How to Avoid Impulse Buying Online?

How to Avoid Impulse Buying Online?

Online shopping has completely changed how we purchase everything, from luxury products and computer devices to groceries and clothing. Products are delivered to our doorstep in a matter of hours or days with a single click. Although this ease is unparalleled, it has also led to an increasing problem: internet impulsive shopping.

Financial experts caution that impulsive buying can stealthily deplete household budgets in 2025, as e-commerce continues to dominate consumer behavior in the United States. These little, impulsive purchases can build up to hundreds of dollars annually for many people, causing stress, clutter, and occasionally debt.

HSBC Cashback Credit Card 2025 – Benefits, Rewards & How to Apply?

The Increase in Online Impulse Purchases

Why Online Impulse Purchases Are More Common

Impulsive purchases are nothing new. Candy has traditionally been positioned close to the checkout line or prominent “limited-time” promotions in physical stores. Nevertheless, the digital world intensifies these stimuli by:

- Countdown timers and flash sales: Using “Only 2 left in stock!” notifications creates a sense of urgency.

- Customized suggestions: Algorithms make suggestions for products based on past browsing activity.

- Free shipping thresholds: To “save” money, customers are encouraged to add additional items.

- Buy now, pay later (BNPL) – Making expensive purchases feel manageable in installments.

Statistics on Impulse Buying in 2025

Consumer research indicates that:

- Over 65% of U.S. adults admit to making at least one unplanned online purchase per month.

- Millennials and Gen Z are the most vulnerable, with social media ads fueling purchases.

- BNPL services like Klarna and Afterpay have increased average order values by 30%.

The Psychology of Impulsive Purchases

Instant Satisfaction

When we expect a reward, dopamine is released in our brains. This reward cycle is fueled by online shopping since the anticipation of acquiring something new frequently feels just as good as actually owning it.

FOMO, or the “fear of missing out,”

Scarcity methods, such as “deal ends in 2 hours,” cause consumers to feel as though they may miss out on savings, which leads them to make hasty purchases.

Triggers for Emotions

Online shopping is frequently done by people to decompress, pass the time, or feel better. Retailers are aware of this and create advertisements that appeal to feelings rather than reason.

