How Neobanks Are Challenging Traditional?

How Neobanks Are Challenging Traditional?

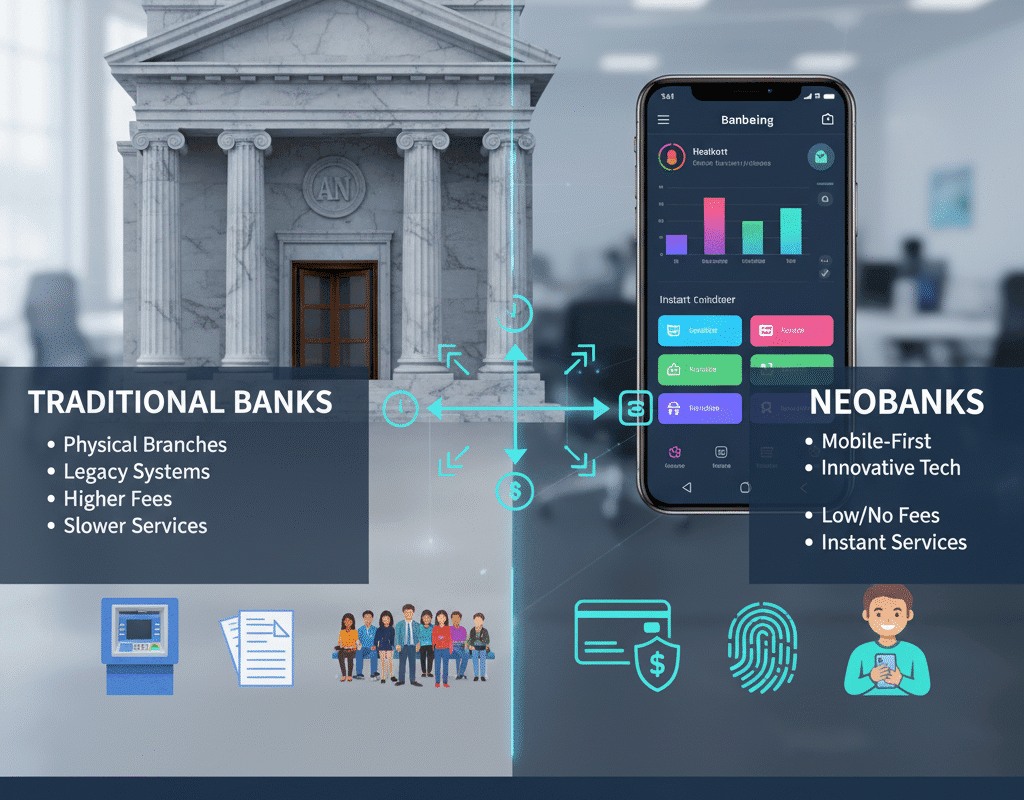

In the rapidly evolving U.S. financial services landscape, a new class of banking-platforms — commonly known as neobanks — has emerged to challenge the dominance of legacy institutions. These digital-first firms are making inroads by offering streamlined, mobile-based accounts, ultra-low fees or no fees, faster onboarding, and user-centric features tailored to tech-savvy or underserved consumers.

Meanwhile, traditional banks are scrambling to adapt: reducing branches, upgrading digital platforms, partnering with fintechs and rethinking the value proposition of physical presence.

HSBC Cashback Credit Card 2025 – Benefits, Rewards & How to Apply?

What Are Neobanks?

A neobank is typically an online-only financial institution that operates without traditional physical branch networks. The operations are conducted via mobile apps, web portals, chat support and digital tools.

Key characteristics of neobanks include:

- No (or very few) physical branches; almost all activity via digital channels.

- Light overhead costs compared to legacy banks, since they burn fewer resources on branch real-estate, legacy IT systems and large staff structures.

- Customer onboarding and service via app interfaces, often with streamlined identity verification, mobile deposits, instant transfers, built-in financial tools.

- Often not chartered banks themselves, but partner with chartered institutions (in the U.S. context) to provide FDIC-insured accounts or banking services.

- Focus on a younger, tech-savvy demographic, or underserved segments (gig economy, underbanked, digital-first customers).

Market Context: Current State of the U.S.

Neobanks’ development and potential disruption are noteworthy, even if they currently make up a small portion of the U.S. banking sector in terms of deposits and product offerings.

According to market commentary, neobanks are moving from niche challengers to credible alternatives: a recent study observed that the “neobank age has given traditional banking institutions a good competitive shake up.”

Further, while neobanks often lack full banking charters and may partner with banks for deposit insurance, they are nevertheless gaining traction — especially among younger, digital-comfortable users.

The rise of direct banking (online only banks with full charters) also hints at broader shifts: even where institutions are chartered banks, the “branchless” model is gaining user acceptance.

Case Studies: U.S. Examples & What They Illustrate

One illustrative U.S. example is Current (financial services company), a U.S.–based mobile banking platform that offers features such as early wage access, fee-free overdraft up to a certain amount, no minimum balances, and savings boosts.

While Current is not a traditional bank, it demonstrates how neobanks position themselves: convenience, digital-native services, and appealing to younger, mobile-first users.

Another important signal: research indicates some neobanks are now reaching the level of “credible challengers” — for example, the consulting firm report found that some may ultimately rival mainstream banks.

Nevertheless, traditional banks retain dominance in areas such as mortgage, business banking, commercial lending and large deposit bases.

Implications for Consumers and What to Watch

From a consumer standpoint, the emergence of neobanks and the ensuing competition mean several potential benefits — but also considerations.

Consumer benefits

- Lower fees, simpler pricing, fewer hidden charges

- Faster account opening and online onboarding

- Mobile-first features (budgeting tools, alerts, early direct deposit, spending analytics)

- Greater choice of banks and account types

- Better value for mobile-first, younger or tech-savvy users

Consumer considerations / risks

- Check FDIC insurance or equivalent protections, especially where the neobank partners with another institution.

- Confirm what services are provided: if you need mortgages, business banking, or full product suites, a neobank may not suffice.

- For complex or high-value banking needs, branch presence or personal advisor may matter.

- Digital only means you rely on app/service availability; downtime or cyber issues could be more impactful.

- Review the provider’s business viability and how they will monetise; some neobanks are still not profitable.

Summary and Concluding Remarks: How Neobanks Are Challenging Traditional?

In sum, the rise of neobanks in the United States is shifting the competitive landscape of retail and digital banking. These challenger banks are leveraging lower cost structures, mobile-first design, customer-centric features and targeting underserved segments to make meaningful gains against traditional banks.

Traditional U.S. banks, while still dominant in many respects, are under pressure to adapt — by improving digital offerings, reducing costs, enhancing customer experience and possibly leveraging new business models or partnerships.

For consumers, the competition is good news: more choices, potentially lower fees, better digital features and faster onboarding. But caveats remain around insurance, full product breadth and long-term viability of challengers.

Why the U.S. Runs Persistent Budget Deficits: Understanding the Structural Drivers

Why the U.S. Runs Persistent Budget Deficits: Understanding the Structural Drivers