How Economic Stimulus Bills Are Funded?

How Economic Stimulus Bills Are Funded?

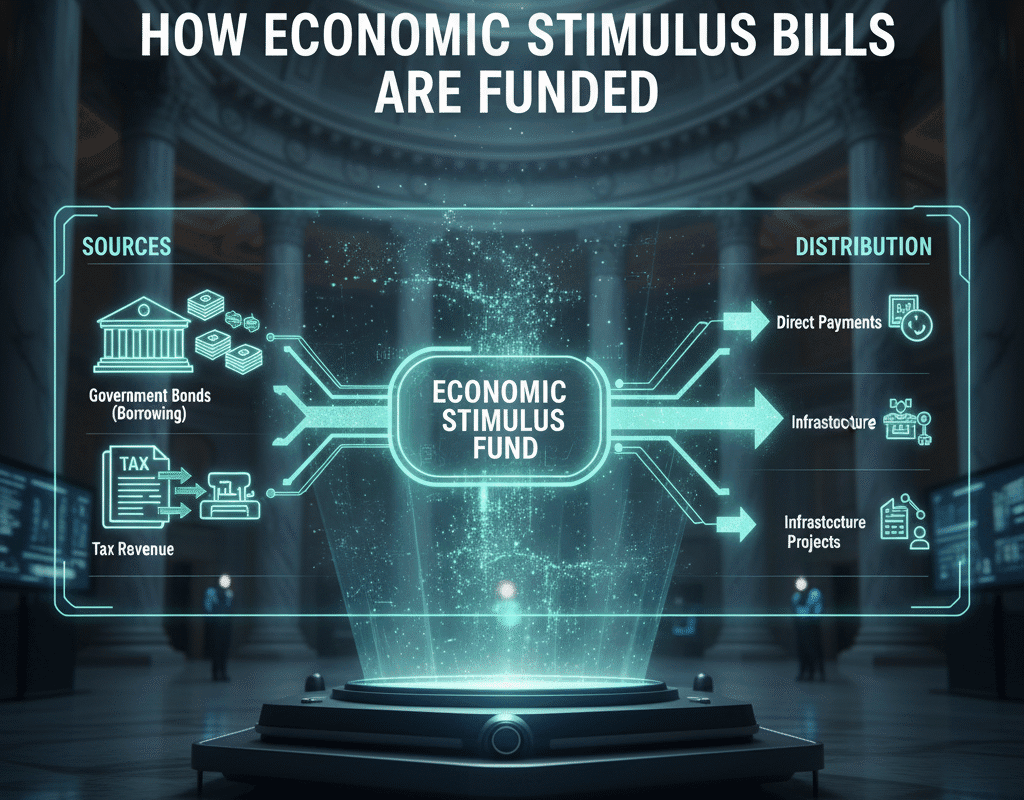

When economic crises hit — whether the 2008 financial meltdown or the COVID-19 pandemic — the U.S. government often responds with large-scale economic stimulus bills. These packages pump billions or even trillions of dollars into the economy to prevent collapse, sustain jobs, and revive consumer confidence.

But one question consistently puzzles citizens: Where does this money actually come from?

Is it “printed out of thin air”? Are future generations footing the bill? Or does the government have a more structured, sustainable funding mechanism?

HSBC Cashback Credit Card 2025 – Benefits, Rewards & How to Apply?

What Is an Economic Stimulus Bill?

An economic stimulus bill is a legislative package passed by Congress to inject financial aid into the economy during downturns. The goal is to boost demand, support employment, and stabilize key industries.

Stimulus bills often include:

- Direct payments to individuals (like stimulus checks).

- Unemployment benefits extensions.

- Business loans and grants.

- Infrastructure investments.

- Tax credits or cuts.

The Myth of “Printing Money”

A common misconception is that the government simply prints money to pay for stimulus bills.

In reality, physical printing plays a minimal role. Most “new money” exists digitally, created by the Federal Reserve when it buys assets or injects liquidity into the banking system.

While this expansion of the money supply can stimulate growth, excessive creation without output growth can trigger inflation, which erodes purchasing power.

The Role of the Federal Deficit and National Debt

Stimulus bills often push the federal deficit higher because spending exceeds revenue.

The national debt — the cumulative total of all deficits — grows as a result.

As of 2025, the U.S. national debt surpasses $35 trillion, partly due to pandemic-era stimulus efforts.

However, economists argue that borrowing during crises can be beneficial if it prevents deeper economic collapse and supports long-term recovery.

Debt Sustainability

The key concern isn’t the absolute size of the debt, but whether the U.S. can service it — that is, make interest payments without disrupting the economy.

As long as investors maintain confidence in U.S. Treasury securities, the system remains stable.

Case Study: The CARES Act (2020)

The CARES Act, passed in March 2020, was a $2.2 trillion stimulus bill responding to COVID-19’s economic shock.

Funding Breakdown:

- Treasury issued over $1.6 trillion in new securities.

- The Federal Reserve expanded its balance sheet by purchasing government and corporate debt.

- Deficit rose from $984 billion in 2019 to $3.1 trillion in 2020.

Despite the historic cost, the package prevented a deeper recession and aided rapid recovery in 2021, according to Congressional Budget Office (CBO) estimates.

Stimulus Funding Politics

Intense political controversy is frequently sparked by stimulus bills.

Progressives contend that deliberate government spending promotes equity and prevents economic collapse, while conservatives stress fiscal discipline and the perils of long-term debt.

In reality, both parties have backed stimulus expenditure when it was required, demonstrating how economic crises frequently take precedence over ideological differences.

The Global Perspective

The U.S. is not alone in using deficit spending to fund stimulus.

Countries like Japan, the U.K., and members of the European Union also rely on government borrowing and central bank intervention to finance stimulus programs.

However, the U.S. dollar’s global reserve status gives the U.S. unique flexibility — it can borrow cheaply and maintain investor confidence even at high debt levels.

Final Thoughts: The Balancing Act

In times of crisis, economic stimulus bills are essential instruments for safeguarding the American economy.

With the Federal Reserve and Treasury at their core, they are financed by a complicated interaction of borrowing, taxation, and monetary policy.

They can hasten recovery and avert recession, but they also give rise to justifiable worries about inflation and the sustainability of debt.

In the end, the effectiveness of stimulus spending depends not just on the amount invested but also on how well it is funded and targeted.

Making educated decisions regarding America’s economic future is made easier for individuals, investors, and legislators when they comprehend this process.

Concluding Remark: How Economic Stimulus Bills Are Funded?

Bills for economic stimulus are not “free money.” These are strategic investments financed by a complex framework that combines monetary and fiscal policy.

In order to prevent today’s solutions from becoming tomorrow’s responsibilities, the U.S. government must strike a balance between short-term alleviation and long-term budgetary health.

How U.S. Tax Treaties Prevent Double Taxation: A Complete Guide

How U.S. Tax Treaties Prevent Double Taxation: A Complete Guide