incomes pay higher tax rates—a system that remains in place today.

Accountability and Self-Reporting

The self-reporting principle is one of the primary reasons Americans file taxes each year. In essence, the IRS trusts taxpayers to honestly report their income and calculate taxes owed. While the agency receives information from employers and financial institutions, it still relies on individual submissions to account for deductions, exemptions, credits, and other complex situations.

This approach has benefits and drawbacks. On the one hand, it empowers taxpayers to take advantage of deductions and tax credits, potentially reducing their tax liability. On the other hand, it can create confusion and stress, as the U.S. tax code is notoriously complicated, with thousands of pages of regulations.

The Role of Payroll Taxes

Beyond income taxes, Americans also pay payroll taxes for Social Security and Medicare. Employers withhold these taxes from paychecks throughout the year. While some might assume this would eliminate the need for filing, annual tax returns ensure that any overpayment or underpayment is corrected. This reconciliation is crucial to determine tax refunds or additional liabilities.

Cultural and Psychological Factors

Filing taxes in the United States is more than just a legal obligation—it’s a cultural ritual. Americans often see tax season as a time to organize finances, claim deductions, and plan for the year ahead. For some, receiving a refund is a celebrated annual event, reinforcing the habit of filing taxes every year.

The psychological impact of tax filing also extends to financial awareness. By requiring citizens to actively engage with their income, deductions, and liabilities, the system encourages personal responsibility and financial literacy.

Challenges of the American System

Despite its benefits, the American annual tax filing system has notable challenges:

- Complexity: The IRS estimates that Americans spend billions of hours collectively preparing tax returns. The tax code is intricate, and many people rely on tax software or professional accountants.

- Stress: April 15th, the traditional tax deadline, is a source of stress for millions. Mistakes can lead to penalties, interest, or audits.

- Equity Concerns: Some critics argue that the self-reporting system favors those with resources to hire professionals, while lower-income taxpayers struggle with compliance.

Why the U.S. Sticks with Annual Filing

Despite the complexity, the U.S. continues to require annual tax filing for multiple reasons:

- Revenue Accuracy: Self-reporting ensures that all eligible deductions and credits are claimed while maintaining fairness in a progressive tax system.

- Legal Tradition: The annual filing requirement has been embedded in U.S. law for over a century, making reform difficult.

- Policy Flexibility: Annual reporting allows lawmakers to introduce new credits, deductions, and incentives each year, which are then accounted for in filings.

- Citizen Oversight: By filing taxes, Americans actively participate in the financial system and indirectly oversee government revenue collection.

Why the United States Continues to Use Annual Filing

The United States still mandates yearly tax filing despite its complexity for a number of reasons:

- Revenue Accuracy: In a progressive tax system, self-reporting guarantees that all allowable credits and deductions are claimed while upholding equity.

- Legal Tradition: Since the annual filing obligation has been ingrained in American law for more than a century, revision is challenging.

- Policy Flexibility: New credits, deductions, and incentives can be introduced annually by lawmakers and recorded in filings thanks to annual reporting.

- Citizen Oversight: Americans indirectly supervise government income collection by actively participating in the financial system through tax filing.

In conclusion: Why Americans File Taxes Every Year?

The American practice of filing taxes every year is a product of history, law, and culture. It distinguishes the United States from most other countries, where taxation is often automatic and invisible to citizens. While complex and sometimes stressful, annual filing reinforces a culture of accountability, financial awareness, and participation in government systems.

Understanding why Americans file taxes annually sheds light on broader issues of taxation, governance, and civic responsibility. For citizens and foreigners alike, it highlights the unique balance between individual responsibility and government oversight that defines the U.S. tax system.

How Federal Reserve Instant Payments Are Revolutionizing Banking in the U.S.

How Federal Reserve Instant Payments Are Revolutionizing Banking in the U.S.