How Home Equity Lines of Credit (HELOCs) Work?

How Home Equity Lines of Credit (HELOCs) Work?

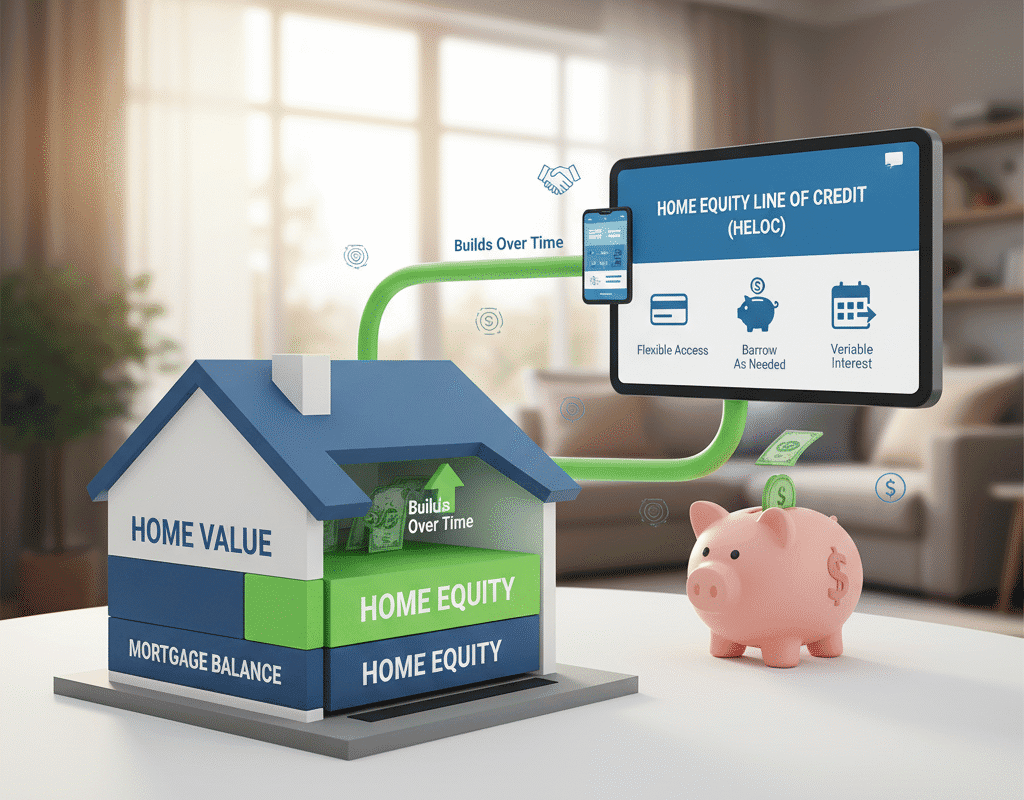

Many American homeowners view their home as a substantial financial asset in addition to a place to live. Homeowners build up a larger portion of their house’s value, known as home equity, as property values increase and mortgage balances decrease. A product known as a Home Equity Line of Credit, or HELOC, is one way to access that equity.

This article will explain how a home equity loan (HELOC) operates in the US, why homeowners select it, how it is borrowed and repaid, the risks and rewards, eligibility and qualifying requirements, and useful tips for responsible use.

HSBC Cashback Credit Card 2025 – Benefits, Rewards & How to Apply?

A HELOC: What is it?

One type of revolving financing that is secured by your house is a home equity line of credit. To put it simply:

- You already own a house, but your mortgage balance is less than the house’s current market worth. Your equity is the difference between the value and the mortgage balance.

- Using your house as security, a lender lets you borrow against some of that equity.

- A HELOC provides you with a credit line, as opposed to a lump-sum loan; you can borrow as needed (up to a limit), pay it back, and borrow again during the designated “draw period.”

- Interest rates are typically lower than those for unsecured credit because your home serves as collateral.

How Do HELOCs Operate?

Evaluation and setting a credit limit

The lender will consider the following when you apply for a HELOC:

- Your home’s value (as determined by an appraisal or current estimate)

- Your remaining mortgage balance or balances

- Your creditworthiness (income, debt-to-income ratio, and credit score)

The amount of credit the lender will grant is determined by these criteria. One common rule, for instance, is to borrow no more than 80–85% of your home’s value less your debt.

