The Impact of Federal Reserve Chair Announcements:

The Impact of Federal Reserve Chair Announcements:

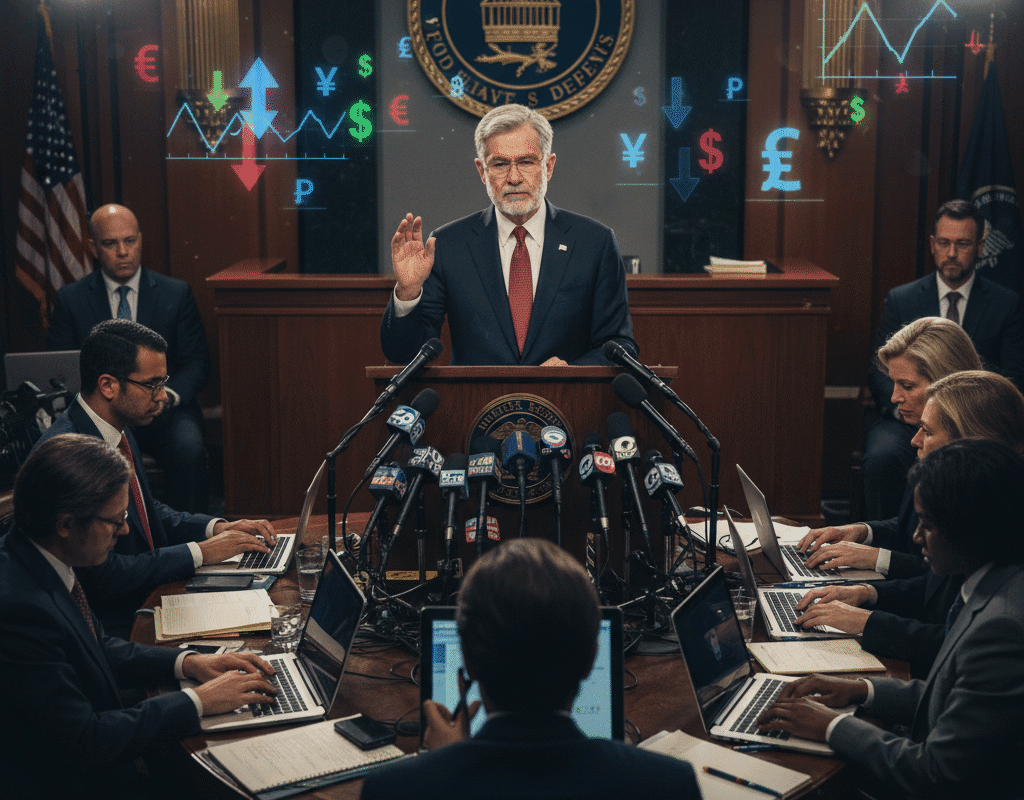

Every time the Federal Reserve Chair steps up to the podium, the world listens. From Wall Street traders to policymakers, from small business owners to everyday consumers, millions hang on every word spoken by the head of the U.S. central bank.

The Federal Reserve Chair’s announcements are among the most influential events in the global financial calendar. They affect interest rates, inflation expectations, investment decisions, and even the psychological confidence of consumers and businesses.

Whether it’s Jerome Powell, Janet Yellen, Ben Bernanke, or Alan Greenspan — the tone, language, and forecasts shared in these briefings have the power to move trillions of dollars within minutes.

HSBC Cashback Credit Card 2025 – Benefits, Rewards & How to Apply?

The Federal Reserve Chair’s Function

The most prominent and influential representative of American monetary policy is the Federal Reserve Chair. The role bears a great deal of responsibility for overseeing the nation’s employment, inflation, and financial stability.

Important roles consist of:

- Monitoring monetary policy in order to keep prices stable.

- Interest rates are set to affect borrowing and spending.

- Directing initiatives for quantitative easing or tightening.

- Informing the public and markets of the Fed’s economic forecast.

The Psychological Effect: Sentiment and Confidence

The Federal Reserve’s responsibilities go beyond economic levers to include confidence management.

