The Role of Bank Holding Companies:

The Role of Bank Holding Companies:

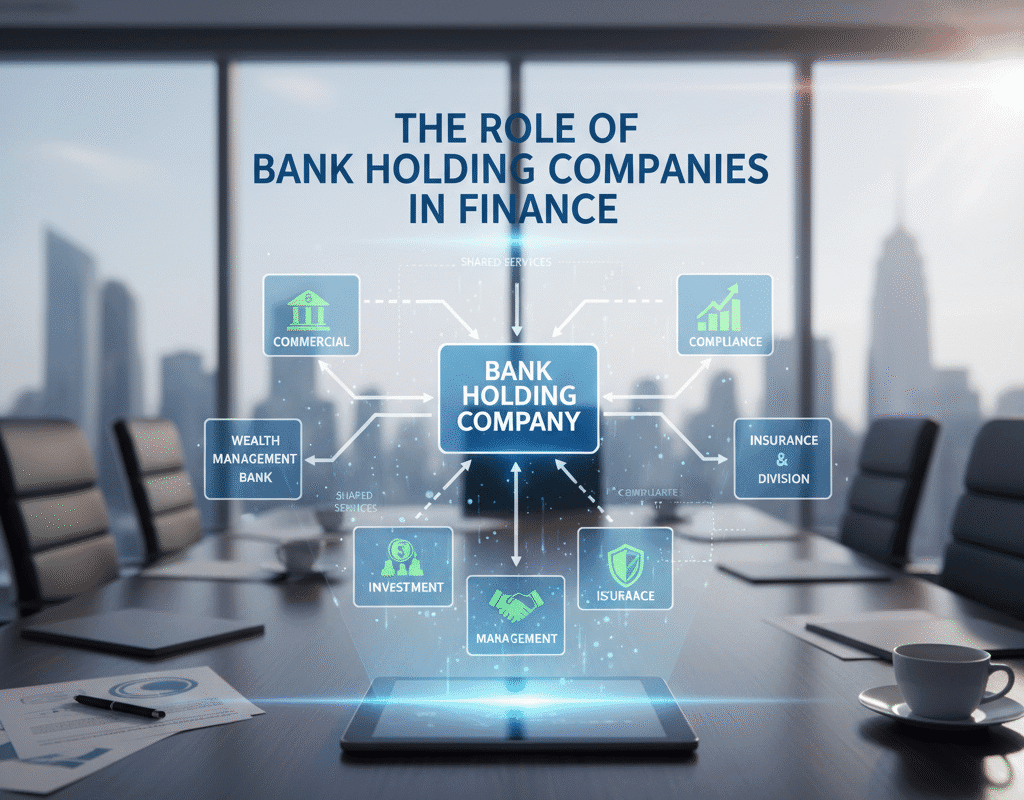

In the complex architecture of the U.S. financial system, bank holding companies (BHCs) occupy a central yet sometimes underappreciated role. These corporate structures—companies that own or control one or more banks—serve as the parent entities for many of the nation’s commercial banks, and they enable a range of banking and non-banking activities under regulatory supervision. Understanding BHCs is critical for appreciating how the banking sector in the United States is organised, how capital and risk flow through banking groups, and how regulatory oversight functions to support financial stability.

HSBC Cashback Credit Card 2025 – Benefits, Rewards & How to Apply?

A bank holding company: what is it?

A corporation that has a majority stake in one or more banks but does not provide banking services is known as a bank holding company.

More precisely, under U.S. law, the term is defined by the Bank Holding Company Act of 1956 (BHCA) and subsequent amendments.

Key features of a BHC include:

- Control of one or more depository institutions (banks).

- Subject to regulatory supervision by the Federal Reserve Board (the Fed) when defined as a BHC.

- Ability, under specified conditions, to engage in bank-related or “closely related” non-banking activities.

- The holding company structure permits separation of bank operations from non-bank activities and allows flexibility in capital issuance, risk allocation, and corporate governance.

Legal and Historical Background

History and the 1956 Bank Holding Company Act

The concept of the BHC predates the modern regulatory regime. As early as the early 1900s, holding companies were used to own several banks in states where branching restrictions existed.

In 1956, the Bank Holding Company Act was enacted to define and regulate the ownership of banks by holding companies, particularly to control expansion, interstate acquisitions, and non-banking interests.

Key provisions included requiring Fed approval for acquisitions of banks by a holding company, limiting non-bank activities of BHCs, and giving the Fed supervisory powers.

Frequency

BHCs own the majority of banks in the United States; as of December 2007, 84% of commercial banks were part of a BHC structure. BHCs nearly always own large banks, particularly those with assets above $10 billion USD.

The Role of BHCs in Banking Crisis and Stability

The structure and regulatory oversight of BHCs have implications for financial crises and banking stability.

- During stress periods, the holding company can provide capital or liquidity to its bank subsidiary, reinforcing the “source of strength” concept.

- The Fed’s supervision of BHCs allows early identification of risks at the group level—such as funding mismatches, risky non-banking activities or cross-subsidisation of banks with weaker operations.

- The holding company form also enables separation of failing or problem assets into holding company subsidiaries, potentially limiting contagion to the core bank.

- Yet, the holding company structure may also amplify systemic risk if the parent or its affiliates become over-leveraged, undertake risky non-banking activities

Risks, Criticisms and Limitations

While BHCs bring many benefits, several criticisms and risks must be noted:

- The holding company layer adds regulatory complexity, cost, reporting burdens and governance demands—especially for smaller institutions.

- The advantages of the BHC structure (e.g., flexible capital issuance, non-banking activities) have been reduced by post-crisis reforms, meaning that for some organisations the cost–benefit ratio may have changed.

- Holding companies may obscure the true riskiness of the banking group by enabling internal transactions, intra-group funding, and non-bank activities that are less transparent.

- Potential for regulatory arbitrage: While many controls exist, the holding company form creates complex affiliation structures that might be used to shift risk or liquidity around the group.

In conclusion: The Role of Bank Holding Companies

Bank holding companies are a cornerstone of the U.S. banking and finance landscape. By enabling banks to access capital markets, diversify activities, manage risk more effectively and scale operations, BHCs contribute significantly to the dynamism of the financial sector.

At the same time, the holding company structure demands robust governance, careful regulatory oversight and a clear understanding of the trade-offs involved.

As the financial world continues to evolve—with technological disruption, regulatory change, global interconnectedness and increased competition from non-banks—the role of BHCs may shift.

Nonetheless, their central place in the U.S. banking architecture means they will remain a critical topic for anyone seeking to understand banking, finance and regulation.

Whether you’re a banking executive pondering the structure of your organisation, a regulator assessing systemic risk, an investor analysing a banking group, or a student of finance, the holding company model is a vital lens through which the modern banking industry should be viewed.

How Federal Grants Support Local Economies: Strengthening U.S. Communities Through Strategic Funding

How Federal Grants Support Local Economies: Strengthening U.S. Communities Through Strategic Funding