How U.S. Auto Loans Differ from Leases?

How U.S. Auto Loans Differ from Leases?

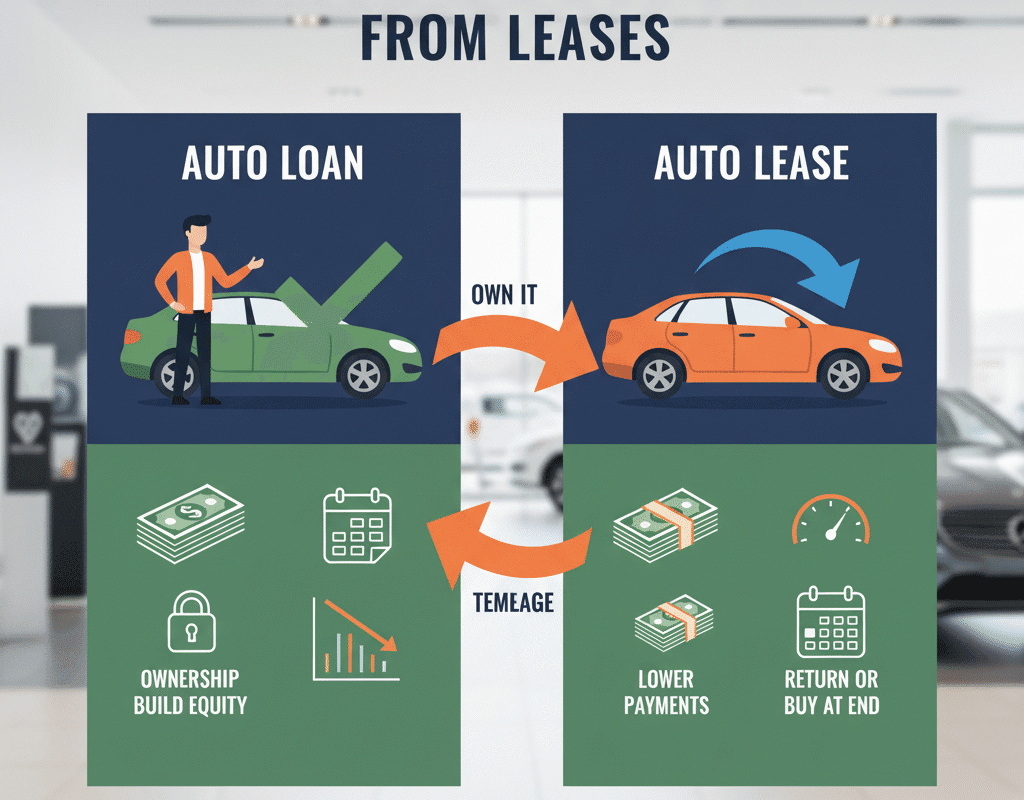

One of the most prevalent financial questions in the auto industry is whether to buy or lease a new car when driving away in the United States.

More than just a difference in paperwork, the difference between an auto loan and a lease influences your monthly payment amount, how long you retain the car, how it impacts your credit score, and even how much money you accumulate over time.

This thorough analysis looks at the differences between leases and U.S. auto loans, as well as their benefits and drawbacks, and how the changing economy, interest rates, and car trends in 2025 are affecting consumer choices.

HSBC Cashback Credit Card 2025 – Benefits, Rewards & How to Apply?

Understanding the Basics: What Is an Auto Loan?

An auto loan is a financing arrangement that allows you to purchase a vehicle outright by borrowing money from a bank, credit union, or financing company. You make monthly payments—typically over 36 to 72 months—until the loan is paid off.

Once the final payment is made, you own the car completely. The lender holds a lien on the vehicle until the debt is cleared, but ownership ultimately transfers to you.

Key Features of Auto Loans:

- You are building equity in the car as you pay it down.

- Payments tend to be higher than lease payments because you’re paying off the full value of the vehicle.

- There are no mileage limits or wear-and-tear penalties.

What Is a Car Lease?

A lease is more like a long-term rental agreement. You don’t buy the car—you pay to use it for a set term, often 24 to 48 months, with mileage limits, typically 10,000 to 15,000 miles per year.

At the end of the lease, you either return the car or sometimes have the option to buy it for its residual value (the estimated value after depreciation).