Even in the face of uncertainty, markets frequently settle when the Chair exudes composure, control, and clarity. However, conflicting signals or unclear remarks might increase volatility.

For instance:

- Positive tone => Promotes corporate investment and consumer spending.

- Anxiety in the market and a decrease in risk-taking are caused by an uncertain tone.

The Role of “Forward Guidance”

Modern central banking relies heavily on forward guidance — communicating future policy intentions to influence expectations today.

Fed Chairs use this technique to:

- Manage market anticipation of rate changes.

- Provide transparency to reduce uncertainty.

- Shape long-term interest rates indirectly.

Reading Between the Lines as a Communication Strategy

A Federal Reserve statement carefully selects each word. Analysts scrutinize:

- Changes in adjectives (“strong” vs. “solid” growth).

- Mentions of inflation or “price pressures.”

- References to employment or “labor market resilience.”

Even subtle adjustments in phrasing can spark massive trading activity.

For instance, removing a single phrase like “the Committee expects” can signal a significant shift in policy direction.

The Global Ripple Effect

The Federal Reserve has a significant impact outside of the United States.

Because the U.S. dollar serves as the world’s reserve currency, Fed policy directly impacts:

- Global capital flows

- Emerging market currencies

- Commodity prices

- International debt servicing costs

When the Fed tightens policy, foreign investors often pull capital from developing nations, leading to depreciation of local currencies and inflationary pressures abroad. Conversely, loose U.S. monetary policy can boost global liquidity, driving up asset prices worldwide.

The Fed’s Balancing Act: Growth vs. Inflation

The Fed Chair continuously balances promoting growth with reining in inflation.

- Although it helps reduce inflation, raising rates runs the danger of slowing the economy.

- While lowering rates can promote growth, they also run the risk of causing asset bubbles or price spikes.

Every announcement aims to achieve this fine balance, and markets respond according to whether or not investors think the Fed is moving too much in one direction.

The Media’s Role in Amplifying Fed Messages

Media outlets play a massive role in interpreting and amplifying the Fed Chair’s words.

Headlines, sound bites, and live analysis can magnify reactions — sometimes beyond what the Fed intended.

For example, a single phrase like “higher for longer” can dominate financial news cycles, shaping investor sentiment for weeks. This demonstrates how communication style and press interactions are as influential as policy itself.

Market Adjustments and Volatility Following Announcement

Immediately after each Fed Chair statement, markets experience intense volatility.

Algorithms scan headlines and react within milliseconds, leading to sharp price swings.

However, within days, markets typically stabilize as analysts interpret the message’s long-term meaning.

For long-term investors, short-term fluctuations often present opportunities to buy undervalued assets once panic subsides.

Looking Ahead: Future of Fed Communication

The future of Federal Reserve communication is evolving with technology.

Livestreams, social media updates, and digital reports have made monetary policy more accessible than ever.

However, this also increases the risk of overinterpretation and misinformation.

Experts predict that the Fed may adopt AI-assisted language analysis tools to assess how its messages are received — ensuring consistency and minimizing unintended volatility.

Conclusion: Why Every Word Still Matters

In an era of algorithmic trading and instant news, the Federal Reserve Chair’s announcements remain the heartbeat of global finance.

Every phrase can shift markets, reshape portfolios, and redefine economic expectations.

For investors, policymakers, and citizens alike, understanding these communications is essential. They are not just statements — they are strategic signals that shape the economic future of the United States and, by extension, the world.

Concluding Remarks: The Impact of Federal Reserve Chair Announcements

All eyes are on the Federal Reserve Chair as the world economy continues to negotiate inflationary pressures, technological advancement, and geopolitical unpredictability. Whether calming markets or warning of challenges ahead, these announcements will continue to serve as critical moments that define the direction of monetary policy — and the fate of the U.S. economy.

How U.S. Tax Treaties Prevent Double Taxation: A Complete Guide

How U.S. Tax Treaties Prevent Double Taxation: A Complete Guide