“Federal vs. State Taxes in the U.S.:

“Federal vs. State Taxes in the U.S.:

The federal government and state-level taxes are the two main levels of taxes that Americans frequently have to deal with. Although they both require annual reports and are dependent on income, the two systems are very different from one another. Anyone who works, resides, or invests in the United States must be aware of these distinctions since mistakes can result in financial loss, penalties, or missed deduction opportunities.

This article for usacurrentaffair.com delves deeply into the distinctions between federal and state taxes, including their goals, methods of collection, differences in rates and regulations, interactions between them, and things you, as a taxpayer, should be aware of.

HSBC Cashback Credit Card 2025 – Benefits, Rewards & How to Apply?

Federal Taxes: What Are They?

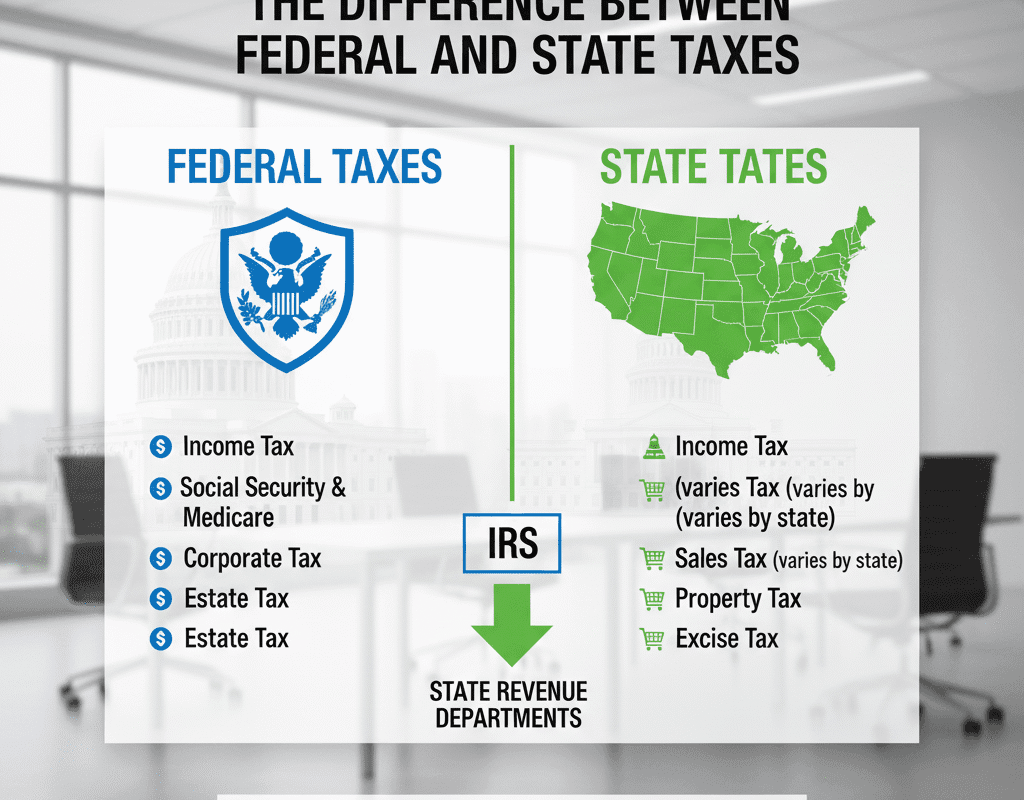

The Internal Revenue Service (IRS) is responsible for managing the federal tax system. Fundamentally, taxable income of individuals, businesses, trusts, and other entities is subject to federal income tax.

Goals and Extent

- Defense, national debt interest, social insurance programs (such as Social Security and Medicare), government infrastructure, disaster relief, and many more initiatives are all financed by federal taxation.

- Because the United States has a progressive income tax system, your marginal rate will increase as your taxable income rises.

- Other federal taxes include payroll taxes (for Social Security and Medicare), gift and estate taxes, excise taxes (on goods like gasoline, tobacco), and corporate income taxes.

Important Features

- The IRS establishes the regulations and rates for a single, consistent federal level of taxes that applies to all states, though they may be altered by legislation.

- The majority of individual taxpayers must file their federal taxes by April 15 (or the following business day) every year.

- Anyone making more than a particular amount is typically required to file federal returns (such as Form 1040).

Why Do We Pay Both Federal and State Taxes?

It’s common to ask: why must individuals pay separate taxes to federal and state entities? The answer lies in the federal system of government in the U.S., where powers and responsibilities are divided among levels of government.

Revenue for different responsibilities

The federal government handles national issues: defence, interstate commerce, immigration, national infrastructure, social insurance programs, etc.

State governments handle more localized issues: state highways, public education, state courts and prisons, health programs, state parks and other services. Because these responsibilities incur costs, states need revenue — hence state taxation.

Tax policy decentralization

One advantage is that governments can customize their tax systems according to their population, economic base, budgetary requirements, and policy agendas. For instance, a state with abundant natural resources might rely more on severance taxes, whereas another would rely more on sales taxes.

Efficiency and equity considerations

Some states may raise sales or property taxes in exchange for lowering or doing away with the state income tax in an effort to draw in citizens and businesses.

You’ll frequently find disparities between federal and state treatments of income, deductions, credits, and tax rates since, from a fiscal policy perspective, different tax bases may result in different incentives and impacts on behavior.

Current Trends & Things to Look Out for

There are changing trends and legislative changes to be aware of, even if many of the basic distinctions between federal and state taxes are still the same.

- Some states are actively pursuing cuts to state income tax rates or elimination of income tax altogether (or reforms of their tax codes) as part of economic-development strategies.

- The SALT deduction cap continues to influence taxpayer behaviour, especially in high-tax states.

- Tax-filing technology and programmes (both federal and state) are evolving, including efforts to streamline filings for eligible taxpayers.

- State tax policy responses to federal tax changes (e.g., changes in federal deductions, credits, or taxable income definitions) vary — meaning a federal change does not automatically translate to state changes.

In conclusion: “Federal vs. State Taxes in the U.S.

The distinction between federal and state taxes in the U.S. is not just a technical detail — it has real impact on how much you owe, how you file, and how you plan financially. The federal system provides national uniformity in income taxation; state systems reflect local choices, economic bases, and policy priorities.

By appreciating how and why the two systems differ — who collects what, how rates vary, how deductions and credits differ, how income is defined differently — you empower yourself to make informed decisions, avoid pitfalls, and potentially reduce your tax burden legally.

The History of Savings and Loan Associations: Evolution, Impact, and Lessons for Today’s Economy

The History of Savings and Loan Associations: Evolution, Impact, and Lessons for Today’s Economy