Why U.S. Homeownership Rates Are Declining?

Why U.S. Homeownership Rates Are Declining?

In the United States, homeownership—often regarded as a crucial component of the American Dream—is encountering challenges. Housing dynamics have changed in recent years, as seen by the decline or stagnation of the percentage of households that own their homes. Analyzing supply-side, policy, demographic, and economic aspects is necessary to comprehend why.

The U.S. homeownership rate was 65.6% in the second quarter of 2024, which is still lower than the 25-year average of 66.4%, according to the National Association of Home Builders (NAHB). By Q2 2025, the rate has further decreased to 65.0%. To put it another way, fewer Americans are homeowners, a development that worries families, economists, and policymakers alike.

HSBC Cashback Credit Card 2025 – Benefits, Rewards & How to Apply?

Rising Mortgage Rates and Borrowing Costs

One of the most significant factors behind the decline in homeownership is the sharp increase in mortgage interest rates. After years of historically low rates, the environment changed. For example, a report found that the dropout in home-ownership among 35-44 year-olds is strongly linked to higher borrowing costs.

Higher rates reduce affordability in two major ways:

- They increase monthly mortgage payments for the same loan amount, making buying more expensive.

- They reduce how much a buyer can borrow for a given monthly payment, effectively shrinking purchase power.

Growth in Home Prices Exceeds Income

Mortgage rates don’t tell the whole story. The other half is the sharp increase in housing costs, especially for entry-level and starter homes. The Urban Institute’s data shows that median home prices have risen far more quickly than household incomes during the last 45 years.

In other words, affordability deteriorates when property prices increase but incomes stagnate or increase slowly:

- First-time purchasers find it difficult to save up enough money for closing costs and down payments.

- Mortgage payments take up a larger portion of income, which makes purchasing more difficult.

- Some prospective purchasers are completely driven out of the market by higher prices.

Limited supply and scarcity of entry-level homes

Supply limitations are another important factor. First-time buyer-friendly homes are in low supply in many U.S. areas. The homeownership rate is significantly hampered by “a limited supply of entry-level homes that would attract first-time buyers,” according to S&P-style commentary.

Particular problems consist of:

- There is less inventory because homeowners with extremely low mortgage rates are less willing to sell.

- Instead of starter homes, builders frequently concentrate on more expensive properties with bigger profit margins.

- In many areas, land-use and zoning laws restrict new supply, which drives up prices.

- First-time buyers may find it more difficult to afford to buy existing properties if they need extensive renovations.

Market-Segment and Regional Differences

The impact varies greatly by geography, metro area, and housing segment, even if these general trends are applicable nationwide. For example:

- Homeownership rates are less than 50% in some expensive metropolitan areas, such as coastal California. According to one survey, among major metro areas, Los Angeles had a rate of about 46.4% and New York City had a rate of about 49.4%.

- Homeownership is typically higher in places where land is less expensive, supply is less restricted, and wages are slightly higher than prices.

- Entry-level buyers are more affected than older age groups who’ve already locked in homeownership; for instance, homeownership for under-35s dropped to 36.4 % in Q2 2025.

Any market forecasts or policy reactions must be localized due to these regional variations.

Economic Uncertainty & Life-Cycle Effects

Beyond direct affordability, broader economic factors and life-cycle effects matter:

- Economic uncertainty (jobs, inflation, recession risk) can make households postpone buying a home and prefer renting until things feel safer.

- Households already own homes with ultra-low rates and see little incentive to move or trade up, which reduces turnover and limits supply for first-time buyers.

- Homeownership historically has been a way to build wealth; but if future affordability looks weaker, households may defer buying altogether.

The net result: a self-reinforcing dynamic where fewer new buyers, less turnover, tighter supply and more renters.

