How Loan Defaults Impact Banks?

How Loan Defaults Impact Banks?

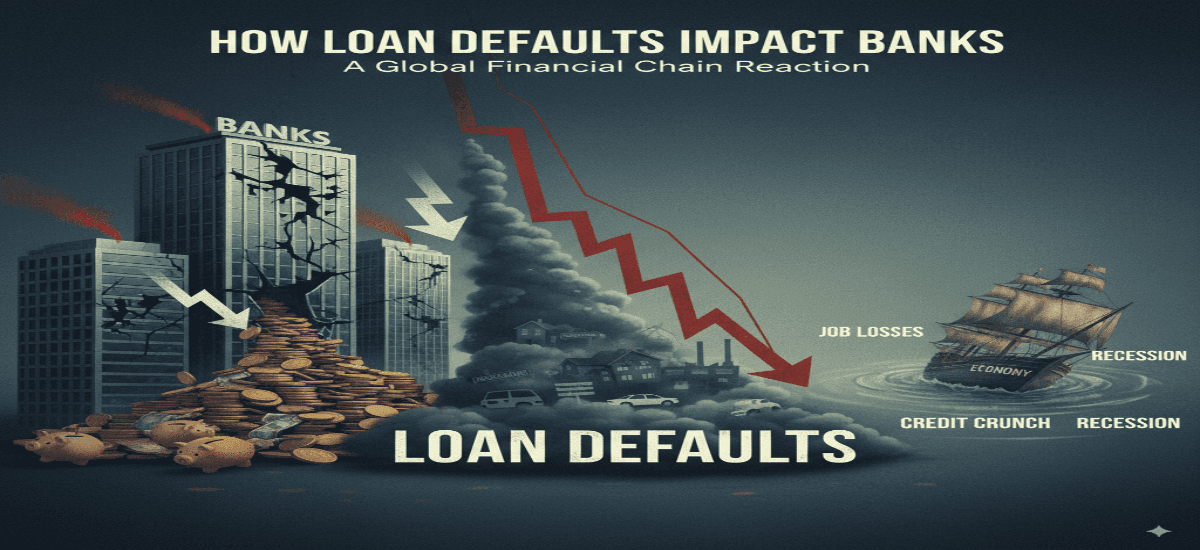

In recent years, loan defaults have emerged as a growing concern for the global financial system, particularly in the United States. When borrowers fail to meet repayment obligations, banks face mounting risks that can destabilize their operations, erode profitability, and even threaten the broader economy. Understanding how loan defaults impact banks is crucial for policymakers, investors, and everyday customers who rely on a stable banking sector.

This article explores the causes, consequences, and long-term effects of rising loan defaults, highlighting why they matter for banks and what steps can be taken to mitigate risks.

HSBC Cashback Credit Card 2025 – Benefits, Rewards & How to Apply?

Loan Defaults: What Are They?

When a borrower does to make loan payments on time, it is known as a loan default. Defaults can happen with:

- Individual loans

- Credit cards

- Mortgages

- Auto loans

- Business loans

When payments are missed repeatedly, banks must reclassify the loan as a non-performing loan (NPL). These NPLs become a direct threat to the financial stability of banks since the money lent out does not generate expected income.

Why Banks Care About Loan Defaults

The main source of income for banks is lending. When borrowers repay loans with interest, banks earn profits. But when borrowers default:

- Revenue shrinks because interest payments stop.

- Assets deteriorate as loans lose value.

- Capital buffers weaken, making banks less resilient.

- Reputation risks grow, as investors and customers lose trust.

For these reasons, rising loan defaults can send shockwaves through the entire financial system.

The Causes of Loan Defaults

Knowing the causes of loan defaults makes it easier to understand how they affect banks. Among the main factors are:

Economic Downturns

Inflation, layoffs, and recessions all affect borrowers’ capacity to make loan payments. For example, during the 2008 financial crisis, mortgage defaults skyrocketed, triggering a global banking meltdown.

High Interest Rates

When central banks raise rates to control inflation, loan repayments become more expensive. This often pushes vulnerable borrowers into default.

Inadequate Lending Procedures

If banks approve loans without strict credit checks, they increase the risk of defaults. The subprime mortgage crisis is a prime example of reckless lending.

Job Loss and Income Instability

Sudden unemployment leaves borrowers unable to service loans, leading to missed payments.

External Shocks

Events such as pandemics, natural disasters, or geopolitical conflicts disrupt economies and repayment capacities.

The Effects of Loan Defaults on Banks

Effect on Bank Balance Sheets

The value of a bank’s assets is diminished by loan defaults. Defaults compel banks to devalue loans because they are recorded as assets. As a result, balance sheets get weaker and solvency is questioned.

A decline in profitability

Bank earnings are falling in the absence of consistent interest income. Their earnings are further harmed by the fact that they have to spend more on provisions for loan losses.

Non-Performing Loans (NPLs) are increasing.

The ability of banks to lend is restricted by high NPL levels. Because consumers and businesses find it difficult to obtain fresh loans, this has a direct impact on economic growth.

Liquidity Pressures

When defaults rise, depositors may lose trust and withdraw funds. This creates liquidity shortages, pushing banks toward bailouts or collapse.

Credit Rating Downgrades

If defaults remain high, rating agencies downgrade banks. This makes it more expensive for banks to borrow money in capital markets.

Banking Sector Contagion

Loan defaults are rarely isolated. If one bank suffers major losses, it can spread panic across the sector, as seen during the failures of Silicon Valley Bank and other regional banks in 2023.

Greater Economic Repercussions

Banks are weakened by loan defaults, which also have an impact on the overall economy:

- Decreased Lending: As banks tighten credit, it becomes more difficult for businesses and families to obtain money.

- Increased Unemployment: Companies that are unable to obtain loans reduce employment.

- Reduced Consumer Confidence: Economic growth is slowed as households grow more cautious.

- Stock Market Instability: Issues in the banking industry frequently lead to financial market sell-offs.

How Banks Manage Loan Defaults

Despite risks, banks adopt various strategies to cushion against defaults:

- Loan Loss Provisions: Setting aside reserves to cover bad debts.

- Collateral Seizure: Recovering value by repossessing assets like homes or cars.

- Debt Restructuring: Renegotiating terms to make repayment easier for borrowers.

- Credit Risk Assessment: Using advanced analytics to identify high-risk borrowers before lending.

- Diversification: Avoiding overexposure to one sector or region.

Concluding remarks: How Loan Defaults Impact Banks?

Loan defaults are systemic hazards that have the potential to destabilize entire economies, making them more than just personal issues for individual borrowers. Banks have credibility issues, reduced earnings, and liquidity constraints as a result of defaults. For society, they can trigger recessions and job losses.

As history shows, how loan defaults impact banks is not just a financial story but also a social one. Managing these risks effectively is essential for safeguarding financial stability in the United States and beyond.

Understanding Price vs Value in Stocks: A Complete Guide for Investors

Understanding Price vs Value in Stocks: A Complete Guide for Investors