How to Prioritize Debt Payments?

How to Prioritize Debt Payments?

Millions of Americans are still dealing with growing debt from credit cards, school loans, mortgages, auto loans, and personal loans as 2025 approaches. Paying off debt has been a primary priority for households nationwide because to rising interest rates, inflationary pressures, and the pandemic’s lasting financial repercussions. According to financial reports, the average American household now carries over $100,000 in debt, making smart repayment strategies more critical than ever.

The question many are asking is simple but pressing: How should you prioritize debt payments?

HSBC Cashback Credit Card 2025 – Benefits, Rewards & How to Apply?

Why Setting Debt Priorities Is Important

It’s simple to feel overburdened when you owe money to several creditors. Interest rates, terms of repayment, and penalties for late payments vary depending on the debt. Improper prioritization can result in:

- Exorbitant interest expenses that deplete your funds.

- Lowered credit scores as a result of missed or late payments.

- Your quality of life is impacted by stress and financial instability.

You may save thousands of dollars, pay off amounts more quickly, and restore financial control by learning how to strategically prioritize debt payments.

Step 1: Enumerate and Sort Your Debts

Making a clear image of your debt is the first step in setting a payment schedule. Creating a debt inventory is advised by many financial consultants. This ought to consist of:

Debt type (credit card, mortgage, student loan, vehicle loan, medical bill, personal loan, etc.).

- The amount owed on every account.

- interest rate linked to every loan.

- Monthly minimum payment is necessary.

- Payment deadlines.

You can use this list as a clear starting point to decide which debts require immediate attention.

Step 2: Cover the Essentials First

Before choosing a repayment strategy, prioritize minimum payments on all debts. Missing minimums can trigger late fees, penalty interest rates, and negative credit score impacts.

At the same time, ensure that basic living expenses—such as rent, utilities, groceries, and healthcare—are covered. Falling behind on essentials may force you deeper into debt just to survive.

Step 3: Gaining Knowledge about Debt Repayment Techniques

Regarding debt prioritization, there are two main schools of thought:

The Avalanche Method for Debt

- How it works: You make minimum payments on the remaining debts while concentrating on paying off the obligation with the highest interest rate first.

- Why it functions: Over time, this approach saves you the most money because it lowers your interest payments.

The Snowball Method of Debt

- How it works: You pay the minimal amount due on other debts while concentrating on paying off the smallest bill first, regardless of interest rates.

- Why it functions: It helps you stay consistent and boosts motivation by giving you immediate wins.

The Hybrid Method

A hybrid approach, which starts with small loans for motivation and moves to high-interest debts for efficiency, is suggested by certain experts.

