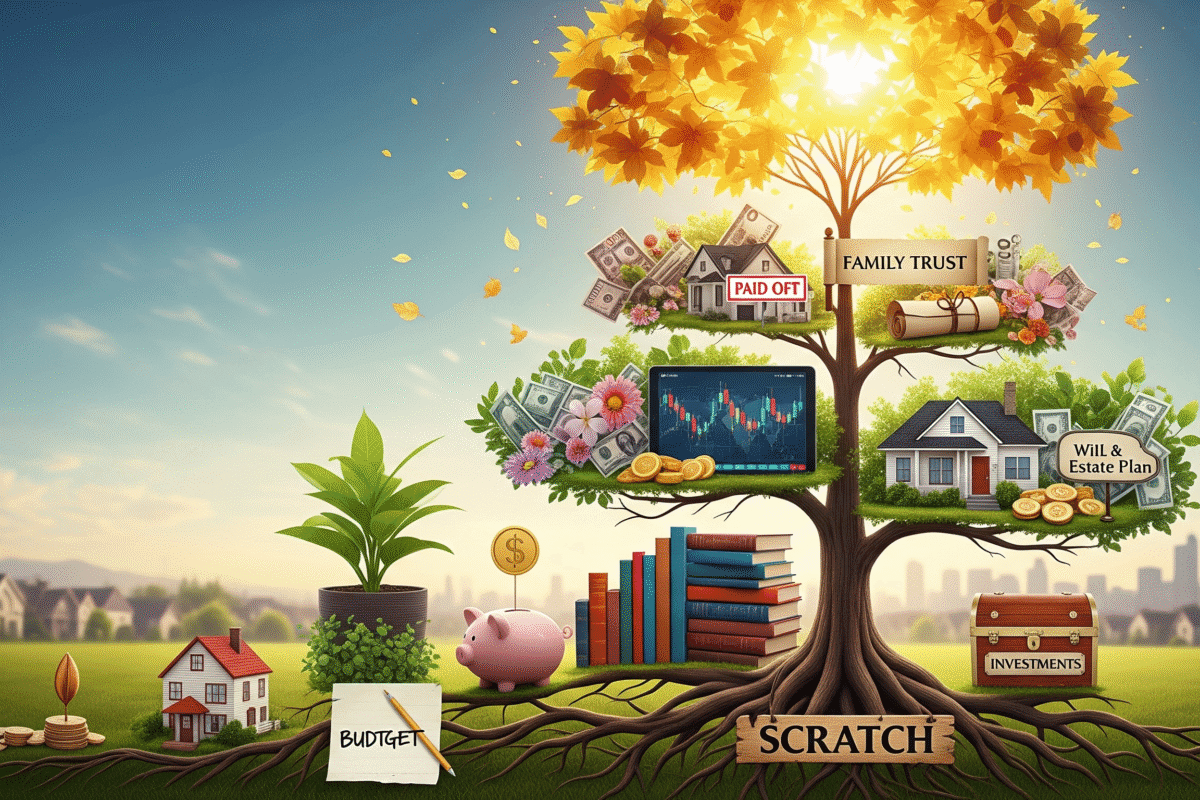

How to Build Generational Wealth from Scratch?

How to Build Generational Wealth from Scratch?

The income disparity is widening in the modern world, and many families are left wondering how to escape the pattern of living paycheck to paycheck. Most Americans have to start from scratch, but some people inherit money, land, or enterprises. The idea of generational wealth—wealth that is passed down from one generation to another—has become a trending financial goal.

But here’s the good news: even if you weren’t born into wealth, you can still build it. Generational wealth doesn’t have to mean being a millionaire overnight. Instead, it’s about making smart financial decisions that create a foundation your children and grandchildren can build upon.

HSBC Cashback Credit Card 2025 – Benefits, Rewards & How to Apply?

What Is Generational Wealth?

Generational wealth refers to any assets, investments, or resources you pass down to the next generation. This can include:

- Cash savings

- Real estate properties

- Stocks, bonds, and retirement accounts

- Businesses

- Intellectual property (books, patents, digital assets)

Unlike short-term wealth, generational wealth is built with long-term vision and discipline. The goal isn’t just to make money—it’s to make money that lasts.

The Mindset Shift: From Survival to Wealth Creation

One of the biggest obstacles in wealth building is mindset. Many people operate on a scarcity mindset—thinking only about bills and immediate needs. To build wealth, you must shift to an abundance mindset, where money works for you rather than you working endlessly for money.

Key mindset changes include:

- Viewing money as a tool, not just income

- Prioritizing assets over liabilities

- Understanding delayed gratification

- Investing in education and skills before luxuries

Start With Financial Literacy

Financial literacy is the foundation of generational wealth. Without it, even large inheritances can be squandered.

