How U.S. Mortgage Rates Are Determined?

How U.S. Mortgage Rates Are Determined?

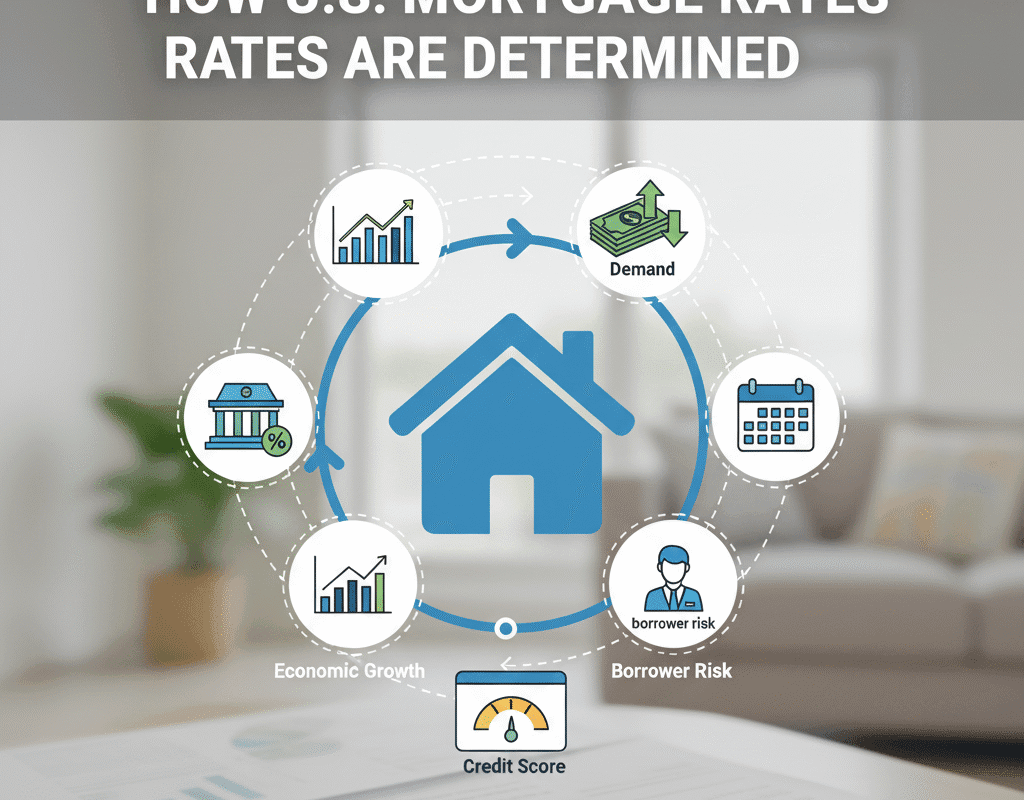

For millions of Americans, mortgage rates are the single most important factor in determining home affordability. Yet, few truly understand how these rates are calculated or what forces drive them up or down.

In 2025, U.S. mortgage rates continue to be influenced by a complex mix of economic indicators, government policy, global events, and market psychology. While many assume that the Federal Reserve directly “sets” mortgage rates, the truth is more nuanced. The Fed plays a major role, but the real story involves bond markets, inflation expectations, and lender-specific risk assessments.

This article breaks down every key element influencing U.S. mortgage rates, explains how they’re determined, and offers a forward look at where rates may be headed next.

HSBC Cashback Credit Card 2025 – Benefits, Rewards & How to Apply?

The Foundation: What Are Mortgage Rates?

A mortgage rate is the interest charged by a lender to finance the purchase of a home. It represents the cost of borrowing money over time. These rates are expressed as a percentage and can be fixed (remaining the same over the life of the loan) or adjustable (changing periodically based on market conditions).

For example:

- A 30-year fixed-rate mortgage offers predictable monthly payments for the life of the loan.

- A 5/1 ARM (adjustable-rate mortgage) starts with a lower rate for five years, then adjusts annually based on a benchmark index.

Understanding how these rates are determined requires looking beyond individual lenders and into the broader U.S. financial ecosystem.

