How the U.S. Estate Tax Works?

How the U.S. Estate Tax Works?

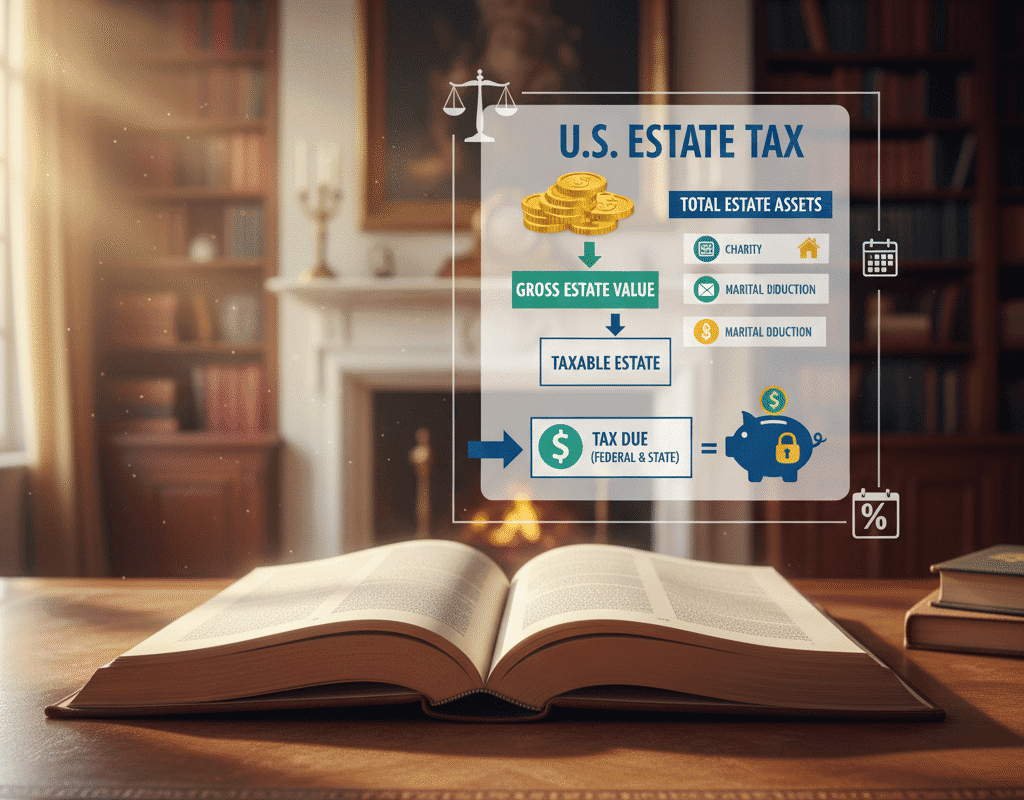

The U.S. estate tax is a federal tax levied on the transfer of property upon an individual’s death. Often misunderstood, it primarily affects high-net-worth individuals and their heirs. Understanding how the estate tax works is crucial for Americans seeking to protect their wealth and plan for the future. This guide delves into the mechanics of the estate tax, including exemptions, rates, filing requirements, and strategies to minimize its impact.

HSBC Cashback Credit Card 2025 – Benefits, Rewards & How to Apply?

What Is the U.S. Estate Tax?

The estate tax, sometimes called the “death tax,” is imposed on the total value of a deceased person’s assets before they are transferred to heirs. The Internal Revenue Service (IRS) administers the federal estate tax, while some states impose additional estate or inheritance taxes.

The estate tax is progressive, meaning the tax rate increases as the value of the estate rises. In 2025, the federal estate tax applies only to estates that exceed a significant threshold, making it relevant mostly for wealthy individuals.

Who Is Subject to the Estate Tax?

Not every American needs to worry about the estate tax. In 2025, only estates valued above $13.61 million per individual are subject to federal estate tax. Married couples can combine exemptions, effectively shielding up to $27.22 million of their estate from federal taxation.

