How Unemployment Benefits Are Funded?

How Unemployment Benefits Are Funded?

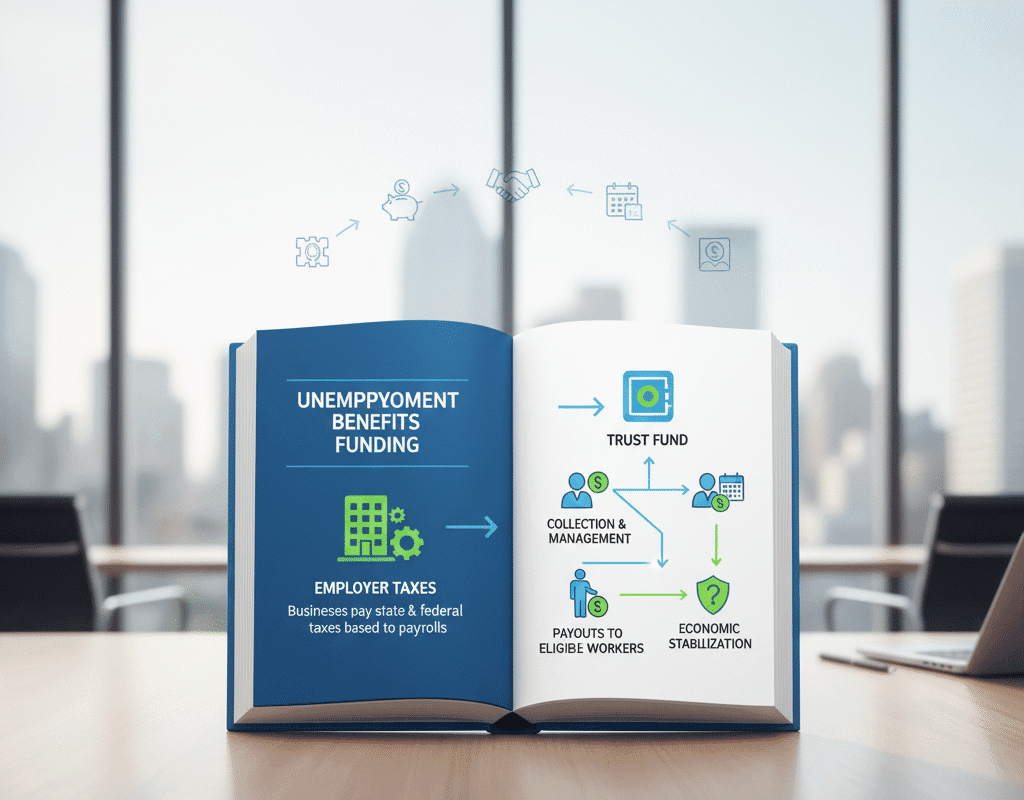

Unemployment benefits have long been a vital part of the American social safety net. These benefits help workers who have lost their jobs through no fault of their own to sustain themselves while searching for new employment. However, many Americans are unaware of how these unemployment benefits are actually funded.

As of 2025, the U.S. unemployment insurance (UI) system continues to rely on a mix of state and federal taxes, employer contributions, and a network of trust funds that ensure temporary financial relief for millions of unemployed workers.

HSBC Cashback Credit Card 2025 – Benefits, Rewards & How to Apply?

Recognizing the Objective of Unemployment Benefits

The purpose of unemployment compensation is to give people who lose their jobs unintentionally temporary financial support. There are two objectives:

- To provide income during times of unemployment in order to stabilize households.

- To sustain consumer spending during recessions in order to boost the economy.

The Social Security Act of 1935 laid the groundwork for the current Unemployment Insurance (UI) program, which is where this system originated.

How the Federal Unemployment Tax Works (FUTA)

Under FUTA, employers pay a 6.0% tax on the first $7,000 of each employee’s annual wages. However, most employers receive a credit of up to 5.4% if they pay their state unemployment taxes on time, reducing the effective rate to 0.6%.

These funds are deposited into the Federal Unemployment Trust Fund, which is maintained by the U.S. Department of the Treasury. The money is used to:

- Fund administrative costs of state unemployment programs

- Provide loans to states during recessions

- Pay for extended and emergency benefits

- Support employment services and job training initiatives

How the State Unemployment Tax Works (SUTA)

Each state collects unemployment taxes from employers to pay for benefits within that state. The tax rate and wage base vary widely depending on the state’s laws and the financial health of its unemployment trust fund.

Key Features of SUTA:

- Employer-funded: Employees in most states do not pay into unemployment insurance directly.

- Experience-rated system: Employers with higher layoff rates pay higher tax rates.

- State wage base: Each state sets a maximum wage base subject to tax (ranging from $7,000 to over $50,000 per employee).

The US Department of Labor’s Function

The national unemployment insurance program is managed by the U.S. Department of Labor (DOL). It ensures states comply with federal requirements, allocates funds, and publishes regular reports on the financial health of the system.

The DOL’s Employment and Training Administration (ETA) monitors each state’s Unemployment Trust Fund (UTF) and manages loans to states that run out of money during economic downturns.

The Trust Fund for Unemployment (UTF)

The Unemployment Trust Fund, which has more than 50 accounts—one for each state plus federal accounts—is where all FUTA and SUTA taxes are placed.

Benefits are paid by each state using its own trust fund; administrative and extended benefit expenses are handled by federal accounts.

A state may borrow money from the federal trust fund when its own trust fund is depleted. Employers in that state, however, lose a portion of their FUTA tax credit if the loan is not immediately repaid, so increasing their federal tax rate until the debt is paid off.

Emergency and Extended Benefits During Crises

During periods of high unemployment—such as recessions or pandemics—the federal government often steps in to provide emergency unemployment compensation.

For example, during the COVID-19 pandemic, programs like Pandemic Emergency Unemployment Compensation (PEUC) and Federal Pandemic Unemployment Compensation (FPUC) were fully funded by the federal government.

These emergency programs temporarily expand benefits by increasing weekly payments or extending the duration of eligibility.

How Benefit Amounts Are Determined by States

Each state uses a formula based on the worker’s previous earnings to calculate weekly benefit amounts. Typically, benefits replace between 40% and 60% of the worker’s previous wages, up to a state-set maximum.

Funding for these payments comes directly from SUTA collections, not from federal funds, except during special federal programs.

Employer Contributions and Incentives

Employers play the largest role in funding unemployment insurance. To maintain fairness and sustainability, the system uses an experience rating—a method that adjusts each employer’s tax rate based on their history of layoffs and claims.

- Experience Rating in Action:

- Employers with few layoffs pay lower tax rates.

- Employers with frequent layoffs face higher rates.

Conclusion: How Unemployment Benefits Are Funded

Unemployment benefits remain one of the cornerstones of the American economic safety net. The combined efforts of employers, states, and the federal government ensure that workers who lose their jobs can stay afloat during tough times.

As the labor market evolves in 2025 and beyond, maintaining a well-funded, transparent, and efficient unemployment system will be crucial to supporting economic stability and protecting American workers.

How Neobanks Are Challenging Traditional U.S. Banks: Digital Disruption & Competitive Strategies

How Neobanks Are Challenging Traditional U.S. Banks: Digital Disruption & Competitive Strategies