The Rule of 72 Explained:

The Rule of 72 Explained:

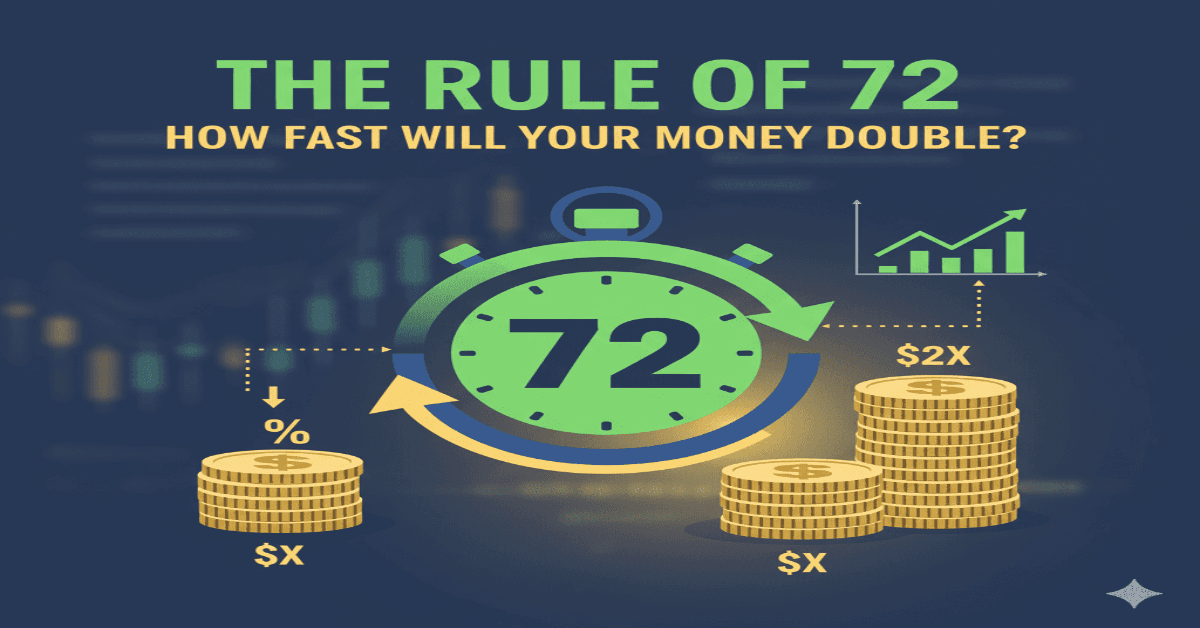

In today’s uncertain economy, where inflation, interest rates, and market volatility dominate financial news, one simple question is on everyone’s mind: “How fast will my money double?”

Enter the Rule of 72 — a centuries-old yet remarkably simple formula that helps investors, savers, and even policymakers estimate how long it takes for money to double at a given rate of return. While Wall Street analysts rely on complex models and algorithms, this straightforward rule continues to be a powerful financial shortcut that anyone can use.

HSBC Cashback Credit Card 2025 – Benefits, Rewards & How to Apply?

The Rule of 72: What is it?

Given a set yearly rate of return, the Rule of 72 is a fast mathematical formula that can be used to calculate how many years it will take for an investment to double in value.

The formula

72÷Interest Rate=Years to Double

For instance:

- At 6% interest, your money doubles in 12 years (72 ÷ 6 = 12).

- At 8% interest, your money doubles in 9 years (72 ÷ 8 = 9).

- At 12% interest, your money doubles in 6 years (72 ÷ 12 = 6).

The beauty lies in its simplicity. No spreadsheets, no complex calculations — just one division problem.

Origins of the Rule of 72

Historians trace the Rule of 72 back to Italian mathematician Luca Pacioli in the late 15th century, the same man who is often called the “Father of Accounting.” However, the concept itself is rooted in compound interest mathematics, which was studied as early as the 13th century.

Financial institutions embraced it in the 20th century as an educational tool, allowing bankers and advisors to help everyday customers understand the power of compounding.

Today, the Rule of 72 is taught in business schools, financial literacy programs, and even high school economics classes across the United States.

Why the Rule of 72 Still Matters in 2025

In a year when the Federal Reserve’s interest rate policies dominate headlines and investors are grappling with market volatility, knowing how fast money grows is crucial.

- Rising Inflation: With inflation eroding purchasing power, Americans want to know how quickly their savings must grow just to keep up.

- Retirement Planning: Baby boomers nearing retirement and Gen Z entering the workforce both need a simple framework for understanding compound growth.

