How U.S. Federal Deficits Influence Bond Market Yields?

How U.S. Federal Deficits Influence Bond Market Yields?

The U.S. federal deficit has become a critical point of discussion among economists, policymakers, and investors alike. With the national debt exceeding unprecedented levels, understanding how federal deficits influence bond market yields is more important than ever. Treasury securities, including bonds, notes, and bills, are the backbone of global financial markets, and shifts in their yields directly affect borrowing costs, investment decisions, and economic stability.

HSBC Cashback Credit Card 2025 – Benefits, Rewards & How to Apply?

Understanding Federal Deficits and Their Causes

A federal deficit occurs when government expenditures surpass revenues within a fiscal year. Unlike debt, which accumulates over time, a deficit represents the shortfall between what the government earns and spends in a given year. Major drivers of federal deficits include defense spending, social welfare programs, healthcare, tax cuts, and economic stimulus measures.

For instance, during economic downturns, the U.S. government often increases spending to stimulate growth, even if it leads to larger deficits. Conversely, tax cuts without equivalent reductions in spending can exacerbate deficit levels. Recent U.S. fiscal policies, including pandemic-related stimulus packages, have contributed to significant deficit expansions.

The Link Between Deficits and Bond Market Yields

The bond market is highly sensitive to government fiscal behavior. Treasury securities are debt instruments issued by the U.S. Department of the Treasury to finance federal deficits. Investors purchase these bonds with the expectation of receiving interest payments, known as yields.

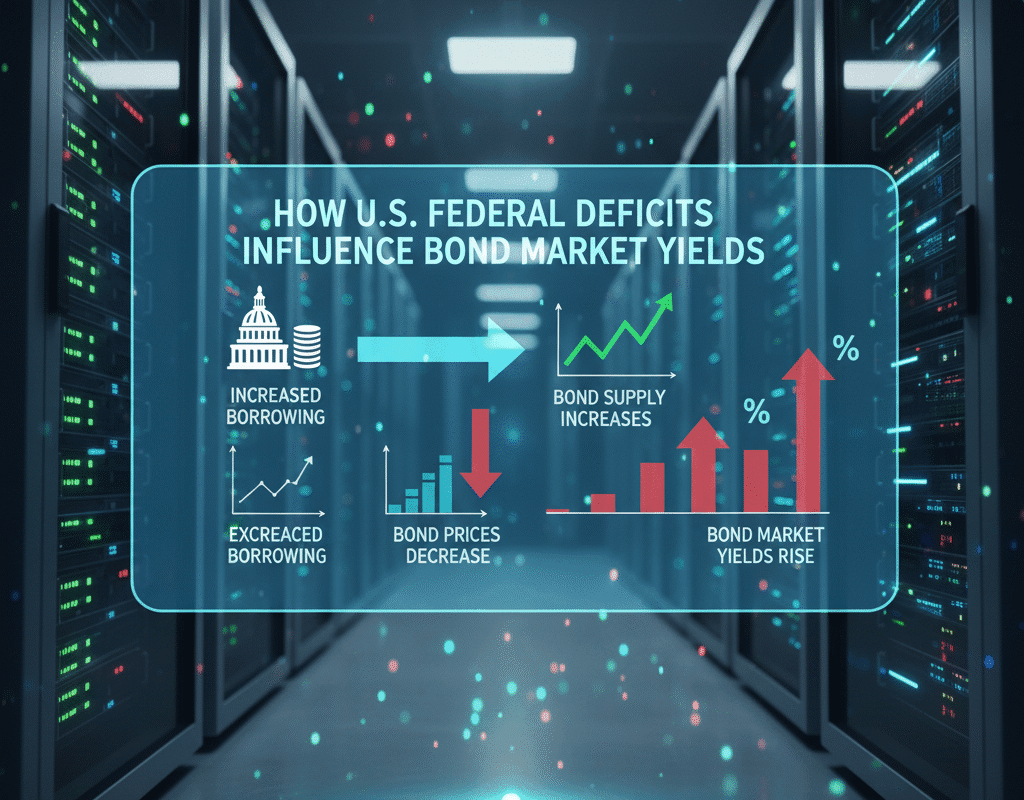

When the federal deficit rises, the government must borrow more by issuing additional Treasury securities. Increased supply of bonds can put downward pressure on their prices. Since bond prices and yields move inversely, falling prices lead to rising yields. In simple terms, higher deficits often translate to higher yields as investors demand greater compensation for lending to a heavily indebted government.

