Understanding Debt-to-Income Ratio (DTI):

Understanding Debt-to-Income Ratio (DTI):

Millions of Americans’ borrowing experiences are still shaped by the Debt-to-Income Ratio (DTI), a crucial indicator in the current uncertain economic climate when inflation, rising interest rates, and stricter lending rules dominate financial news. When discussing loan approvals, credit scores frequently take center stage, but lenders across place equal weight on knowing how much of a borrower’s monthly income is used to pay off debt.

The Debt-to-Income Ratio is more than a financial formula—it is a reflection of a household’s financial health, stability, and long-term borrowing capacity. As Americans strive to buy homes, refinance mortgages, or secure personal loans in 2025, knowing how this ratio works has never been more critical.

HSBC Cashback Credit Card 2025 – Benefits, Rewards & How to Apply?

What Is the Ratio of Debt to Income?

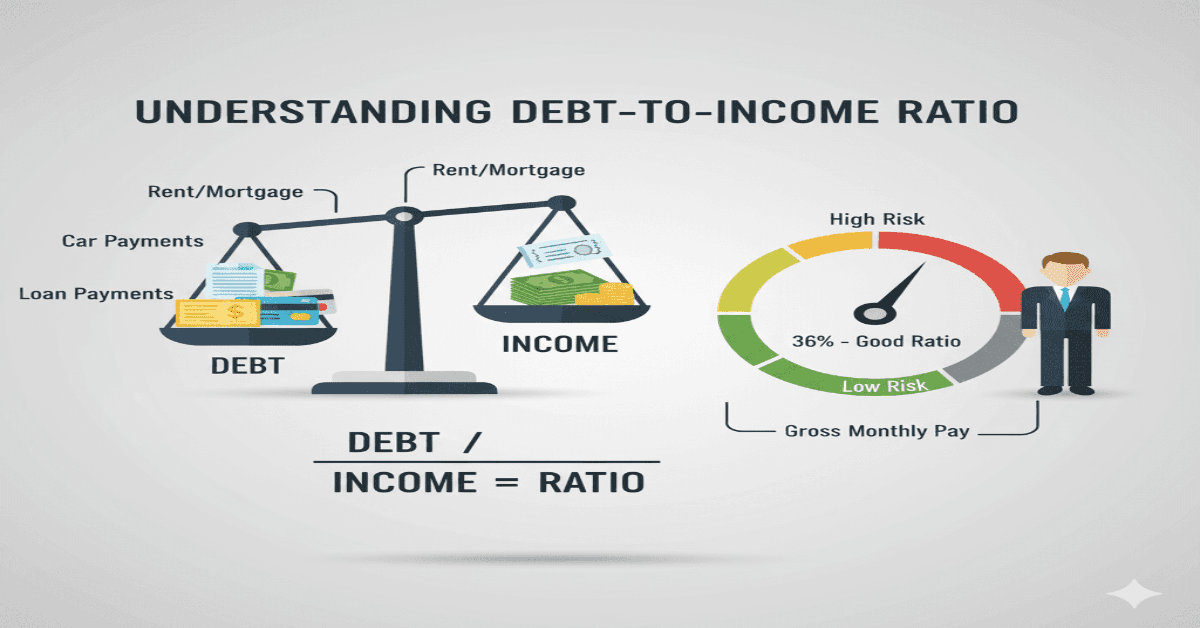

The Debt-to-Income Ratio (DTI) is essentially a percentage that contrasts your monthly debt payments with your gross monthly income (before taxes and deductions).

The equation is straightforward:

DTI = (Total Monthly Debt Payments ÷ Gross Monthly Income) × 100

For instance:

- Your DTI would be 33% if your gross monthly income was $6,000 and your monthly debts (credit cards, school loans, auto payments, and mortgage) totaled $2,000.

- This figure enables lenders to determine whether your finances are already overburdened or if you can manage taking on further debt.

Why the Debt-to-Income Ratio Is Used by Lenders

When you apply for a mortgage, auto loan, or personal loan, lenders evaluate risk. A high credit score demonstrates responsibility in managing past credit, but your DTI shows how much capacity you have left to take on new obligations.

- High DTI (over 43%) → Suggests financial strain, higher risk of missed payments.

- Moderate DTI (30–40%) → Indicates manageable debt but potential limits on borrowing.

- Low DTI (below 30%) → Signals financial stability and strong likelihood of repayment.

In short, DTI is a forward-looking indicator. A borrower may have an excellent credit score but still be denied a loan if their DTI suggests they cannot realistically handle another payment.

Back-end versus front-end DTI

The debt-to-income ratio is frequently divided into two categories by lenders, especially in the mortgage sector:

House Ratio (Front-End Ratio):

- proportion of income allocated to housing expenses (rent or mortgage, property taxes, homeowners insurance, and HOA dues).

- As an illustration, the front-end ratio is 25% ($6,00 ÷ $1,500 in housing expenses).

Total Debt Ratio, or Back-End Ratio:

- percentage of income devoted to total debts (personal loans, credit card payments, student loans, auto loans, and housing).

- Example: $2,500 total debts ÷ $6,000 income = 41% back-end ratio.

Most lenders focus more on the back-end DTI, as it paints the full financial picture.

What Is a Good Debt-to-Income Ratio?