Consequences for Inequality and Wealth Building

In the American economy and society, homeownership plays a special role since it facilitates wealth accumulation, neighborhood stability, and wealth transmission between generations. There are various ramifications when rates are falling or staying the same:

- Wealth disparities may increase as fewer households acquire equity through homeownership.

- Lower-income and younger households are disproportionately impacted, increasing inequality. The Urban Institute notes that lower-income households aged 35-44 are “much less likely” to become homeowners now than in past generations.

- Regions with constrained homeownership may experience slower community investment, less stable neighbourhoods and altered housing markets.

Policy scholars argue that if homeownership becomes out of reach for large segments of the population, the classic pathway for wealth building is weakened.

In conclusion: Why U.S. Homeownership Rates Are Declining?

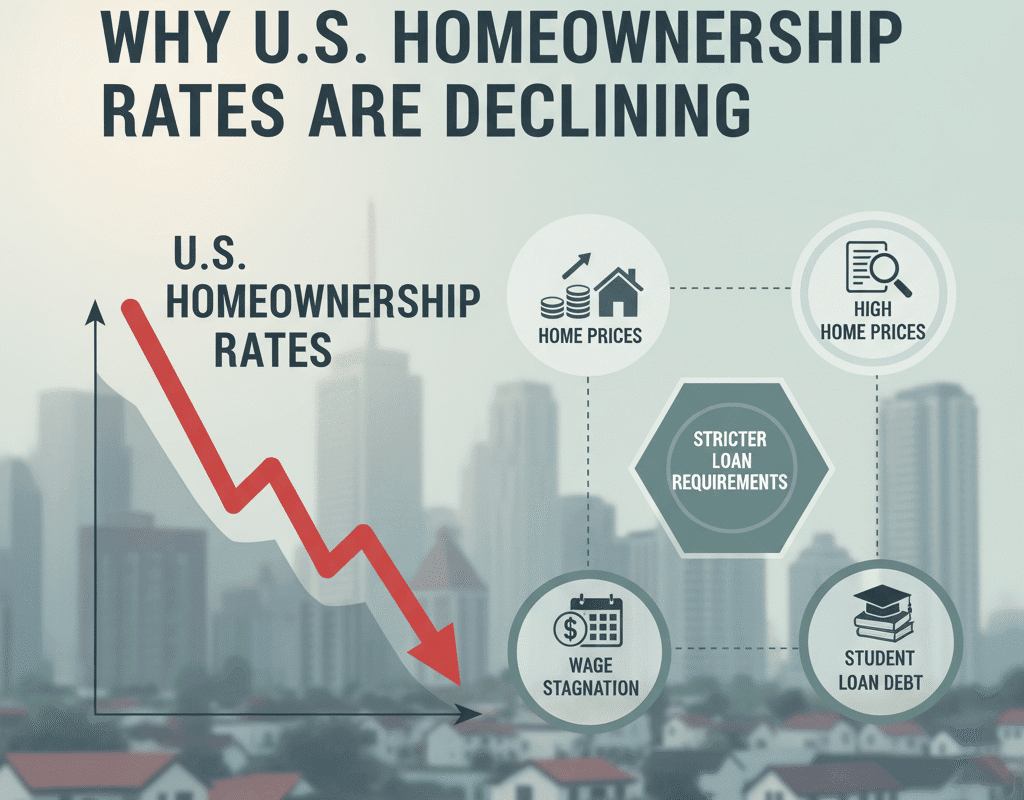

There are multiple factors contributing to the drop in homeownership rates in the United States, including supply, policy, demographics, and the economy.

Many Americans now find it increasingly difficult to become homeowners due to a combination of factors, including high mortgage rates, rising housing prices, a limited supply (particularly of starter homes), changes in household formation, and economic instability.

The difficulties are biggest for younger households, households with lesser incomes, and prospective first-time purchasers.

The drop in homeownership could have wider effects on wealth accumulation, inequality, and community stability in the United States if significant solutions aren’t taken, especially in terms of raising supply and enhancing affordability.