The History of the U.S. Gold Standard:

The History of the U.S. Gold Standard:

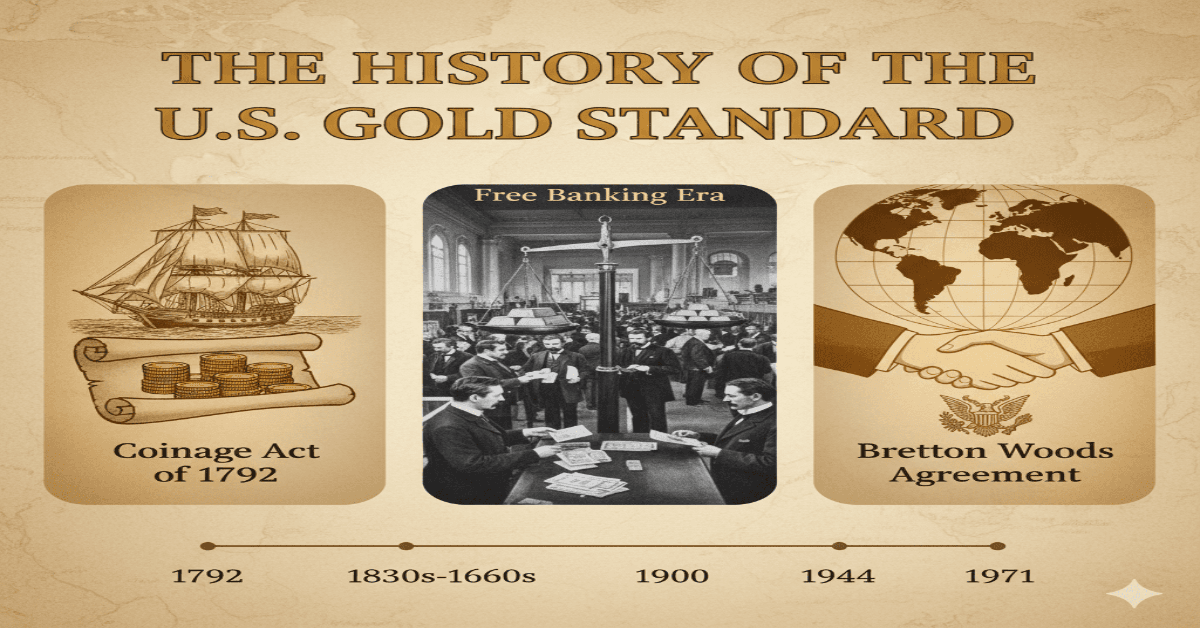

A pillar of American monetary policy for a long time, the gold standard has shaped the country’s economy and had an impact on international financial institutions. From the 19th century until the middle of the 20th century, this system—in which the value of a nation’s currency is directly linked to a certain quantity of gold—played a significant role in the US. Gaining knowledge about the history of the U.S. gold standard helps one understand how American economics, monetary stability, and policy choices have changed over time and still affect the country now.

HSBC Cashback Credit Card 2025 – Benefits, Rewards & How to Apply?

Early Beginnings of the Gold Standard in the U.S.

The concept of the gold standard in the United States can be traced back to the Coinage Act of 1792. This legislation established the U.S. dollar and created a bimetallic standard using both gold and silver. The U.S. Mint began producing gold coins such as eagles, half eagles, and quarter eagles, defining their values in terms of a specific gold content.

During this era, gold and silver circulated side by side, and the government allowed citizens to bring in raw gold or silver to mint coins. The early bimetallic approach helped stabilize the young nation’s economy, ensuring that the currency had intrinsic value while supporting international trade.

The Move Toward a Pure Gold Standard

Throughout the 19th century, the United States gradually shifted toward a gold-centric system. The discovery of gold in California in 1848, which triggered the Gold Rush, significantly increased the supply of gold. This abundance allowed the U.S. government to solidify its reliance on gold as a monetary standard.

The Civil War temporarily disrupted the gold standard. To finance the war, the U.S. issued paper currency known as “greenbacks,” which were not backed by gold. This move created inflation and caused economic instability.

In 1873, Congress passed the Coinage Act of 1873, often called the “Crime of ’73” by its critics, which officially ended the standard for silver and placed the United States on a de facto gold standard.