The definition of a “good” DTI depends on the type of loan and lender requirements. However, general guidelines used across the financial industry include:

- Conventional Mortgages: Maximum 43–45% DTI (some exceptions up to 50%).

- FHA Loans: Typically allow up to 57% combined DTI in special cases.

- VA Loans: Prefer 41% or lower, but flexible with strong compensating factors.

- Personal Loans: Varies by lender, often 35–40% or below.

- Auto Loans: Usually less strict, but lenders still prefer below 45%.

Ideal DTI Range:

- 20–30%: Excellent (room for future borrowing).

- 30–40%: Acceptable (manageable but watch spending).

- Above 43%: Risky territory (may limit loan approvals).

Debt-to-Income Ratio vs. Credit Score

Although they serve different purposes, DTI and credit score work hand-in-hand during the loan approval process.

- Credit Score: Measures your history of repayment and creditworthiness.

- DTI Ratio: Measures your current ability to manage debt relative to income.

A borrower with a high credit score but high DTI may be denied, while someone with a moderate score and low DTI may still be approved. Both metrics are crucial for lenders.

How to Determine Your Own Ratio of Debt to Income

List every loan payment due each month:

Rent or mortgage

- Auto loans

- Student loans

- Minimum payments on credit cards

- Individual loans

- Any additional debt in installments

Determine your gross monthly revenue.

- Pre-tax salary

- Commissions and bonuses (if regular)

- revenue from a business (if consistent)

- Child support or alimony (if applicable)

Use the following formula:

DTI% is equal to Total Monthly Debt ÷ Gross Monthly Income × 100.

For instance:

- Monthly debt = $1,800

- Gross Income = $5,500

- DTI = 32.7%

Why Debt-to-Income Ratio Matters in 2025

As interest rates remain elevated and inflation pressures household budgets, lenders are paying closer attention to DTI than ever before. Americans already face record-high credit card balances, with the Federal Reserve reporting over $1 trillion in revolving debt nationwide.

A manageable DTI not only improves the chances of loan approval but also protects households from becoming financially overextended during uncertain economic times.

Methods for Raising Your DTI Ratio

You can take proactive measures to reduce your DTI if it is excessively high:

Reduce Debt

- Prioritize high-interest credit card loans.

- Employ the avalanche method (highest interest first) or the snowball method (smallest balances first).

Steer clear of new debt

- Put off large purchases that need to be financed.

- Avoid creating pointless credit accounts.

Raise Your Income

- Look for freelance work, part-time jobs, or overtime.

- Ask for a raise or look into more lucrative options.

Consolidate or refinance loans

- Take into account refinancing at a reduced interest rate.

- Combine several debts into one affordable payment.

Make Additional Payments

- Long-term debt can be paid off more quickly with even modest additional principal payments.

Debt-to-Income Ratio and Mortgages

For aspiring homeowners, DTI often becomes the deciding factor in whether a mortgage application is approved. In fact, lenders evaluate DTI more strictly than for other types of loans because mortgages are long-term commitments.

- Conventional Loans: Most accept DTIs up to 43–45%.

- FHA Loans: Allow higher DTIs, making them popular for first-time buyers.

- VA Loans: No official DTI cap, but 41% is the standard guideline.

- USDA Loans: Typically prefer DTIs below 41%.

A borrower with a high DTI might still be approved for a mortgage if they have significant savings, excellent credit, or a strong employment history.

The Ratio of Debt to Income and Student Loans

One of the biggest causes of high DTIs among younger borrowers is still student debt. Many graduates are experiencing strain when repayment resumes after interruptions during the outbreak.

- Even if a student loan is on deferment, lenders still include the minimum monthly payment toward DTI.

- Income-driven repayment schemes can increase borrowing capacity by lowering DTI and reducing monthly commitments.

The Ratio of Debt to Income and Credit Cards

When calculating DTI, credit card debt is a major factor. The minimum monthly payments are covered even if you don’t have any sizable balances. The problem is made worse by the fact that high utilization might also have an indirect impact on your credit score.

The Effects of DTI on the Mind

A high debt-to-income ratio causes emotional stress in addition to financial stress. Families with a DTI of 50% or more frequently report:

- Anxiety about money

- Having trouble saving money for emergencies

- Relationship stress

- Restricted options for professional paths

Improving DTI lowers stress and raises quality of life in addition to increasing financial prospects.

Ratio of Debt to Income in the Overall Economy

Household DTIs have an impact on the health of the economy nationally. High average DTI levels can:

- Reduce consumer spending power

- Increase default rates on loans

- Slow down housing market growth

- Contribute to tighter credit conditions

Conversely, when households maintain manageable DTIs, economies are more resilient, with healthier borrowing and spending cycles.

Last Word

Americans need to be more aware of their debt-to-income ratios as financial strains increase in 2025. Although having a high credit score can lead to opportunities, the DTI has the final say over whether or not those opportunities are maintained. Households can set themselves up for future security and opportunity by making wise financial decisions, managing debt sensibly, and maintaining a high income.

DTI serves as a personal financial compass in addition to being a tool for lenders. The difference between financial stress and long-term security can be found in knowing your number, comprehending its implications, and striving for improvement.

Why Penny Stocks Are Risky: Hidden Dangers Every Investor Should Know

Why Penny Stocks Are Risky: Hidden Dangers Every Investor Should Know