How the U.S. Gift Tax Works?

How the U.S. Gift Tax Works?

For many Americans, the concept of giving generous gifts—whether money, real estate, or other assets—brings joy and satisfaction. Yet when the dollar amounts climb, questions arise: Will I owe a tax when I gift something to my child or grandchild? Does the recipient pay tax?

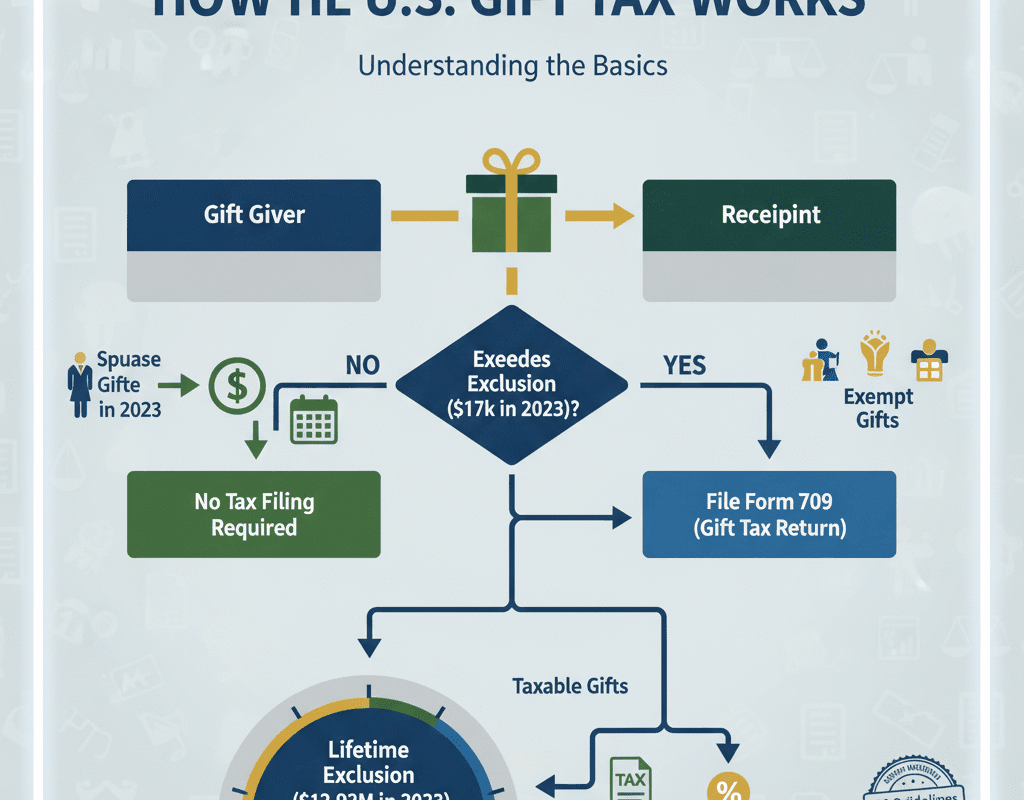

The truth is that the U.S. federal gift tax system, administered by the Internal Revenue Service (IRS), governs transfers of property for less than full value during one’s lifetime, and though most people never pay any gift tax, it’s critical to understand the rules so large gifts don’t inadvertently trigger tax consequences.

HSBC Cashback Credit Card 2025 – Benefits, Rewards & How to Apply?

For tax purposes, what is a gift?

For tax reasons, a transfer of money or property from one person (the donor) to another (the receiver, also known as the donee) without full compensation (i.e., full fair market value) is considered a “gift” under U.S. law.

Here are some crucial details:

- The transfer needs to be either entirely or partially gratuitous, which means that you provide something and don’t get nearly comparable value back.

- Cash, real estate, stocks, artwork, automobiles, debt forgiveness, renting property below market value, or making an interest-free (or below-market-interest) loan are all examples of gifts.

Annual Exclusion: How Much Can You Give Each Year?

One of the main thresholds in gift-tax planning is the annual exclusion. This is the amount you can give to each person each calendar year without having to file a gift-tax return (in many cases) and without reducing your lifetime exemption.

- 2025 Annual Exclusion

- For tax year 2025, the annual exclusion amount is $19,000 per recipient.

- If you are married, you and your spouse can each give to the same recipient, effectively allowing a married couple to give up to $38,000 to one person in 2025 without triggering the gift-tax filing requirement (via gift-splitting).

- What Happens If You Give More Than the Annual Exclusion?

- Exceeding the $19,000 (2025) annual exclusion per recipient does not necessarily mean you owe a gift tax.

- What it does mean is that you must file Form 709 (the U.S. Gift (and Generation-Skipping Transfer) Tax Return) to report the excess amount.

