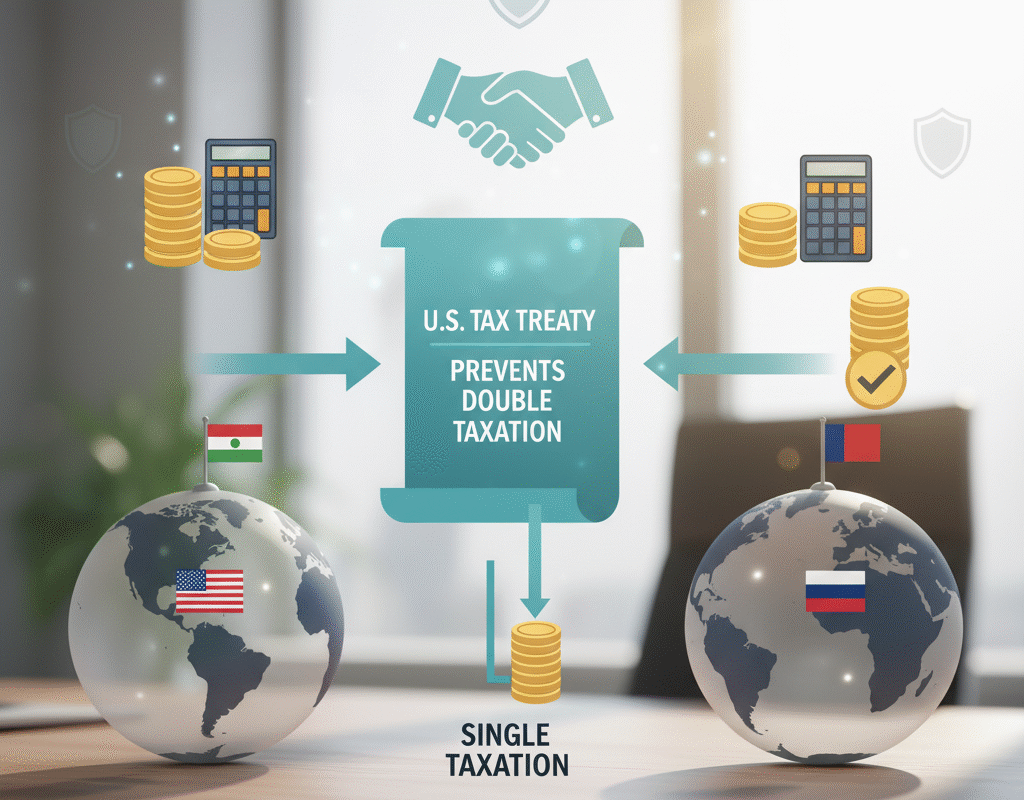

How U.S. Tax Treaties Prevent Double Taxation?

How U.S. Tax Treaties Prevent Double Taxation?

In an era of globalization, the movement of people, goods, and services across borders has increased dramatically. For U.S. citizens and residents working abroad or earning income from foreign sources, navigating taxation can be a complex challenge.

One of the key mechanisms the United States uses to protect taxpayers from unfair financial burdens is its network of tax treaties. These treaties are designed to prevent double taxation, where the same income is taxed by two different countries. Understanding how these treaties work is essential for individuals, businesses, and international investors.

HSBC Cashback Credit Card 2025 – Benefits, Rewards & How to Apply?

Double taxation: What is it?

When the same income is subject to taxation in multiple jurisdictions, this is known as double taxation. For instance, both the French and American governments may tax a U.S. citizen who earns money in France. Without safeguards, taxpayers could have to pay full taxes in several nations, which would put a hardship on their finances and deter international trade.

The United States has put in place a number of measures to reduce double taxation, including tax treaties, foreign tax credits, and deductions. Tax treaties provide an organized framework for international tax cooperation, even while domestic tax legislation offers some relief.

Summary of US Tax Treaties

A bilateral agreement between the United States and another nation is known as a U.S. tax treaty. These agreements are negotiated in order to:

- Distribute the two nations’ taxing rights.

- Minimize or do away with income double taxation.

- Stop tax avoidance and promote openness.

- Encourage international investment and trade.

As of 2025, the United States has tax treaties with over 65 countries, including major economies like Canada, the United Kingdom, Germany, Japan, and Australia. Each treaty contains unique provisions, but most follow a similar structure that addresses income types, residency, and tax credits.

How Double Taxation Is Prevented by US Tax Treaties

Several tactics are used by U.S. tax treaties to avoid double taxation:

Exemption Method

In some treaties, income earned in a foreign country is exempt from U.S. taxation if it has already been taxed abroad. This method primarily applies to certain types of income, such as business profits or government pensions.