Key Features of a Lease:

- Monthly payments are lower than for loans.

- You don’t build equity—you’re paying for the depreciation during your use period.

- There are mileage and condition restrictions, with fees for excess wear or extra miles.

- Leasing is ideal for those who like driving new cars frequently.

3. The Core Difference: Ownership

The single biggest difference between loans and leases is ownership.

| Feature | Auto Loan | Lease |

| Ownership | You own the car after payments | You never own the car unless you buy it after the lease |

| Equity | Builds equity | No equity |

| Flexibility | Can sell or modify anytime | Restrictions apply |

| Long-Term Cost | Generally cheaper over time | May cost more if repeated |

When you finance through a loan, every payment increases your ownership stake. Leasing, on the other hand, is essentially paying for temporary use, similar to renting an apartment.

Cost Analysis: Lease vs. Loan Payments

Because leases offer cheaper monthly payments, they can seem more alluring. This is so because a lease only covers interest and fees, as well as depreciation, which is the difference between the car’s purchase price and its worth at the conclusion of the lease.

In contrast, auto loans increase monthly expenses by requiring the payback of the whole car value plus interest.

For instance:

- The cost of a new automobile is $40,000.

- Monthly lease payment: around $450

- Loan payment: around $650/month

The Role of Interest Rates and Money Factors

Both loans and leases involve financing costs:

- Auto Loans: use interest rates (APR) that reflect your credit risk and market conditions.

- Leases: use a money factor, a small decimal number that functions like an interest rate.

To convert a money factor to an APR, multiply it by 2,400.

Example: A money factor of 0.0025 ≈ 6% APR.

With rising Federal Reserve interest rates in recent years, both loan and lease costs have increased. However, lease rates may remain slightly more competitive due to manufacturer incentives, especially for electric vehicles (EVs).

Mileage Restrictions and Fees: The Unspoken Expense of Renting

Mileage restrictions are included in lease agreements, and going above them can be expensive—typically between $0.15 and $0.30 per mile.

If a person drives 18,000 miles a year instead of 12,000, the extra mileage could end up costing them hundreds or even thousands of dollars.

You can also be subject to wear-and-tear penalties for dents, scratches, or other alterations. These expenses don’t matter when you have a loan because you own the car and can determine how much wear is appropriate.

Impact on Credit Score

Since both loans and leases are types of installment debt, they have comparable effects on your credit report and credit score.

But:

- Over time, a loan payback increases credit use.

- Since the account is canceled at the end of the lease term, lease returns do not contribute to the development of long-term credit history.

Auto loans may provide a longer-term advantage if your objective is to establish or restore credit.

Fees and Taxes

The way taxes are applied is one distinction that is frequently disregarded.

The majority of U.S. states:

- Sales tax is paid up front on the entire purchase price for loans.

- Leases: unless certain states apply full tax, you just pay tax on the monthly payment.

In the short term, this may make leasing more alluring, especially for luxury cars. But eventually, ownership increases the long-term worth for buyers.

9. Long-Term Financial Outlook

Over a decade, owning a car is typically the less expensive route, especially if you maintain it well and keep it for several years after the loan ends.

Leasing, however, can make sense for drivers who prioritize new technology, predictable costs, and frequent upgrades—especially with EVs that rapidly evolve.

| Financial Goal | Best Option |

| Lowest long-term cost | Auto loan |

| Lowest monthly payment | Lease |

| Driving new cars often | Lease |

| Building equity | Loan |

| Avoiding repair costs | Lease |

| Long-term value retention | Loan |

In conclusion: How U.S. Auto Loans Differ from Leases?

Both auto loans and leases have legitimate benefits. Loans lead to ownership and potential long-term savings, while leases deliver short-term flexibility and lower payments.

In an era of rising interest rates, technological advancement, and changing consumer behavior, the smartest approach is to evaluate your personal finances, lifestyle, and vehicle needs before committing.

Whether you’re financing your dream SUV or leasing the latest EV, knowing how these systems differ is the key to staying in the driver’s seat—financially and literally.

The Role of the U.S. Treasury Department: Functions, Responsibilities, and Impact on the Economy

The Role of the U.S. Treasury Department: Functions, Responsibilities, and Impact on the Economy