- The amount in excess of the annual exclusion is counted toward your lifetime gift tax exemption (which we’ll discuss next).

Which Gifts Are Not Taxable or Exempt?

The IRS allows certain gifts to be excluded from the gift-tax rules altogether (i.e., they don’t count toward the annual exclusion or lifetime exemption). Some key exemptions:

- Gifts to your spouse, provided the spouse is a U.S. citizen, are fully exempt.

- Payments made directly to a medical provider for someone else’s medical expenses.

- Payments made directly to an educational institution for someone’s tuition. (Note: payments for room and board, books, supplies may not qualify.)

- Gifts to qualified charities or political organizations (in certain circumstances) may also be exempt.

Filing Requirements: When and How to File Gift-Tax Returns

Even if you don’t expect to pay gift tax, if you make gifts that exceed the annual exclusion, you must file the appropriate form.

Form 709 — U.S. Gift (and Generation-Skipping Transfer) Tax Return

- If you give during a calendar year gifts to someone exceeding the annual exclusion per recipient, you must file Form 709 for that year.

- Filing Form 709 does not necessarily mean you owe tax. Rather, it tracks how much of your lifetime exemption you have used.

- The form is due by April 15 of the year following the gift (unless you file an extension, just like your tax return).

Practical Scenarios — What You Should Know

Here are some common situations and how the gift-tax rules apply.

Scenario 1: Grandparent gives money to grandchild

Suppose a grandparent gives $25,000 cash to a grandchild in 2025.

- Annual exclusion is $19,000, so $6,000 in excess must be reported on Form 709.

- The $6,000 reduces the grandparent’s lifetime exemption from $13.99 m to $13.984 m (assuming no prior gifts).

- No gift tax is owed unless lifetime gifts exceed $13.99 m.

- The grandchild has no gift tax to pay.

Scenario 2: Parents give substantial assets over many years

A parent transfers $5 million worth of real estate over five years (above annual exclusions).

- Each year the excess above annual exclusions reduces the parent’s lifetime exemption.

- The parent must file Form 709 for those years in which gifts exceeded the annual exclusion.

- Unless the parent ultimately gives or estates more than $13.99 m, they will not owe gift tax.

The Big Picture of the Gift Tax’s Existence

Knowing the “why” underlying the gift-tax statute makes it easier to understand how it fits within the larger estate and tax structure.

The gift tax system was created to stop taxpayers from merely giving away assets prior to death in order to avoid paying the estate tax. Put otherwise, it addresses a possible estate planning loophole.

A set of regulations known as the gift tax, estate tax, and generation-skipping transfer tax (GST tax) are designed to guarantee that significant transfers—whether made during life, at death, or between generations—are taxed in some way.

The gift tax largely affects high-net-worth persons who engage in significant transfers or estate-planning schemes due to the generous yearly exclusion and lifetime exemption.

What’s Changing and What to Look Out for

The annual exclusion and lifetime exemption are adjusted for inflation periodically; for example, the annual exclusion rose to $19,000 in 2025.

Some tax-law watchers expect the lifetime exemption to change after 2025, so if you anticipate large gifting, timing may matter.

States may have their own gift‐tax or transfer‐tax rules, though the federal gift tax is the primary concern.

For international gifts (e.g., a U.S. person giving to a foreign person, or non-resident aliens making gifts of U.S. property), special rules may apply.

Bringing It All Together: A Checklist for Donors

Use this checklist to help you plan if you’re thinking about giving important gifts:

- Determine the value of the gift (cash, property, real estate, etc.).

- Compare the value per recipient to the annual exclusion ($19,000 in 2025).

- If below the exclusion per recipient, you may not need to file Form 709.

- If above, you’ll likely need to file Form 709 and reduce your lifetime exemption.

- Consider exempt categories: pays direct tuition, medical bills, gifts to spouse, gifts to charity.

- Track your lifetime exemption usage (gifts above the annual exclusion reduce it).

- Prepare for Form 709 if required — gather valuation, documentation, spouse’s election if gift-splitting.

- Consult a tax or estate-planning professional if you anticipate large transfers, international issues.

In conclusion: How the U.S. Gift Tax Works?

Although the federal gift tax may seem intimidating, only a small percentage of taxpayers are really subject to it. The majority of common family gifts—cash to kids or grandkids, birthday or holiday presents, small donations—fall comfortably beneath the annual exclusion and are tax-free.

Nevertheless, it is crucial to comprehend how the gift tax operates whether you are gifting substantial amounts, real estate, or structuring transfers to reduce estate-tax liability.

The Impact of Subprime Mortgages on the 2008 Financial Crisis: Lessons for Today’s Economy

The Impact of Subprime Mortgages on the 2008 Financial Crisis: Lessons for Today’s Economy