This high exemption ensures that the majority of Americans, particularly middle-class families, are not affected. However, estates exceeding this threshold must carefully navigate complex tax rules to minimize liability.

Deductions and Exemptions from Estate Taxes

The federal estate tax system provides several exemptions and deductions to lower the taxable estate:

- Unified Credit / Exemption: Every individual has a lifetime exemption (currently $13.61 million in 2025) that shields a portion of their estate from taxation.

- Marital Deduction: Assets transferred to a surviving spouse are generally exempt from estate tax. This deduction ensures that the estate tax is deferred until the death of the surviving spouse.

- Charitable Deduction: Donations to qualified charities can reduce the taxable estate.

- Funeral and Administrative Expenses: Reasonable expenses incurred for funeral services and estate administration are deductible.

- Debts and Liabilities: Outstanding debts, mortgages, and certain taxes owed by the deceased are subtracted from the estate’s value.

How Estate Tax Rates Work

The federal estate tax rates in 2025 are progressive, starting at 18% and climbing to a maximum of 40% for estates exceeding the exemption threshold. The tax applies only to the portion of the estate above the exemption.

For example, if an estate is worth $15 million in 2025:

- The first $13.61 million is exempt.

- The remaining $1.39 million is taxed at rates that increase progressively from 18% up to 40%.

This system ensures that larger estates bear a higher tax burden while leaving smaller estates largely untouched.

How to File an Estate Tax Return

Estates exceeding the exemption threshold must file IRS Form 706, the United States Estate (and Generation-Skipping Transfer) Tax Return. The form requires detailed reporting of all assets, liabilities, deductions, and credits.

Key deadlines and requirements include:

- Filing within nine months of the deceased’s death.

- Requesting a six-month extension if necessary.

- Paying any estate taxes due at the time of filing.

Estate Tax Planning Strategies

Proactive estate planning can help reduce or defer estate taxes legally. Common strategies include:

- Gifting: Annual gifting of up to $17,000 per recipient in 2025 can reduce the taxable estate.

- Irrevocable Trusts: Assets placed in irrevocable trusts are removed from the taxable estate, offering long-term tax savings.

- Charitable Trusts: Donating to charitable remainder trusts can reduce the estate while benefiting charities.

- Family Limited Partnerships: This strategy allows high-net-worth individuals to transfer business interests to family members at discounted valuations.

- Life Insurance Planning: Proper structuring of life insurance proceeds can shield assets from estate taxes.

The Importance of Professional Advice

Navigating the U.S. estate tax system requires expertise. Estate planning attorneys, accountants, and financial advisors can help:

- Accurately value estate assets

- Identify applicable deductions and credits

- Establish trusts and gifting strategies

- Ensure compliance with IRS and state laws

Professional advice is particularly crucial for high-value estates or complex family and business situations.

Common Misconceptions About the Estate Tax

There are several myths surrounding the estate tax:

- It affects everyone: False. Only estates above the exemption are taxed.

- It is a double tax: Not exactly. The estate tax applies to the transfer of assets, not income earned by heirs.

- It can be easily avoided: Avoidance is complex. Legal tax planning is required to minimize liability without violating IRS rules.

In conclusion: How the U.S. Estate Tax Works?

For high-net-worth Americans, the U.S. estate tax is a crucial component of wealth management. While most estates are exempt due to the high federal threshold, understanding how the tax works, planning strategies, and filing requirements is essential to avoid unnecessary liability.

By leveraging exemptions, deductions, and professional guidance, families can preserve their wealth and ensure a smooth transfer of assets to future generations.

Estate tax planning is not just a financial necessity—it’s a proactive approach to securing your legacy and protecting your loved ones from unexpected burdens.

How Federal Reserve Instant Payments Are Revolutionizing Banking in the U.S.

How Federal Reserve Instant Payments Are Revolutionizing Banking in the U.S.