Dividend Reinvestment Plans (DRIPs) Explained:

Dividend Reinvestment Plans (DRIPs) Explained:

Many American investors are turning to dependable and steady methods for accumulating wealth over the long term in the current unpredictable stock market. The Dividend Reinvestment Plan (DRIP) is one strategy that has been gaining popularity over time.

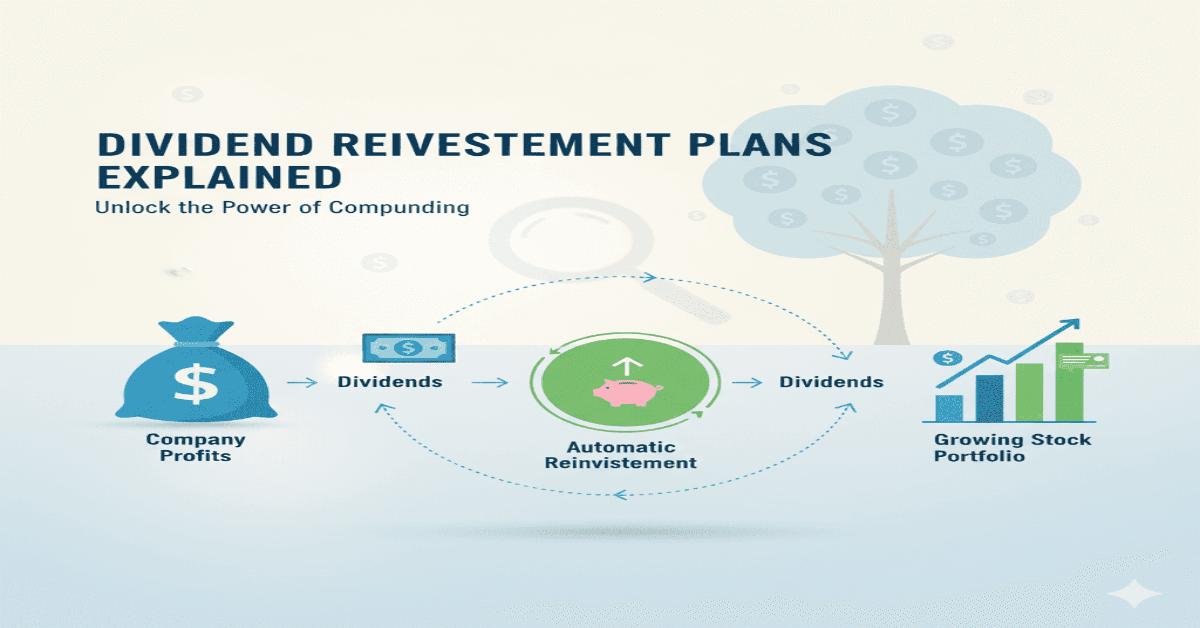

Instead of getting cash distributions, DRIPs give investors the option to automatically reinvest their dividends into more business stock. Through this approach, investors can take advantage of compound interest and expand their portfolio over time.

It’s critical to comprehend DRIPs’ operation, advantages, possible drawbacks, and suitability for your investing strategy in 2025 as more American businesses provide them to shareholders.

HSBC Cashback Credit Card 2025 – Benefits, Rewards & How to Apply?

A Dividend Reinvestment Plan (DRIP): What is it?

Companies and brokerage houses offer a scheme called a Dividend Reinvestment Plan (DRIP) that enables owners to automatically reinvest cash dividends into more shares or fractional shares of stock.

Investors purchase extra shares in lieu of quarterly or annual cash payments, frequently without incurring commission costs. This has the potential to result in substantial portfolio growth over time.

For instance:

- You would get $100 in dividends if you owned 100 shares of a company that paid a $1 annual dividend.

- That $100 is automatically reinvested into additional shares via a DRIP.

- Your future payouts rise in tandem with the growth of your holdings, causing a snowball effect.

The Function of DRIPs in the US Stock Market

This is a detailed explanation of how DRIPs work:

- Dividend Declaration – The company announces a dividend payout.

- Automatic Reinvestment – Instead of cash, dividends purchase additional shares directly.

- Fractional Shares – Most DRIPs allow fractional share purchases, ensuring no dividend money goes unused.

- Compounding Growth – Each reinvestment leads to more shares, which generate larger future dividends.

Many companies offer DRIPs directly to shareholders, while others are available through brokerages. In 2025, most major U.S. brokers like Charles Schwab, Fidelity, Vanguard, and Robinhood offer free DRIP enrollment.

Dividend Reinvestment Plans’ Advantages

Compounding Power

DRIPs use the compounding effect to their advantage. Your investment will increase more quickly if dividends are reinvested more frequently.

Economical Investing

In contrast to typical stock purchases, the majority of DRIPs are commission-free, saving investors money.

DCA, or dollar-cost averaging

By reinvesting dividends consistently, investors buy shares at different price points, reducing the impact of market volatility.