- Investment Choices: From stocks and bonds to crypto and real estate, investors use the Rule of 72 to compare potential returns.

This makes the Rule of 72 not just a mathematical curiosity but a practical survival tool in today’s financial landscape.

Examples of the Rule of 72 in Practice in the Real World

2025 Savings Accounts

The average U.S. savings account interest rate in 2025 hovers around 0.5% to 1%. Using the Rule of 72:

- At 1%, money doubles in 72 years.

- At 0.5%, money doubles in 144 years.

Clearly, traditional savings accounts do not grow wealth meaningfully.

Stock Market Returns

Historically, the S&P 500 has delivered around 7–10% annual returns over the long term.

- At 7%, money doubles in ~10 years.

- At 10%, money doubles in ~7 years.

This explains why financial advisors encourage long-term stock market investments for wealth building.

Inflation’s Impact

- Inflation works against you by halving purchasing power over time.

- At 6% inflation, the Rule of 72 shows your money loses half its value in 12 years.

- That means a basket of groceries costing $100 today will cost $200 in 12 years if inflation remains at 6%.

Cryptocurrency and High-Risk Investments

Some investors chase returns of 20% or higher in crypto and speculative assets.

- At 20%, money doubles in just 3.6 years.

However, such investments also carry extreme volatility — meaning your money could just as easily vanish.

Real Estate

Real estate typically returns around 4–6% annually through appreciation and rental yields.

- At 6%, property values double in 12 years.

This explains why real estate remains a favorite for long-term investors seeking steady growth.

The Rule’s Mathematic Basis

The logarithmic formula for compound growth is really approximated by the Rule of 72:

Formula:

t = In(2) / In(1+r)

Where:

t = time to double

r = interest rate

The number 72 works well because it is highly divisible (by 2, 3, 4, 6, 8, 9, 12). This makes mental math easier.

For interest rates between 6% and 10%, the Rule of 72 is very accurate, with only a small margin of error.

The Rule of 72’s benefits

- Simplicity: No need for a calculator.

- Fast Decision-Making: Instantaneous Investment Comparison.

- Financial Literacy Tool – Great for beginners learning compound interest.

- Universal Application – Works for savings, investments, debt, and inflation.

Limitations of the Rule of 72

- Accuracy – Best for rates between 6% and 10%; less accurate at very high or very low rates.

- Doesn’t Consider Taxes & Fees – Real returns may be lower.

- Market Volatility – Assumes a fixed rate of return, which is rarely the case in real markets.

Comparing the Rules of 72, 70, and 69

Because they are theoretically closer to the actual logarithmic formula, some economists choose the Rule of 70 or Rule of 69.3.

- Rule of 69.3 is most accurate for continuous compounding.

- Rule of 70 is sometimes used in macroeconomics (e.g., GDP growth).

- Rule of 72 wins in practicality and ease of use.

The 72-rule in personal finance

Planning for Retirement

Your money doubles every nine years if your retirement portfolio generates an average of 8% annually. There will be more doubling cycles before retirement if you start earlier.

Growth in Debt

The Rule of 72 is applicable to credit card debt as well as savings. If left unpaid, debt doubles in just four years at an interest rate of 18%.

Savings for College

The formula can be used by parents who are saving for their child’s education to estimate how much their current savings will be worth when the youngster turns 18.

How the Rule of 72 Will Be Used in 2025

- Examine your investment options, including stocks, bonds, and real estate.

- Track Inflation Impact – Estimate how fast costs will double.

- Plan Retirement More Accurately – Understand growth cycles.

- Assess Risk – High returns may double money fast but carry more danger.

Rule of 72 in Global Economic News

Governments and economists also use the Rule of 72 to forecast economic growth and population trends.

For example:

- If a country’s GDP grows at 3% annually, it doubles in about 24 years.

- If inflation averages 4%, the cost of living doubles in 18 years.

This makes the rule not just personal finance advice but a macro-economic forecasting tool.

In Conclusion

The Rule of 72 is more than just a mathematical shortcut. It provides insight into the power of compound interest, which is the same force that gradually increases debt or creates riches.

Whether you’re planning retirement, saving for a child’s college, or simply trying to outpace inflation, this rule provides a quick and powerful reality check.

One issue is universal as the U.S. economy enters 2025: How quickly will your money double? This question is influenced by changing interest rates, inflation worries, and international uncertainties.

With the Rule of 72 in your toolkit, the answer is only a simple calculation away.

How to Stop Keeping Up with the Joneses: Smart Money Habits for a Happier Life

How to Stop Keeping Up with the Joneses: Smart Money Habits for a Happier Life