Draw (loan) duration

After approval, the draw period begins:

- Usually lasting five to ten years, this time frame can differ depending on the lender.

- You can borrow up to the maximum amount on your credit line during this period. Only the amount you borrow is subject to interest; the entire line limit is not.

- It provides flexibility since it functions similarly to a credit card for your house—you have a line, you draw, you repay, and you draw again.

Time frame for repayment

The repayment period starts when the draw period concludes:

- No further borrowing is allowed; you start repaying principal plus interest on the outstanding balance.

- The repayment term may run 10-20 years (or longer, depending on terms) for amortization.

- Because many HELOCs have variable interest rates, your payments can change when rates shift.

Why Homeowners Use HELOCs

Flexibility

One of the biggest draws: you don’t need to borrow a large lump sum upfront. Use only what you need, when you need it. During the draw period you can reuse the credit.

Lower interest rate (compared with unsecured debt)

Because your home is collateral, interest rates tend to be lower than credit cards or personal loans.

Access to equity for major expenses

Typical uses include: home improvements/renovations, debt consolidation (especially high-interest debt), education expenses, emergencies.

Possible deduction of taxes

Tax deductions may be available for interest paid on a home equity loan (HELOC) utilized for home improvement and other approved purposes. (Note: consult a tax advisor at all times.)

“Standby” liquidity

Some homeowners open a HELOC and don’t borrow immediately — they simply have the credit line as a backup in case of emergencies. (As reported, many HELOCs are opened with zero balance initially.)

Criteria for Qualification

In order to grant a HELOC, lenders usually look at:

- Credit history and credit score

- Stability of income and employment

- Ratio of debt to income (DTI)

- Existing mortgage balances and home value

- The amount of available home equity

The type of property, its location, whether it is your permanent residence or an investment property, and any additional fees or closing charges are possible additional factors.

When a HELOC Might Not Be the Best Option

If your income fluctuates or your credit history is bad,

- If you intend to spend little time at home (short-term residence),

- If you are depending on equity growth or appreciation to save you, property prices may stagnate or even fall.

- If you’ll draw and won’t make a clear plan to repay principal

- If your purpose is purely consumption (vacation, luxury spending) rather than value‐building

Strategic Applications of a HELOC

Home Remodeling and Value Boosting

Your home’s value can rise when you use a HELOC for improvements, which lowers the cost of borrowing.

Consolidation of Debt

You can save money by switching from high-interest credit card debt to a lower-rate home equity loan (HELOC), but only if you refrain from using your credit cards further.

Education or Significant Costs

Financing significant financial demands, such as tuition or medical bills. One benefit of a line is its flexibility.

Backup Emergency Fund

Although one should still save funds, having an unused HELOC set aside as “standby credit” for unexpected expenses can bring comfort.

Business Use or Investment

Some homeowners use HELOC funds to launch a business or look for investment opportunities. This is more dangerous and needs careful consideration.

Timeline and Key Milestones in the U.S. HELOC Market

- HELOCs began to surge in the U.S. in the early 2000s, due in part to rising home values and tax incentives.

- More recently, homeowners are increasingly using HELOCs in response to interest‐rate changes, home equity increases, and greater flexibility in borrowing.

- But as markets tighten and regulations evolve, lenders may reduce available credit or impose stricter terms.

Summary and Concluding Remarks: How Home Equity Lines of Credit (HELOCs) Work

For American homeowners, a home equity line of credit can be an effective instrument. It provides flexibility, reduced interest rates, and access to otherwise illiquid home equity when used prudently, whether for investments, debt consolidation, emergency backup, or remodeling. It is not risk-free, though; if you use your house as collateral, you will have to pay it back, interest rates could go up, and misuse could endanger your house.

If you’re thinking about taking out a home equity loan (HELOC), proceed as you would with any major financial decision: read the terms carefully, evaluate your ability to pay back the loan, have a clear strategy for how you’ll spend and repay the money, and keep an eye on your property value and interest rate environment.

The Role of State Regulators in Banking: Safeguarding the U.S. Financial System

The Role of State Regulators in Banking: Safeguarding the U.S. Financial System