Some basics to master:

- Budgeting: Tools like Mint, YNAB, or simple spreadsheets help track income and expenses.

- Debt management: Pay off high-interest debt before investing aggressively.

- Emergency funds: At least 3–6 months of expenses should be set aside.

- Credit scores: A healthy score makes borrowing cheaper and opens doors to real estate and business loans.

- Generational wealth requires passing down financial knowledge as much as passing down money.

Income: The Fuel for Wealth Building

You cannot invest what you don’t earn. Therefore, increasing your earning potential is step one.

Ways to grow income include:

- Career advancement: Upskill, switch industries, or pursue higher-paying roles.

- Side hustles: Freelancing, consulting, or gig economy jobs.

- Entrepreneurship: Starting a small business that can scale.

- Digital income: Blogs, YouTube, or online courses.

The modern economy makes it possible to generate multiple streams of income, which is key to building wealth from scratch.

Prioritizing Savings Over Spending

All too frequently, after earning money, individuals squander it and then save “what’s left.” The opposite is true for wealthy families, who pay themselves first.

Among the wise saving practices are:

- Savings are automatically transferred to different accounts.

- Using savings accounts with high yields

- Steer clear of lifestyle inflation by not upgrading everything as your income increases.

- Making use of tax-advantaged retirement plans such as IRAs and 401(k)s

The link between income and investments is savings.

Investing: The True Secret to Wealth Creation for Future Generations

Inflation reduces the value of money kept in a bank. Investing creates wealth.

The stock market

- ETFs & Index Funds: Low-cost, diversified, and long-term growth.

- Dividend Stocks: Provide recurring income streams.

Real Estate

- Rental properties provide passive income.

- Appreciation increases property value over time.

- REITs (Real Estate Investment Trusts) for low-cost entry.

Business Investments

- Owning a business is one of the fastest ways to build wealth.

- Franchises and online businesses are scalable models.

Retirement Accounts

- Employer-matched 401(k)s are essentially free money.

- Roth IRAs grow tax-free, making them powerful wealth tools.

Building Assets, Not Liabilities

Robert Kiyosaki, author of Rich Dad Poor Dad, famously said: “The rich buy assets. The poor buy liabilities.”

- Assets: Investments that put money in your pocket (stocks, rental income, businesses).

- Liabilities: Expenses that drain your wealth (cars, luxury items, credit card debt).

- When building wealth, always ask: Does this purchase generate income or cost me money long-term?

Protecting Your Wealth

Building wealth is one thing. Protecting it ensures it lasts.

- Insurance: Life insurance and health insurance protect families from financial ruin.

- Estate Planning: Wills, trusts, and power of attorney documents prevent wealth disputes.

- Taxes: Using tax-efficient investment strategies keeps more money in your pocket.

Educating the Upcoming Generation

When children lack the management skills, generational wealth fails. Just as crucial as transferring assets is transferring financial knowledge.

Methods for teaching children about money:

- Assign them a chore-based allowance.

- Show them how to manage modest sums of money.

- Engage them in conversations about family investments.

- Create custodial accounts in order to begin investing.

Contemporary Resources for Creating Wealth

Wealth generation is now more accessible because to technology. Tools such as

- Robinhood, Fidelity, Vanguard (for investing)

- Fundrise (real estate crowdfunding)

- Coinbase (cryptocurrency investing—risky but potentially rewarding)

- Personal Capital (wealth management tracking)

These platforms make it easier than ever to start building wealth with as little as $5.

Common Mistakes That Destroy Generational Wealth

Many families lose wealth within two generations. Avoid these pitfalls:

- Overspending and lifestyle inflation

- Lack of financial education for heirs

- Poor estate planning leading to disputes

- Depending on one income stream only

- Ignoring taxes and inflation

Real-Life Examples of Generational Wealth Building

- Rockefeller Family: Built wealth through oil, invested across industries, and created trusts to manage assets.

- Everyday Families: Teachers, nurses, and small business owners who invested consistently in retirement accounts and real estate often pass down substantial wealth.

Creating Wealth from Nothing: A Comprehensive Guide

- Boost revenue through side projects or professional advancement.

- Build an emergency fund.

- Pay off high-interest debt.

- Save and invest consistently.

- Buy assets (stocks, real estate, businesses).

- Protect wealth with insurance and estate planning.

- Teach financial literacy to children.

- Repeat the cycle across generations.

In summary, your legacy begins today.

It takes more than luck or being born into the proper family to create riches that lasts for generations. It all comes down to consistency, financial intelligence, and discipline. Regardless of your age, you can begin now.

You may leave a lasting financial legacy that spans decades by concentrating on income growth, saving prudently, investing strategically, and passing on knowledge to the next generation.

The Future of Universal Digital Wallets: How They Will Transform Finance and Daily Life

The Future of Universal Digital Wallets: How They Will Transform Finance and Daily Life