Ownership of Fractional Shares

Unlike traditional stock purchases, DRIPs allow you to buy fractions of shares, ensuring every cent of your dividend is put to work.

Long-Term Wealth Building

For patient investors, DRIPs can lead to exponential growth over decades. Many investors who reinvested dividends in companies like Coca-Cola, Johnson & Johnson, or Procter & Gamble have seen tremendous long-term returns.

DRIPs’ Hazards and Cons

Despite their strength, DRIPs have drawbacks.

- Lack of Liquidity: Reinvested dividends result in less cash on hand right away.

- Concentration Risk: Your portfolio may become overweight if you reinvest in the same business.

- Tax Liabilities – Even reinvested dividends are taxable in the U.S. (unless in retirement accounts).

- Market Volatility – If a company’s stock price declines, your reinvested dividends may lose value.

- Limited Control – Investors cannot always time the purchase or choose when dividends are reinvested.

DRIPs’ effects on taxes in the US.

The idea that reinvested dividends are tax-free is a frequent misunderstanding. Reinvested dividends are really considered taxable income by the IRS.

- Depending on your tax bracket, qualified dividends are typically taxed at 0%, 15%, or 20%.

- Ordinary income taxes are applied to non-qualified dividends.

- Dividends, even if reinvested, must be reported annually in taxable brokerage accounts.

- DRIPs that are kept in tax-advantaged accounts, such as Roth IRAs or 401(k)s, are exempt from immediate taxation.

In order to ensure proper cost basis reporting, investors should keep a close eye on reinvested dividends.

DRIP Types Available

DRIPs Managed by the Company

- Directly overseen by the company.

- Direct stock purchase programs (DSPPs) are frequently permitted.

- Coca-Cola, Johnson & Johnson, and ExxonMobil are a few examples.

Brokerage-Operated DRIPs

- Offered by brokers like Fidelity, Schwab, and Vanguard.

- Easier enrollment, covering a wide range of stocks and ETFs.

- Convenient for investors managing multiple holdings.

Synthetic DRIPs

- Provided by some brokers, where dividends are pooled and used to buy shares.

- Functionally similar to company DRIPs, but more flexible.

2025’s Top US Dividend Stocks with DRIPs

DRIPs are provided by some of the most reputable dividend-paying businesses in the US:

- Coca-Cola (KO) is well-known for its steady dividend increases.

- A dividend aristocrat with decades of distributions is Johnson & Johnson (JNJ).

- Procter & Gamble (PG) is a major manufacturer of household goods.

- ExxonMobil (XOM): High dividends in the energy sector.

- Another powerful consumer staple is PepsiCo (PEP).

- Despite its concerns, AT&T (T) has a historically high dividend yield.

- An established dividend payer is 3M (MMM).

These businesses are well-liked by DRIP investors because to their track record of consistent payouts and sustained expansion.

Who Needs to Think About DRIPs?

DRIPs are especially appropriate for:

- Those looking for compounding over decades are known as long-term investors.

- Investors who are income-focused want dividends in order to increase their wealth in the future.

- Beginners: Automatic reinvestment and fractional shares are advantageous for novice investors.

- Retirement Planners: DRIPs can greatly increase retirement savings in 401(k)s or IRAs.

DRIPs, however, might not be as attractive to traders with limited time horizons or those who require quick income flow.

DRIPs vs. Taking Cash Dividends

| Aspect | DRIP | Cash Dividend |

| Liquidity | Reinvested, not immediately available | Cash in hand |

| Compounding | Accelerates long-term growth | No compounding effect |

| Taxes | Still taxable | Taxable |

| Portfolio Balance | Concentrated in same stock | Flexible reinvestment options |

Advice for Optimizing the Benefits of DRIP

- Avoid becoming overexposed to a single company by combining DRIPs with diversification.

- Reduce the burden of IRS taxes by using DRIPs in tax-advantaged accounts.

- Target Dividend Aristocrats: Businesses that have increased their dividends over decades.

- Regularly reevaluate to make sure the business still supports your long-term objectives.

- ETFs Should Not Be Ignored: A lot of dividend ETFs also permit automatic reinvestment.

Plans for Dividend Reinvestment in 2025 and Later

As technology advances, DRIPs are becoming more accessible. Zero-commission brokerages, fractional shares, and mobile trading apps have made dividend reinvestment easier than ever.

In the U.S., younger investors are increasingly embracing dividend strategies as a hedge against inflation and market volatility. Analysts predict that by 2030, more than 60% of retail investors will use DRIPs in some form.

Conclusion: Should You Enroll in a DRIP?

Dividend Reinvestment Plans remain one of the simplest yet most effective wealth-building strategies available in the U.S. market.

While they are not without risks — such as tax obligations and portfolio concentration — their ability to compound returns, reduce costs, and encourage disciplined investing makes them a powerful tool for long-term investors.

For those planning retirement, building generational wealth, or seeking steady portfolio growth, DRIPs are an investment strategy worth serious consideration in 2025.