The Gold Standard and the Federal Reserve

The Federal Reserve System, established in 1913, played a pivotal role in managing the U.S. economy under the gold standard. The Fed’s responsibility included controlling the money supply and stabilizing the financial system while maintaining the dollar’s gold value.

During World War I, the U.S. temporarily suspended the gold standard to fund military expenses, issuing more currency than the available gold reserves could back. After the war, the country returned to the gold standard in 1919, but at a fixed exchange rate that many economists later criticized as unsustainable.

The Gold Standard and the Great Depression

The Great Depression that followed the 1929 stock market crash revealed significant flaws in the gold system. The U.S. government had to decide whether to keep gold convertible or permit more flexible monetary measures to boost the economy as banks collapsed and economic activity stalled.

In 1933, President Franklin D. Roosevelt made a bold move by ending the gold standard domestically. The people could no longer swap dollars for gold since they had to convert gold coins and certificates into paper money. By taking this action, the government was able to alleviate the economic crisis and increase the money supply.

The Global Gold Standard and the Bretton Woods System

The Bretton Woods system, which was created in 1944 by representatives of 44 Allied countries, fixed foreign currencies to the US dollar and made them convertible to gold at a price of $35 an ounce. This agreement strengthened America’s dominant position in the world economy and established the US dollar as the reserve currency of the world.

For a while, the system was effective in fostering international trade and the post-war economic recovery. But by the late 1960s and early 1970s, the system was under stress from rising U.S. deficits, inflation, and global demand for gold. As nations increasingly traded dollars for gold, U.S. gold reserves were depleted and trust in the dollar’s stability was weakened.

The Gold Standard’s Decline

Known as the Nixon Shock, President Richard Nixon said on August 15, 1971, that the dollar would no longer be convertible into gold. The Bretton Woods system was essentially terminated by this ruling, and the United States switched to a fiat currency system. The dollar’s worth under fiat money is determined by public trust and governmental control rather than being linked to a tangible good.

With increased monetary policy flexibility following the demise of the gold standard, the Federal Reserve was better equipped to handle inflation, unemployment, and economic crises. But it also spurred discussions among historians and economists over the long-term effects on inflation control and financial stability.

Effects of the Gold Standard on the Economy

Many advantages were offered by the gold standard, especially in its early years:

- Price Stability: The U.S. dollar kept a comparatively steady value by restricting the money supply to gold reserves, which promoted economic confidence.

- International Trade: By offering a generally accepted standard of worth, a currency backed by gold promoted international trade.

- Inflation Control: Restricting currency issuance to gold holdings helped prevent excessive inflation.

But the system also has some significant shortcomings:

- Limited Flexibility: The gold standard limited the government’s capacity to expand the money supply during economic downturns like the Great Depression.

- Deflationary Pressures: Restrictions on the supply of gold occasionally resulted in deflation, which might exacerbate recessions and slow economic expansion.

- Global Vulnerabilities: Because of the interdependence of the gold standard system, economic instability in one nation might have an impact on the entire world.

The United States’ Gold Standard Legacy.

The legacy of the gold standard endures even though the United States no longer uses it. Economists often refer to gold standard principles when discussing monetary discipline, inflation control, and fiscal responsibility. Gold itself remains a vital asset for investors and central banks, symbolizing financial stability and wealth preservation.

Moreover, the history of the U.S. gold standard provides lessons on the balance between monetary stability and flexibility. Policymakers continue to weigh the benefits of strict fiscal discipline against the need for responsive economic tools in an unpredictable global economy.

In Conclusion: The History of the U.S. Gold Standard

The evolution of monetary policy and the difficulties of overseeing a complex economy are both demonstrated by the history of the US gold standard. The nation’s financial environment was significantly shaped by the gold standard, from its early bimetallic origins to its formal adoption, crises, and eventual abandonment.

Even though the US dollar is currently used as fiat money, knowing the background of the gold standard can help one better comprehend government policies, economic stability, and the complex relationship between money and trust. Discussions about financial regulation, monetary policy, and the future of the US economy are still influenced by the lessons learned from the past.

How Digital Identity is Transforming Banking in the USA: Security, Innovation, and Future Trends

How Digital Identity is Transforming Banking in the USA: Security, Innovation, and Future Trends