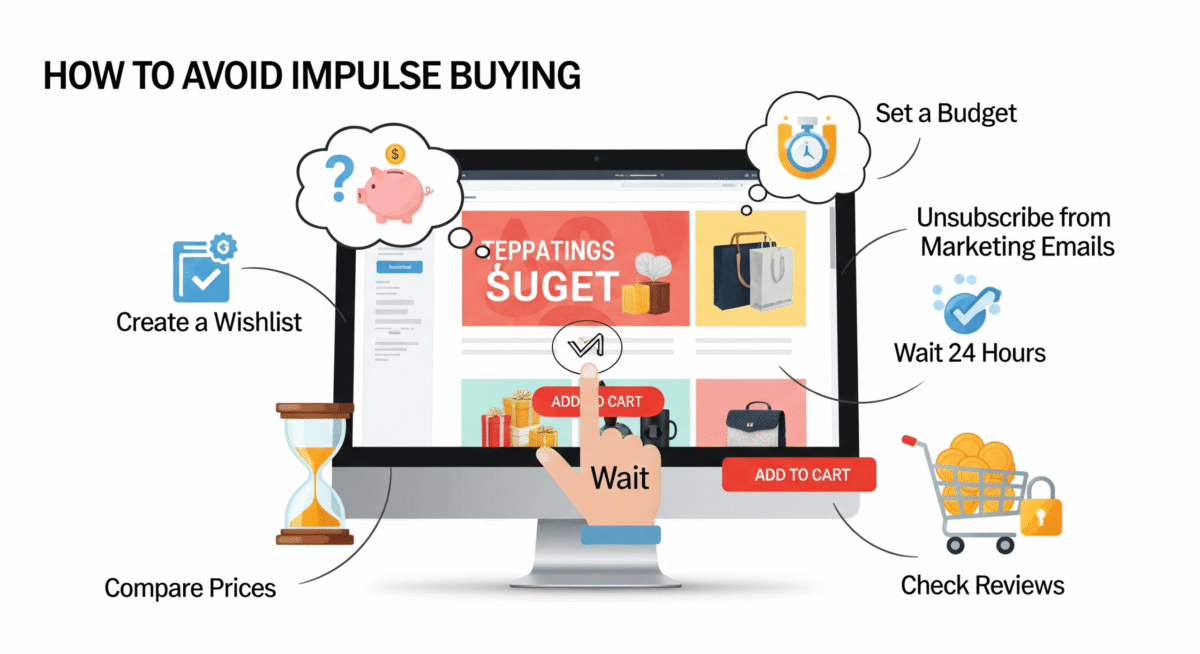

Proven Strategies to Avoid Impulse Buying Online

Establish a 24-Hour Regulation

Before buying anything that isn’t essential, wait at least 24 hours. This cooling-off period helps separate wants from needs.

Stick to a Shopping List

Just like grocery shopping, make a digital shopping list. If an item isn’t on your list, resist buying it.

Disable One-Click Checkout

While convenient, one-click checkout removes friction and encourages impulsivity. Instead, keep checkout steps that give you time to reconsider.

Remove Saved Credit Cards

If your payment details are stored, checkout becomes too easy. By removing them, you’ll pause before completing a purchase.

Unsubscribe from Promotional Emails

Emails with “exclusive offers” are designed to lure you. Unsubscribing reduces exposure to triggers.

Employ App Limits & Ad Blockers

Ad exposure can be decreased with the use of tools like screen-time management applications and ad blockers.

Establish a monthly spending plan

Set aside a certain amount for “fun” purchasing, and keep track of it. Spending can be managed with apps like Mint or YNAB (You Need a Budget).

Refrain from shopping when upset

Never shop when anxious, weary, or unhappy. Find substitutes instead, such as journaling, calling a friend, or going for a walk.

Monitor Purchases

Record your impulsive purchases and your feelings about them. Repetitive behavior is decreased by awareness.

Make Good Use of Cash-Back & Savings Apps

Although cashback is a benefit, needless purchases cannot be justified by it. Only use these instruments for necessities.

Intelligent Resources to Help You Manage Impulsive Purchases

- Rakuten and Honey are excellent for comparing prices and making sure you don’t overspend.

- CamelCamelCamel: Monitors past Amazon prices to see whether a “sale” is genuine.

- Apps for budgeting that classify spending patterns include YNAB and Mint.

- Shopping sites are temporarily blocked by Cold Turkey Blocker.

- A straightforward do-it-yourself budget tracker for thoughtful shopping is Google Sheets Tracker.

Social Media’s Role in Impulse Buying

Platforms like Instagram, TikTok, and Facebook have integrated shopping features that turn entertainment into consumption. Influencer marketing and viral product trends push users into fast, unplanned purchases.

Tip: Unfollow accounts that promote excessive shopping and follow finance or minimalist creators instead.

Long-Term Benefits of Avoiding Impulse Buying

- Financial Freedom – Saving for bigger goals like a house, car, or investments.

- Reduced Stress – Less financial anxiety and regret.

- Clutter-Free Living – Fewer unnecessary items piling up at home.

- Improved Self-Control – Stronger willpower that benefits other areas of life.

Case Study: The Journey of a Shopper

Emma, a 29-year-old marketing expert, used to spend about $600 a month on impulsive purchases from Instagram and Amazon. Within three months, she reduced wasteful spending by 40% by deleting stored credit cards and applying the 24-hour rule. That money is immediately put into her emergency fund.

Concluding remarks

Online impulse shopping is becoming more and more of a problem in the fast-paced, digital-first economy of today. However, control can be regained with awareness, discipline, and intelligent tools.

Keep in mind that every impulsive purchase you put off today is an investment in your future financial independence.

Why Car Insurance Rates Keep Rising in 2025: Factors Behind the Surge

Why Car Insurance Rates Keep Rising in 2025: Factors Behind the Surge