How Disability Benefits Are Determined?

How Disability Benefits Are Determined?

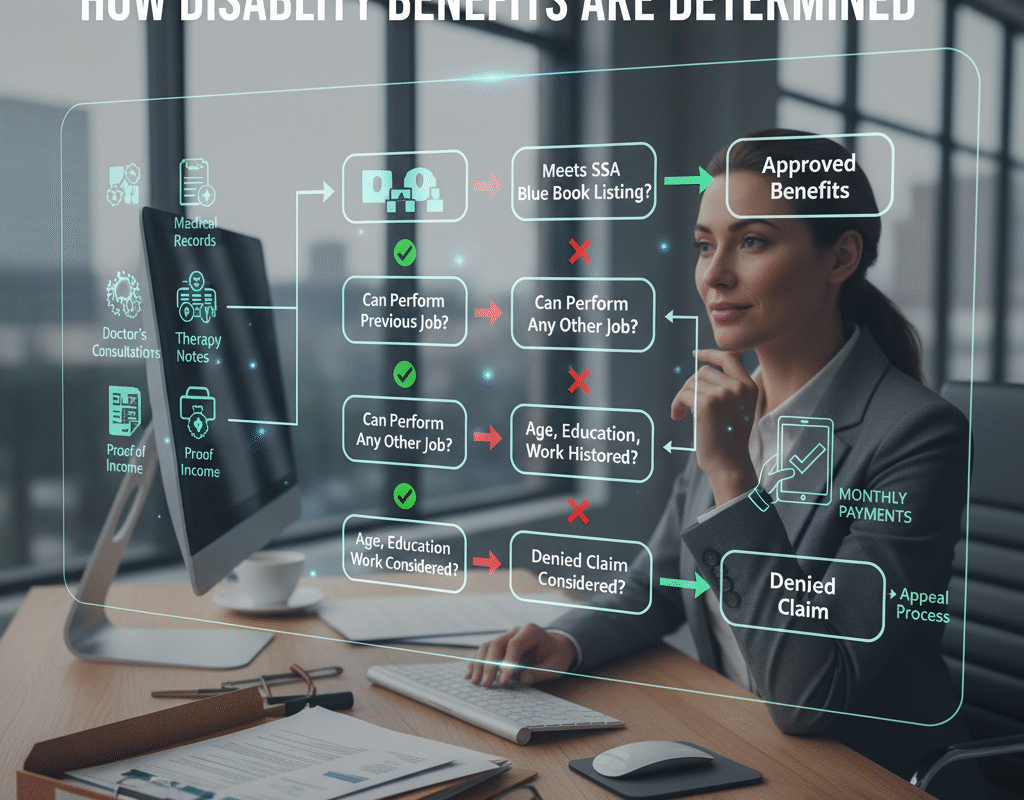

When individuals in the United States become unable to work because of a severe medical condition, they often turn to federal disability benefit programs for support. But how exactly are disability benefits determined?

This article provides a deep dive into the process by which the Social Security Administration (SSA) reviews applications, makes eligibility decisions, and calculates benefit amounts — particularly within its two major programs: Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI). Understanding the rules, definitions, steps and formulas can help applicants prepare better and avoid unexpected outcomes.

HSBC Cashback Credit Card 2025 – Benefits, Rewards & How to Apply?

Overview of the Key Programs: SSDI and SSI

Before delving into how benefits are determined, it’s essential to understand the two main federal programs through which disability benefits are paid.

SSDI (Social Security Disability Insurance): This program is for people who have a qualifying work history and have paid into the Social Security system through payroll taxes.

SSI (Supplemental Security Income): This is a need-based program for people who have disabilities (or are 65 or older or blind) and have low income and limited resources, regardless of their work history.

The eligibility criteria and benefit-calculation rules differ between these programs — which means that how disability benefits are determined will vary depending on which program you are applying for or qualify under.

The Procedure for Determining Disability

Following submission of a claim (by mail, online application, or in person at a Social Security field office), the procedure typically entails the following steps:

- Initial intake: The SSA field office gathers your data, including medical documents, a description of your impairment, and your employment history.

- State Disability Determination Services (DDS): The case is sent to the DDS, a state organization, for a medical assessment. The DDS creates medical evidence and, if necessary, may request a consultation examination.

- Decision: The SSA receives a decision from the DDS indicating whether or not it is handicapped. Benefits are calculated and payment starts if the person is disabled. If not, you can file an appeal.

Common Misconceptions & FAQs

1. Misconception: “If I have a disability, I automatically get benefits.”

Reality: Having a medical condition is not enough. The condition must meet criteria, must impact your ability to work, and you must meet program-specific requirements (work credits, income/resources).

2. Misconception: “The more severe the disability, the more I’ll get.”

Reality: For SSDI, the amount you receive is based primarily on your earnings history, not severity per se. Two applicants with the same condition but vastly different work histories might receive different benefits.

3. Misconception: “If I work some, I lose all benefits.”

Reality: There are rules (trial work period, allowable income) that permit some work while still on disability benefits, depending on program.

Tips for Applicants: Maximizing Your Chance & Understanding Outcome

- Document thoroughly. Keep all medical records, test results, treatment notes, work history and earnings. Strong documentation supports your claim.

- Show functional limitation, not just diagnosis. A doctor’s diagnosis is helpful, but SSA focuses on how your condition limits your ability to work.

- Use your own words (with your doctor’s support). Include how the condition affects walking, standing, lifting, concentrating, etc.

- Understand the “other work” test. The SSA will consider whether you can shift to other types of work — consider your age, education, past job, transferrable skills.

- Be honest and consistent. Inconsistencies in forms, witness statements, medical records can hurt a claim.

- Consider the benefit amount in advance. Know that SSDI is based on your earnings history; gaps in employment or low earnings will reduce the benefit.

- Consider timing and waiting period. For SSDI there is typically a 5-month waiting period after disability onset before benefits begin.

- Be prepared for appeal. Many claims are initially denied. If so, appeal early and engage help if needed.

Overview: How Disability Benefits Are Determined?

To wrap up, here are the key elements that determine whether you’ll receive disability benefits, and how much:

- Eligibility: Did you work enough (SSDI) or meet financial need (SSI)? Does your impairment meet SSA’s definition? Have you met the duration requirement?

- Medical Evaluation: Is your condition severe? Is it expected to last at least 12 months (or result in death)? Does it meet or equal a Listing?

- Functional Capacity: Can you do your past work? Can you do any other work given age, education, work history, skills?

- Earnings History: For SSDI, what were your average indexed earnings (AIME)? What is your PIA?

- Other Factors: Living arrangements (for SSI), other public benefits, trial work period, offsets.

- Process & Timing: Document submission, DDS evaluation, decision, appeals, waiting period.

By understanding these components, applicants and their advocates can better frame their case, anticipate outcomes, and navigate the system with greater clarity.

Why U.S. Mortgage Rates Move with Treasury Yields: A Deep Dive into the Connection

Why U.S. Mortgage Rates Move with Treasury Yields: A Deep Dive into the Connection