Inflation Expectations and Interest Rates

Inflation plays a crucial role in determining bond yields. Large federal deficits may increase the money supply or lead to expansive fiscal policies, potentially triggering higher inflation. Investors, wary of eroding purchasing power, will demand higher yields on bonds to offset inflation risks.

Conversely, if the Federal Reserve raises interest rates to curb inflation, bond yields also rise. In this scenario, deficits can indirectly influence market yields through monetary policy. Understanding this dynamic is essential for investors, economists, and policymakers navigating the interplay between fiscal and monetary policy.

Debt-to-GDP Ratio: Measuring Sustainability

Economists often evaluate federal deficits relative to the size of the economy using the debt-to-GDP ratio. A higher ratio indicates that government debt is growing faster than the economy, potentially raising concerns about fiscal sustainability. Markets closely watch this ratio, as unsustainable deficits could lead to higher borrowing costs, increased yields, and even credit rating downgrades.

Historically, the U.S. has maintained a robust credit rating due to its strong economy and reserve currency status. Nonetheless, persistent deficits and growing debt-to-GDP ratios can influence investor sentiment and long-term bond yields.

Investor Behavior and Market Expectations

Bond market yields are largely driven by investor expectations. When deficits expand rapidly, investors may anticipate future interest rate hikes or inflationary pressures. As a result, they may demand higher yields to compensate for perceived risks.

On the other hand, U.S. Treasury bonds are considered one of the safest assets globally. Even amid high deficits, strong demand from domestic and international investors can stabilize yields. For example, during periods of economic uncertainty, investors often flock to U.S. Treasury bonds, driving prices up and yields down, a phenomenon known as a “flight to safety.”

Historical Perspective: Deficits and Yields

Examining historical data reveals the complex relationship between deficits and bond yields. In the 1980s, the U.S. experienced significant federal deficits due to tax cuts and defense spending. During this period, Treasury yields increased sharply, reflecting heightened investor concerns about fiscal sustainability.

Conversely, after the 2008 financial crisis, the federal deficit surged as the government implemented stimulus programs. Surprisingly, bond yields remained low due to massive demand from global investors and accommodative Federal Reserve policies. This historical context highlights that while deficits influence yields, other economic factors often play a critical role.

Global Implications of U.S. Deficits

The U.S. dollar and Treasury securities serve as cornerstones of the global financial system. Rising deficits can have ripple effects beyond domestic markets. Higher yields may attract foreign investment, strengthening the dollar but potentially increasing borrowing costs for other countries. Conversely, if investors question the U.S. fiscal trajectory, it could create volatility in international markets.

Emerging economies that rely on U.S. Treasuries as reserves can experience shifts in asset values and interest rates based on U.S. fiscal policies. Hence, the impact of federal deficits on bond yields is both a domestic and global concern.

Deficits, Yields, and Economic Growth

While high deficits can lead to rising yields, it is essential to consider the context. Strategic deficit spending aimed at infrastructure, research, or education can stimulate long-term economic growth, potentially offsetting the burden of higher yields.

However, unrestrained borrowing without productive investment can crowd out private sector investment. Higher yields make borrowing more expensive for businesses and consumers, potentially slowing economic expansion. Policymakers must balance deficit financing with sustainable economic growth strategies.

In conclusion: How U.S. Federal Deficits Influence Bond Market Yields?

U.S. federal deficits significantly influence bond market yields, but the relationship is intricate and influenced by multiple factors including investor behavior, inflation expectations, monetary policy, and global economic dynamics. While rising deficits can increase yields and borrowing costs, strategic fiscal management and strong investor confidence can mitigate these effects.

For policymakers, understanding this dynamic is crucial to ensuring sustainable economic growth while maintaining market stability. For investors, monitoring federal deficits and related fiscal developments is essential to making informed decisions in the Treasury market.

As the U.S. continues to navigate complex fiscal challenges, the interplay between federal deficits and bond yields will remain a key indicator of economic health and financial stability.

Why Americans File Taxes Every Year: Understanding the Unique U.S. Tax System

Why Americans File Taxes Every Year: Understanding the Unique U.S. Tax System