Understanding Insurance Deductibles:

Understanding Insurance Deductibles:

One of the most crucial financial instruments available to American families and individuals is insurance. All types of insurance, including health, auto, house, and renters insurance, shield you against unforeseen financial difficulties. The deductible, however, is a term that policyholders frequently misunderstand.

Because insurance deductibles have a direct impact on your monthly premiums, out-of-pocket costs, and overall financial planning, it is imperative that you comprehend how they operate. In this detailed article, we’ll break down the meaning of deductibles, the different types, how they vary across insurance categories, and tips for choosing the right deductible for your situation.

HSBC Cashback Credit Card 2025 – Benefits, Rewards & How to Apply?

An Insurance Deductible: What Is It?

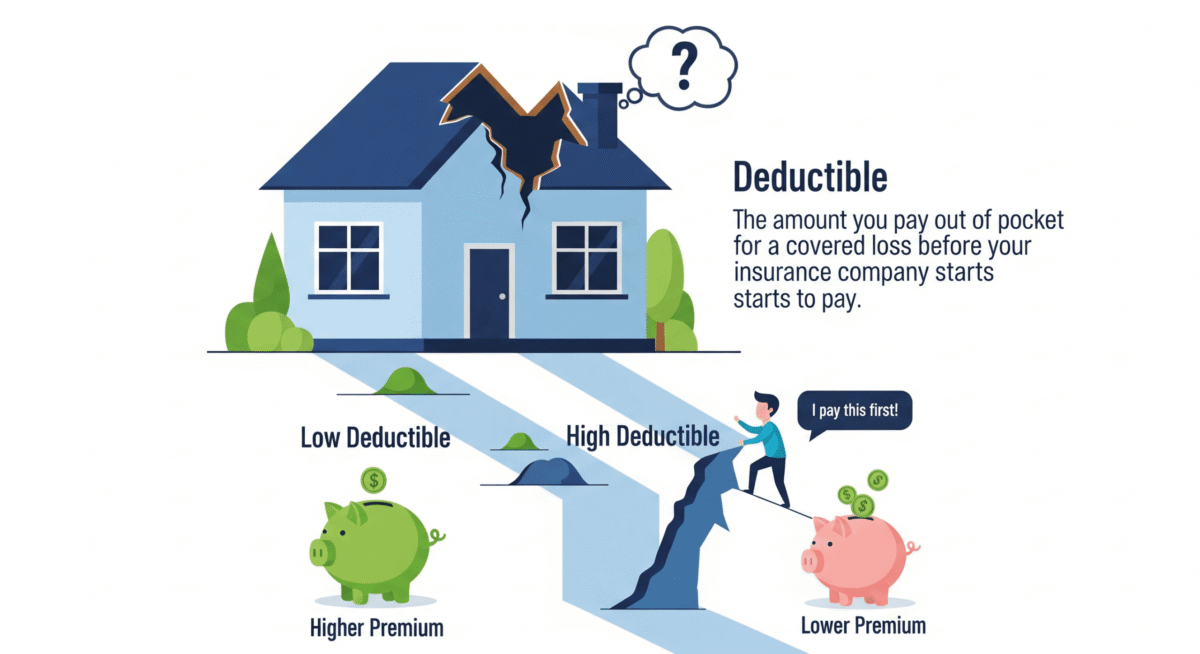

The amount you must pay out of pocket as a policyholder before your insurance company starts to pay the remaining costs is known as your insurance deductible.

For instance:

- If you have a $1,000 deductible on your auto insurance coverage and you are in an accident that results in $5,000 in damages, you will have to pay $1,000 up front. The remaining $4,000 will subsequently be paid by the insurance.

- Depending on your plan, you may have to pay $2,000 in medical bills before your insurance begins to cover charges if your deductible is $2,000 in health insurance.

Simply said, your monthly premium will be lower the larger your deductible is, and vice versa.

Why Do Insurance Deductibles Exist?

Deductibles exist for several important reasons:

- Preventing Minor Claims: Without deductibles, people might file small, frequent claims, which would raise costs for insurers.

- Shared Risk: Deductibles ensure that policyholders share some financial responsibility, reducing the overall risk for insurers.

- Lower Premiums: Deductibles allow insurance companies to offer lower premiums to those willing to take on more out-of-pocket costs.

- Encouraging Responsible Behavior: For example, in auto insurance, having a deductible encourages drivers to be more cautious.

