How Corporate Inversions Impact U.S. Tax Revenues?

How Corporate Inversions Impact U.S. Tax Revenues?

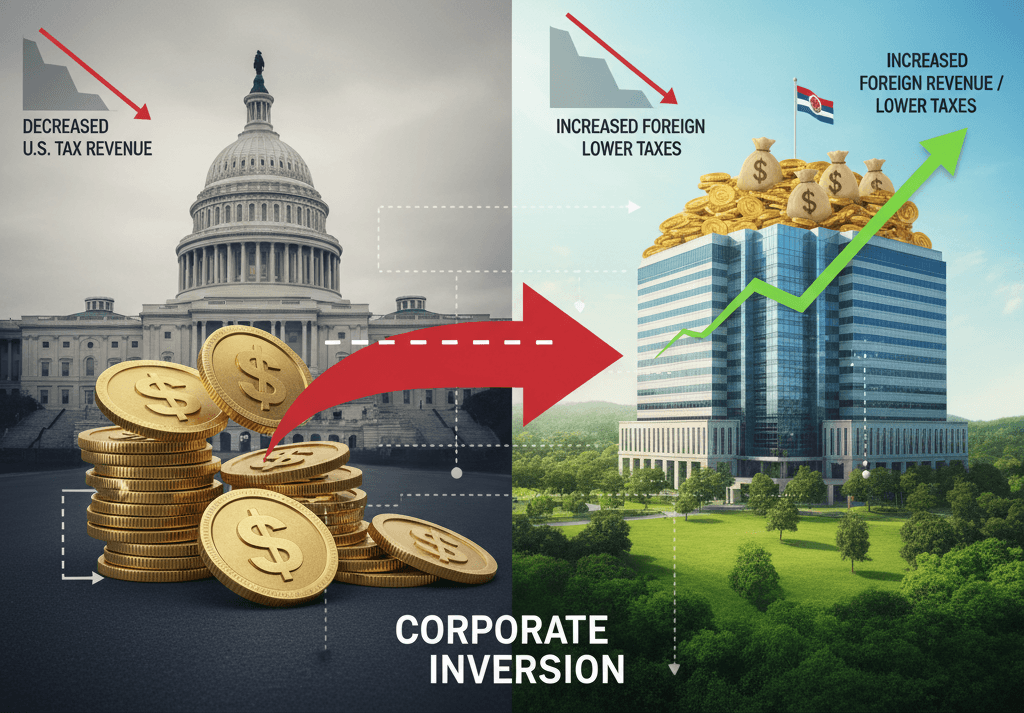

Corporate taxation in the United States has always been a contentious political and economic battleground, but few issues have generated as much debate as corporate inversions—a practice in which U.S.-based multinational companies shift their legal headquarters overseas to benefit from lower taxes.

Although regulatory changes in recent years have made inversions more difficult, the issue remains relevant in 2025 as companies continue to explore new structures and loopholes that reduce their overall tax obligations. As policymakers debate how to make the U.S. tax system more competitive and fair, the question remains crucial: How do corporate inversions affect U.S. tax revenues?

HSBC Cashback Credit Card 2025 – Benefits, Rewards & How to Apply?

Comprehending Corporate Inversions

When a U.S.-based business purchases or merges with a foreign company and moves its legal headquarters to a nation with a lower corporate tax rate, this is known as a corporate inversion. Legally, the business becomes a foreign entity even if it may continue to have an executive or operational presence in the US.

Corporate inversions are frequently motivated by the following:

- Reduced business tax rates overseas

- Benefits of offshore earnings for taxes

- avoiding paying US taxes on company earnings made abroad

- Shifting profits to low-tax jurisdictions with flexibility

- Pressure from shareholders to increase after-tax revenue

Companies do not always depart the US as a result of inversions. Many inverted firms still employ thousands of American workers and maintain substantial U.S. operations.

The Importance of Inversions in the US Corporate Tax System

Prior to the Tax Cuts and Jobs Act (TCJA) of 2017, American multinational corporations were subject to worldwide taxation based on their worldwide income. In the meantime, territorial systems were employed by the majority of rival countries, which exclusively taxed revenue received inside their boundaries.

Companies were encouraged to relocate their headquarters overseas as a result of this mismatch.

Inversions are still appealing to some businesses even after the TCJA reduced the federal corporate tax rate from 35% to 21% because of:

- Reduced foreign exchange rates (some less than 15%)

- Regulatory and tax incentives in countries like Ireland, Bermuda, Luxembourg, and the Netherlands

- Opportunities for profit shifting through intellectual property and transfer pricing

The Reasons Businesses Support Corporate Inversions

Inversions are usually justified by executives and shareholders using a number of arguments:

Competitiveness

Businesses contend that lower taxes already give foreign rivals an unfair edge in international marketplaces.

Increasing Value for Shareholders

Investors reward larger earnings as a result of lower taxes.

Efficiency in Law and Structure

Companies claim U.S. tax regulations are overly complex and restrictive.

Pressure from Global Markets

Boards often face intense pressure from activist investors who push for inversion strategies to increase returns.

How Would Inversions Be Permanently Reduced?

Economists suggest a number of remedies:

Further Reducing the Corporate Tax Rate

Making the U.S. rate globally competitive, according to others, would eliminate incentives for relocation.

Increasing International Tax Cooperation

Initiatives for a global minimum tax could lessen aggressive profit shifting.

Entire Tax Reform

Revenue could be stabilized by streamlining regulations and eliminating gaps.

Encouraging Domestic Investment

Remaining in the United States may be more appealing due to tax advantages for capital investment, manufacturing, and research.

In conclusion: How Corporate Inversions Impact U.S. Tax Revenues?

Corporate inversions represent one of the most complex challenges in modern U.S. tax policy. While companies argue that inversions are necessary to remain competitive, policymakers warn that these strategies erode the tax base, distort markets, and undermine public trust.

As global tax competition intensifies, the United States faces a pivotal decision: reform its tax code to reduce incentives for inversion or risk continued erosion of its corporate tax revenue. The outcome of this ongoing debate will shape the nation’s economic future for decades.

In 2025, one thing is clear—corporate inversions are not simply a tax issue, but a reflection of the global economic pressures facing the United States in an increasingly interconnected world.

How Semiconductor Subsidies Are Transforming the U.S. Industry and Boosting Innovation

How Semiconductor Subsidies Are Transforming the U.S. Industry and Boosting Innovation