The Federal Reserve’s Function

Although the Fed doesn’t directly determine mortgage rates, its policies have a significant impact on them. The Fed’s main tool is the federal funds rate — the short-term interest rate that banks charge each other for overnight lending.

When the Fed raises or lowers this rate, it sends a signal to the broader economy:

- Rising federal funds rate: Borrowing costs increase, often pushing mortgage rates higher.

- Falling federal funds rate: Borrowing becomes cheaper, which can help lower mortgage rates.

- The Fed also affects mortgage rates through its balance sheet operations — especially its purchases of mortgage-backed securities (MBS).

Mortgage-Backed Securities (MBS) and the Bond Market

Mortgage rates are closely tied to the yields of mortgage-backed securities, which are investment products created from bundles of home loans. Investors buy these securities, providing liquidity to lenders so they can issue more loans.

The yield (or return) on these MBS moves in tandem with the 10-year U.S. Treasury note, one of the most watched indicators in finance. Historically, 30-year fixed mortgage rates are about 1.5% to 2% higher than the 10-year Treasury yield.

When investors buy more bonds (driving yields down), mortgage rates tend to drop. Conversely, when investors sell bonds (pushing yields up), mortgage rates typically increase.

The Impact of Rising Prices

An important factor in influencing mortgage rates is inflation. Investors and lenders want to make sure their profits exceed inflation.

- Mortgage rates usually rise in response to inflation because future repayments become less valuable in actual terms.

- Rates often decrease as purchasing power stabilizes as inflation declines.

Although it has decreased from pandemic-era highs, inflation in the United States is still a major worry in 2024–2025. The Fed may be unable to lower rates due to persistent inflation, which would keep consumer mortgage costs high.

Economic Growth and Employment

Mortgage rates often move with broader economic growth trends. When the economy is expanding rapidly and unemployment is low, consumer demand for housing increases, which can push rates higher.

Conversely, in periods of economic slowdown or rising unemployment, the Fed often eases monetary policy to stimulate growth — leading to lower mortgage rates.

Key indicators that impact mortgage rates include:

- GDP growth rate

- Unemployment rate

- Consumer spending data

- Retail sales and manufacturing output

Lender-Specific Factors

Even though national economic trends dominate, individual lenders still play a role in setting rates. Each lender assesses its own:

- Operational costs

- Profit margins

- Risk tolerance

- Competition within the market

Lenders may also adjust rates based on your credit profile — including credit score, debt-to-income ratio, and loan-to-value ratio. Borrowers with excellent credit and stable finances generally qualify for lower rates.

Government-Sponsored Enterprises (GSEs): Fannie Mae and Freddie Mac

Two key players in the U.S. mortgage system — Fannie Mae and Freddie Mac — buy mortgages from lenders, package them into securities, and sell them to investors. This process helps maintain liquidity in the housing market.

Their guidelines influence which loans are considered “conforming” and eligible for favorable rates. Changes in GSE policies can ripple through the market, affecting overall borrowing costs.

For example, if Fannie Mae tightens credit requirements or changes its risk-based pricing models, lenders might increase rates on certain types of loans.

Global Events and Investor Sentiment

Mortgage rates are not purely domestic phenomena. Global economic conditions, wars, trade tensions, and geopolitical risks can all influence U.S. bond markets.

During global instability, investors often seek the safety of U.S. Treasury bonds — a phenomenon known as a “flight to quality.” Increased demand for Treasuries drives yields down, often leading to lower mortgage rates domestically.

However, if global markets stabilize or foreign central banks tighten their policies, global bond yields may rise, influencing U.S. rates upward.

Conclusion: How U.S. Mortgage Rates Are Determined?

Understanding how U.S. mortgage rates are determined is more than an academic exercise — it’s essential financial literacy for homeowners and investors alike. The interplay of government policy, global markets, and personal credit risk all shape the cost of borrowing.

In 2025, staying informed about inflation, Federal Reserve actions, and bond market dynamics can help borrowers make better timing decisions and secure lower mortgage costs in a rapidly evolving economy.

How the U.S. Government Borrows Money: Treasury Bonds, Deficits, and Debt Explained

How the U.S. Government Borrows Money: Treasury Bonds, Deficits, and Debt Explained