When to Rebalance Your Portfolio?

When to Rebalance Your Portfolio?

Investors frequently ask the crucial question, “When should I rebalance my portfolio?” in today’s dynamic financial markets. The timing of rebalancing can make a significant difference in long-term returns, risk management, and overall financial stability.

This guide dives deep into the what, why, and when of portfolio rebalancing, helping both beginners and seasoned investors align their strategies with 2025’s economic realities.

HSBC Cashback Credit Card 2025 – Benefits, Rewards & How to Apply?

What is meant by portfolio rebalancing?

The practice of realigning the weight of assets in an investment portfolio is known as portfolio rebalancing. The rates of growth of stocks, bonds, and alternative assets vary throughout time. Your portfolio can deviate from its initial target allocation if you don’t rebalance.

For instance:

- A soaring stock market may cause you to switch to 75% stocks and 25% bonds, increasing your risk exposure, if your target is 60% stocks and 40% bonds.

- Rebalancing ensures that risk aligns with your financial objectives by returning the portfolio to its original composition.

The Importance of Rebalancing in 2025

Concerns about inflation, changes in Federal Reserve policy, and the quick development of technology in markets will all influence the U.S. financial scene in 2025. Rebalancing has never been more important due to increased volatility.

Advantages of Rebalancing

- Controlling risk helps you keep your portfolio in line with your tolerance.

- Profit Capture: This compels you to “buy low, sell high.”

- Long-Term Stability: Prevents rash choices during market fluctuations.

- Retirement Security: Prevents excessive exposure to risky investments in retirement accounts.

Signs It’s Time to Rebalance Your Portfolio

Although it might be challenging to time portfolio rebalancing, there are certain important indicators:

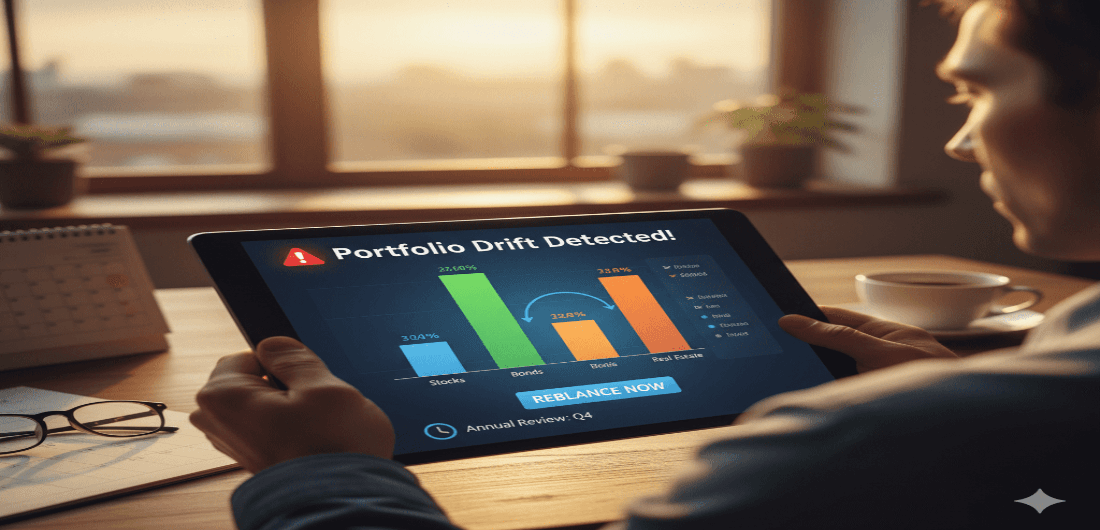

Drift in Asset Allocation

Rebalancing is necessary if your goal allocation deviates by more than 5–10%. For instance, a 70/30 portfolio turning into an 80/20 one.

Semi-Annual or Annual Examinations

Most financial advisors recommend checking once or twice a year. This avoids excessive trading while keeping your plan on track.

After Major Life Events

- Retirement

- Marriage or divorce

- Buying a home

- Receiving an inheritance

These milestones can change your financial goals — requiring portfolio adjustments.

Market Volatility

In times of sharp stock market rallies or downturns, your portfolio may quickly become unbalanced.

What is the ideal frequency for rebalancing?

Although experts disagree on this issue, the following are typical approaches:

Rebalancing Based on the Calendar

- On a predetermined timetable (quarterly, semi-annually, or annually), rebalance.

- straightforward and reliable.

Using a Threshold to Balance

- Only when allocations diverge by more than a predetermined percentage (5%, 10%) should you rebalance.

- more adaptable to the state of the market.

Hybrid Method

- Every year, check, but only rebalance if assets are noticeably out of line.

- lowers trading expenses without sacrificing discipline.

Tax Consequences of Rebalancing

U.S. investors need to think about the tax implications:

- Taxable Accounts: Capital gains taxes may be due when assets are sold.

- Since there is no urgent tax obligation, tax-advantaged accounts (401k, IRA) are safer for rebalancing.

- Tax-Loss Harvesting: Sell underperforming assets to offset gains.

Rebalancing Retirement Portfolios

Rebalancing becomes even more crucial for retirees:

- Protecting Income Streams – Ensures enough fixed-income investments for withdrawals.

- Reducing Market Shock Risk – Avoids being overexposed to stocks in downturns.

Aligning with RMDs (Required Minimum Distributions) – Strategic rebalancing helps meet IRS withdrawal requirements.

Professional Perspectives for 2025

In 2025, financial gurus advise American investors to do the following:

- Rebalancing is about consistency, not market timing, so maintain your discipline.

- Utilize Technology: Automated rebalancing is now available through brokerage tools and robo-advisors.

- Think Global: Stability is added by international diversification.

- Examine Other Options: ETFs, commodities, and real estate can all be used to help hedge against inflation.

Case Study: Portfolio Rebalancing in Action

Scenario:

- John, 45, with a $500,000 portfolio (60% stocks, 40% bonds).

- After a bull market, stocks rise, shifting allocation to 75% stocks, 25% bonds.

- Risk exposure now exceeds his comfort zone.

Rebalancing Move:

- John sells $75,000 of stock funds.

- He reinvests into bonds to restore 60/40.

- This ensures his portfolio aligns with his retirement timeline.

Conclusion: When Is It Time to Rebalance?

Rebalancing your portfolio is most effective when:

- The deviation of your allocations is greater than 5–10%.

- You carry out a review every year or every six months.

- Your funds are impacted by significant life or market events.

Rebalancing ultimately comes down to constant discipline rather than “perfect timing.” Investors in 2025 may preserve capital, seize gains, and continue on their path to financial independence by remaining proactive.

The Latte Factor: Myth or Reality? Breaking Down the Personal Finance Debate

The Latte Factor: Myth or Reality? Breaking Down the Personal Finance Debate