The Impact of Reshoring Manufacturing on Inflation:

The Impact of Reshoring Manufacturing on Inflation:

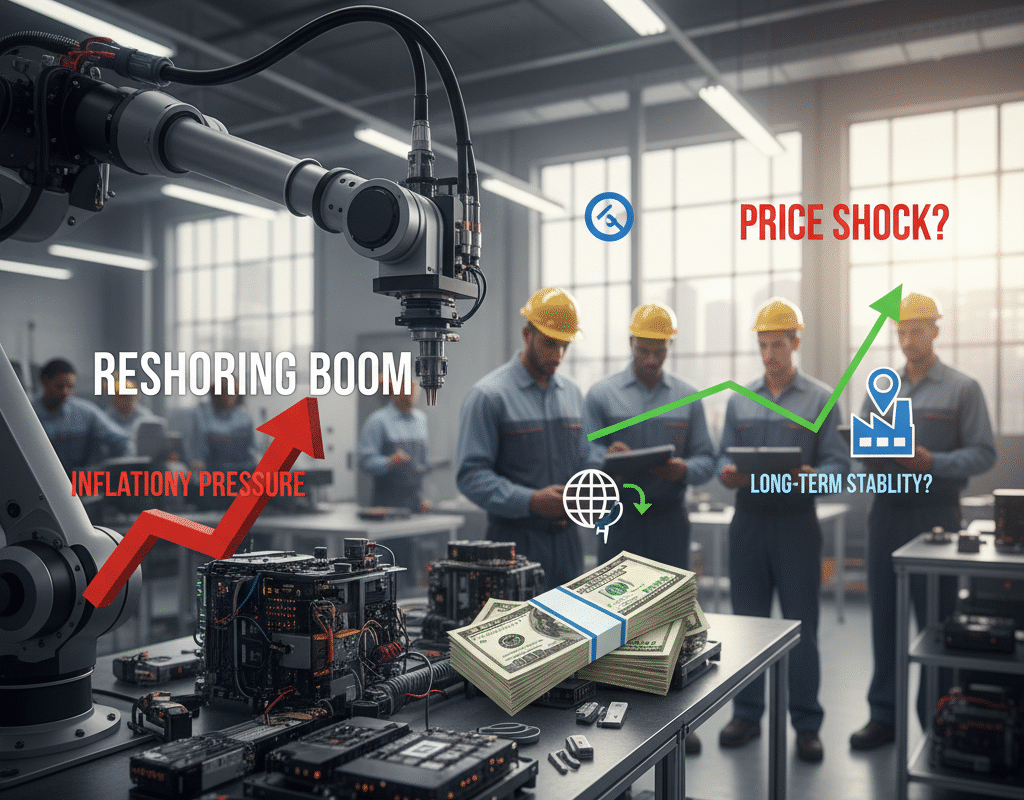

In recent years, the United States has witnessed a significant policy shift towards reshoring manufacturing — the process of bringing production back home from overseas. This move has sparked intense debate among economists, policymakers, and business leaders about its potential impacts on inflation.

With supply chains disrupted by the COVID-19 pandemic, rising geopolitical tensions, and the desire to reduce dependence on foreign manufacturing, reshoring has emerged as both an economic strategy and a national security priority. Understanding how this trend affects inflation is crucial for investors, consumers, and the broader public.

HSBC Cashback Credit Card 2025 – Benefits, Rewards & How to Apply?

Comprehending Manufacturing Reshoring

Reshoring refers to the strategic relocation of production and supply chains from foreign countries back to the domestic economy. Over the past few decades, globalization encouraged companies to offshore manufacturing to countries with lower labor costs, such as China, Mexico, and Southeast Asian nations. While this reduced production costs and allowed for cheaper goods, it also created vulnerabilities in supply chains and exposed the U.S. economy to global disruptions.

The COVID-19 pandemic highlighted these vulnerabilities. Lockdowns, transportation delays, and factory closures in overseas markets led to shortages of essential goods, from electronics to medical supplies. As a result, companies and policymakers began advocating for reshoring as a means to strengthen domestic production, secure supply chains, and stabilize the economy.

Challenges of Reshoring

Despite its potential benefits, reshoring manufacturing presents several challenges:

- Higher Initial Costs: Transitioning production from overseas to domestic facilities involves substantial capital investment, retooling factories, and logistical planning.

- Workforce Skill Gaps: U.S. manufacturing requires skilled labor capable of handling modern machinery and automated systems. Workforce training programs must keep pace with reshoring efforts.

- Global Trade Pressures: Reshoring could trigger retaliatory measures from other countries, potentially affecting imports, exports, and international pricing.

- Time Frame for Benefits: Inflation control and supply chain stabilization are long-term benefits. In the short term, consumers may experience higher prices for reshored products.

Implications for Policy

Policymakers play a crucial role in shaping the economic impact of reshoring:

- Tax Incentives and Subsidies: Government programs can reduce the cost burden of domestic production, encouraging companies to reshore without significantly increasing consumer prices.

- Trade Policies: Tariffs, trade agreements, and import regulations can influence the economics of reshoring, affecting domestic production costs and inflation.

- Workforce Development: Investments in education and vocational training ensure a skilled labor force capable of supporting advanced manufacturing, which is critical for productivity and inflation control.

- Infrastructure Support: Enhancing transportation, logistics, and energy infrastructure supports efficient domestic production, reducing costs and minimizing inflationary effects.

Long-Term Outlook for Inflation

While reshoring manufacturing may initially increase production costs, it offers long-term benefits for controlling inflation:

- Price Stability Through Resilient Supply Chains

Local production reduces vulnerability to global disruptions, stabilizing prices for essential goods and mitigating sudden inflation spikes.

- Technological Advancements and Productivity Gains

Automation and innovative manufacturing techniques can offset higher labor costs, maintaining efficiency and reducing the risk of sustained inflation.

- Balanced Labor Market Effects

Higher domestic wages increase consumer spending, stimulating economic growth. Combined with productivity improvements, this balance can prevent runaway inflation.

In conclusion: The Impact of Reshoring Manufacturing on Inflation

Reshoring manufacturing is a calculated move to improve national security, bolster the American economy, and stable supply chains. Long-term advantages include increased price stability, increased productivity, and less reliance on erratic international markets, even though the initial effect on inflation may be slightly larger due to higher production costs.

The US can use reshoring as a tool to manage inflation while reviving domestic businesses by investing in infrastructure, worker development, and technology. As companies and policymakers continue to embrace reshoring, the impact on inflation will become more evident, shaping the economic landscape for years to come.

The Role of Fiscal Stimulus in U.S. Economic Inequality: How Government Spending Shapes Wealth Gaps

The Role of Fiscal Stimulus in U.S. Economic Inequality: How Government Spending Shapes Wealth Gaps