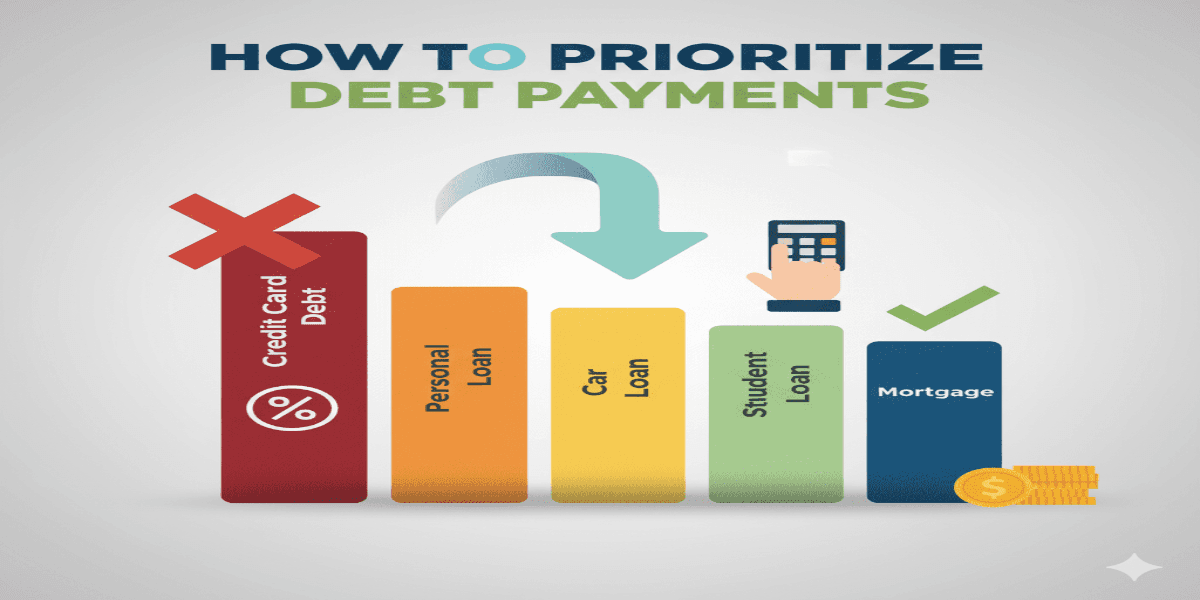

Step 4: Debt Payment Priority Hierarchy

When it comes to debt repayment, financial experts typically advise the following priority order:

- High-interest unsecured debt: Credit cards are the most expensive debt to carry since they frequently have interest rates higher than 20%.

- Variable-rate loans: When interest rates rise, variable-rate credit lines or mortgages may become erratic.

- Student loans: Although federal loans usually have lower interest rates, there may be long-term repercussions if you default.

- Auto loans: Since automobiles lose value quickly, defaulting puts you at risk of being repossessed.

- Mortgages: Although missing mortgage payments can lead to foreclosure, high-interest debt often has a higher priority for repayment than mortgages because mortgage rates are typically lower.

- Personal loans and medical expenditures are significant commitments, but they could have more accommodating conditions for repayment than credit cards.

Step 5: Examine Consolidation of Debt

In 2025, debt consolidation is becoming more and more popular among Americans who are struggling with several debts. Among the options are:

- Credit cards for balance transfers with 0% annual percentage rates are available.

- personal loans with a single, set payment to settle high-interest debts.

- However, if you default on a home equity loan or credit line, your house could be at jeopardy.

Although debt consolidation makes payments easier and might lower interest, it necessitates strict self-control to prevent accruing further debt.

Step 6: Budgeting’s Function

Without a reasonable budget, no debt reduction plan can be successful. It’s crucial to set aside a certain amount of your monthly income for debt repayment. Typical budgeting techniques include:

- 50% for needs, 30% for wants, and 20% for debt repayment and savings is known as the 50/30/20 rule.

- Zero-based budgeting makes sure that no money is wasted by giving each dollar a specific purpose.

Maintaining consistency, avoiding overspending, and speeding up debt repayment are all made possible by budgeting.

Step 7: Repayment of Debt and Emergency Savings

Experts advise keeping a small emergency fund of at least $500 to $1,000 before pursuing aggressive debt repayment, despite the fact that this may seem illogical. This keeps you from using credit cards to cover unforeseen costs.

Step 8: Professional Assistance

If debt feels unmanageable, professional help is available:

- Credit counseling agencies offer debt management plans and negotiation support.

- Debt settlement companies attempt to negotiate lower balances, though this can damage your credit.

- Bankruptcy is a last resort but may provide relief for those with overwhelming debt.

Effects of Debt on the Mind

Debt is emotional as well as financial. Excessive debt loads have been linked in studies to relationship problems, anxiety, and depression. In addition to lowering balances, using structured repayment programs like avalanche or snowball helps people feel more at ease.

2025 Debt Repayment: What Americans Can Anticipate

Strategies for repaying debt are changing as a result of 2025 economic trends:

- Credit card debt is more costly than ever due to rising interest rates.

- Younger borrowers are under pressure as student loan repayments have started following interruptions due to the pandemic.

- Homeowners are being forced to balance their mortgage payments with other debts due to housing affordability concerns.

- AI-powered budgeting applications and digital financial tools are assisting households in better tracking and prioritizing debt payments.

Professional Advice for Staying on Course

- To prevent late fees, automate your payments.

- If at all possible, bargain with lenders for reduced interest rates.

- Reduce wasteful spending and reroute money to debt.

- Boost revenue by taking in freelance employment or side projects.

- To keep yourself motivated, celebrate when you reach debt repayment milestones.

Conclusion: Creating a Future Free of Debt

One of the most crucial financial choices Americans will have to make in 2025 is to prioritize debt payments. Consistency, discipline, and a well-defined plan are crucial, regardless of whether you go for the debt avalanche, snowball, or hybrid approach.

Although debt liberation takes time, Americans can attain long-term prosperity and financial security with careful budgeting, focus, and perseverance.

How to Freeze Your Credit Report in 2025 – Step-by-Step Guide to Protect Your Identity

How to Freeze Your Credit Report in 2025 – Step-by-Step Guide to Protect Your Identity