Insurance Deductible Types

Deductibles are not all made equal. The following sorts may be encountered, depending on your insurance policy:

The standard deduction

A set sum that you have to pay before your insurance starts. prevalent in house and auto insurance.

Percentage Deductible

Instead of a flat dollar amount, your deductible is a percentage of your policy’s total coverage. This is often used in homeowners’ insurance, especially for natural disasters.

Example: If your home is insured for $200,000 and your deductible is 2%, you must pay $4,000 before insurance covers the rest.

Cumulative Deductible

Applies when multiple coverages are bundled together. You must meet the total deductible before any benefits are paid.

Deductible Per Claim

Every time you submit a claim, you have to pay a deductible. In property insurance, this is typical.

The yearly deduction

Most prevalent in health insurance. Throughout a calendar year, you pay for medical bills until you reach the deductible amount. Your insurer then begins to pay for expenses.

Insurance Deductibles by Category

1.Deductibles from Health Insurance

Annual deductibles are a common feature of health insurance in the United States. Your insurance covers a percentage of the covered treatments after you meet the deductible, but you can still be responsible for co-payments or coinsurance until you hit your out-of-pocket maximum.

- HDHPs, or high deductible health plans, have higher upfront expenses but lower premiums. frequently combined with HSAs (Health Savings Accounts).

- Plans with low deductibles have higher initial premiums but more coverage.

For instance, if your hospital bill is $5,000 and your deductible is $1,500, you will pay $1,500 and the insurer will cover the remaining amount (based on co-insurance terms).

2.Auto Insurance Deductibles

Auto policies often use per-claim deductibles. Common deductibles range from $250 to $1,500.

- Collision Coverage Deductible: Applies if your car is damaged in an accident.

- Comprehensive Coverage Deductible: Applies for damages not caused by a collision (theft, natural disasters, vandalism).

Tip: Drivers with older cars may opt for higher deductibles since repair costs may not justify lower deductibles.

3.Homeowners Insurance Deductibles

Homeowners insurance protects against damages like fire, theft, or natural disasters. Deductibles can be either flat-rate or percentage-based.

- Standard Deductible: Often $500–$2,500.

- Percentage Deductible: Common for hurricane or earthquake coverage, typically 1–5% of the insured home value.

Example: If your home is insured for $300,000 and you have a 3% deductible, you must pay $9,000 before insurance coverage applies.

4.Renters Insurance Deductibles

Renters insurance also requires deductibles, usually $500 to $1,000. This applies when your belongings are stolen or damaged.

Which Is Better, High Deductible or Low Deductible?

Your financial status and level of risk tolerance will determine whether you choose a high or low deductible.

- Elevated Deductible

- Benefits: Cheaper monthly rates, ideal for responsible drivers or healthy people.

- Cons: Increased up-front expenses while filing a claim.

- Minimal Deductible

- Benefits: Insurance begins to pay out sooner and causes less financial strain when a claim is made.

- Cons: Monthly premiums are higher.

Rule of thumb: A high deductible could save you money if you have emergency funds and don’t often submit claims. Choose a low deductible if you desire peace of mind or expect to need medical treatment frequently.

Considerations for Selecting an Insurance Deductible

- Monthly Budget: Are you able to pay for unforeseen high out-of-pocket expenses or rising premiums?

- Savings Cushion: If necessary, do you have adequate emergency funds to pay a high deductible?

- Risk Exposure: Lower deductibles may be advantageous for those who travel frequently, have health issues, or live in disaster-prone locations.

- Asset Value: Low deductibles might not be justified by low-value possessions or older vehicles.

- Plans Sponsored by the Employer: Verify whether your workplace provides HSAs or deductible support for health insurance.

In Conclusion

One of the most crucial components of any policy is the insurance deductible. They establish your monthly payment amount as well as your emergency financial responsibilities.

- Take your savings and medical history into account when purchasing health insurance.

- Consider your driving habits and car’s worth when purchasing vehicle insurance.

- Consider the dangers of natural disasters when purchasing home insurance.

In the end, the ideal deductible is the one that strikes a balance between cost, risk, and comfort. Knowing how deductibles operate can help you make more informed decisions that will safeguard your future and finances.

How to Create a Business Emergency Fund: Complete Guide for U.S. Entrepreneurs

How to Create a Business Emergency Fund: Complete Guide for U.S. Entrepreneurs