Credit Method

Most treaties allow U.S. taxpayers to claim a foreign tax credit for taxes paid to the other country. This credit reduces the amount of U.S. tax owed on the same income, ensuring that taxpayers are not taxed twice.

Lower Withholding Rates

The withholding tax rates on profits, interest, and royalties are frequently reduced by treaties. For example, a treaty may lower the total tax burden on cross-border investments by lowering the foreign withholding tax on dividends from 30% to 15%.

Determination of Residency

In order to prevent both nations from claiming the taxpayer as a resident for tax reasons, tax treaties specify residence requirements. Treaties reduce conflicts and the possibility of double taxation by defining which nation has main taxing rights.

Key Provisions in U.S. Tax Treaties

Most U.S. tax treaties include common provisions designed to provide clarity and reduce tax burdens. Among them are:

- Dividends, Interest, and Royalties: Limiting withholding taxes on passive income streams.

- Business Profits: Typically taxable only in the country where the business is conducted.

- Personal Services Income: Defines how salaries and wages earned abroad are taxed.

- Pensions and Social Security: Preventing double taxation on retirement benefits.

- Capital Gains: Guidelines on taxing gains from property sales or investments.

- Mutual Agreement Procedure (MAP): A formal process for resolving disputes about treaty interpretation or double taxation.

Effects on U.S. Foreigners

Tax treaties have a direct impact on American citizens and residents who work overseas. For instance, treaty rules may allow a U.S. expat residing in Germany to receive lower tax rates on profits, interest, or royalties. Furthermore, filing for international tax credits guarantees that income taxed overseas won’t be subject to double taxation when submitted to the IRS.

Additionally, tax treaties offer certainty. Knowing which nation has taxing rights and how credits or exemptions apply might help foreigners make better financial plans. Cross-border taxation would be erratic and sometimes punitive in the absence of treaties.

Effects on American Companies and Investors

U.S. tax treaties also benefit foreign businesses. Businesses can prevent double taxation on profits made overseas by making tax duties clear. Treaties cut the total cost of investing in overseas markets by lowering withholding taxes on dividends, interest, and royalties.

For multinational corporations, tax treaties also provide legal safeguards. They allow businesses to:

- Avoid unexpected foreign tax liabilities.

- Optimize global tax planning strategies.

- Enhance competitiveness by reducing the cost of doing business internationally.

Typical Myths Regarding Tax Treaties

Despite their significance, there are a number of myths regarding US tax treaties:

- They Eliminate All Taxes Abroad – Tax treaties do not exempt all income from foreign taxation; they reduce or allocate taxes in specific circumstances.

- They Automatically Apply – Taxpayers must actively claim treaty benefits using the correct IRS forms, such as Form 8833.

- They Replace Domestic Law – Treaties work alongside U.S. tax law. Taxpayers may still owe domestic taxes depending on their residency and income type.

- They Apply to Everyone – Certain treaty provisions only apply to residents or citizens of the treaty countries.

IRS and Tax Treaty Enforcement

The IRS plays a critical role in enforcing U.S. tax treaties. Taxpayers claiming treaty benefits must provide documentation proving eligibility. Forms such as W-8BEN (for foreign individuals) or W-8BEN-E (for foreign entities) are commonly used to claim reduced withholding rates on income received from U.S. sources.

Additionally, the IRS monitors compliance to ensure that taxpayers do not misuse treaty provisions. Failure to properly report foreign income or claim treaty benefits incorrectly can result in penalties and interest.

U.S. Tax Treaties’ Future

Tax treaties are becoming more and more important as globalization increases. To handle new challenges like digital services, e-commerce, and international corporation taxation, the US updates and negotiates new treaties.

In order to prevent tax evasion and guarantee equitable taxation in a global economy, the Biden administration and the U.S. Treasury have placed a strong emphasis on international collaboration. Stricter reporting standards, stronger dispute resolution procedures, and revised clauses for new revenue streams could all be included in future treaties.

In conclusion: How U.S. Tax Treaties Prevent Double Taxation?

For people and companies doing business internationally, U.S. tax treaties are crucial instruments in preventing double taxation. They facilitate cross-border commercial activity, lower financial constraints, and offer transparency. U.S. taxpayers can more effectively manage overseas taxation, seek credits, and adhere to IRS regulations by comprehending how these treaties operate.

Understanding U.S. tax treaties is essential for reducing tax obligations and making wise future plans, regardless of whether you are an expat, investor, or multinational corporation. With over 65 treaties in force, the United States continues to balance domestic tax enforcement with international cooperation, ensuring fairness and predictability in an increasingly interconnected world.