How the Alternative Minimum Tax (AMT) Works?

How the Alternative Minimum Tax (AMT) Works?

Every year when filing federal income taxes, most Americans rely on one basic calculation: gross income minus allowable deductions equals taxable income, and then the progressive tax brackets determine their tax liability.

But for some taxpayers—especially those with higher incomes or significant tax-preference items—there is a second tax calculation they must consider: the Alternative Minimum Tax (AMT).

Understanding how the AMT works is essential, even if you believe your tax situation is straightforward, because the AMT can unexpectedly apply.

HSBC Cashback Credit Card 2025 – Benefits, Rewards & How to Apply?

What is the Alternative Minimum Tax (AMT)?

The AMT is a parallel tax system in the U.S. federal tax code. Rather than replacing the standard income tax system, it exists alongside it. Under the AMT regime, certain tax deductions, credits and exclusions that are permitted under the regular tax rules are either disallowed or modified.

The purpose: to ensure that taxpayers who might otherwise reduce their regular tax liability significantly via tax preferences still pay at least a minimum level of tax.

Why Did the AMT Get Started?

The AMT’s origins date back many years. In the 1960s, the U.S. Treasury discovered that some taxpayers with very high incomes were paying little to no federal income tax—despite their economic income being substantial—thanks to tax preferences and deductions. For example, as the Tax Reform Act of 1969 notes: “155 high‐income households” paid nothing in federal income tax in 1966.

In response, Congress enacted the Tax Reform Act of 1969, which included the precursor to today’s AMT. Over time, the modern version of the AMT evolved to expand the tax base for high-income filers and prevent excessive reduction of tax via preferences.

How Is the AMT Determined?

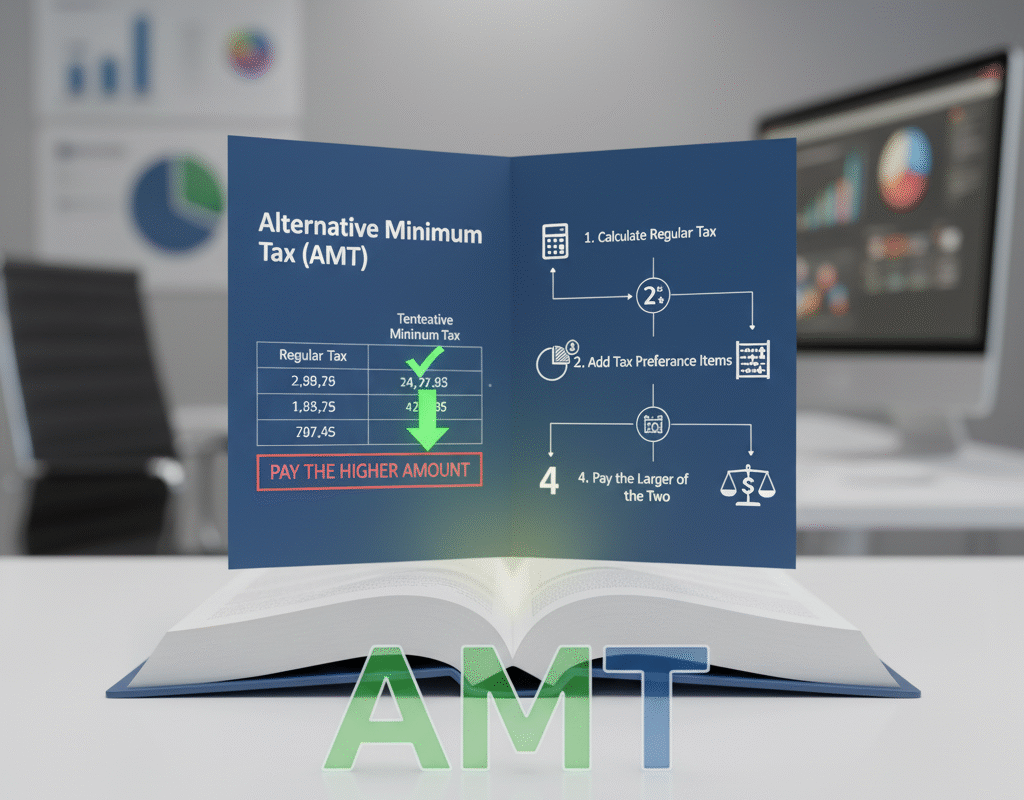

Comprehending the computation aids in demystifying the AMT. The process has several steps:

Start with regular taxable income.

Use your regular tax calculation: adjusted gross income (AGI) minus deductions or exemptions (standard or itemized) gives your taxable income under the regular system.

Make AMT adjustments and preference item add-backs.

Under the AMT rules you must add back or adjust certain items that were allowed under the regular system. These include disallowed deductions or exclusions (for example, state and local tax deductions, certain tax-exempt interest, incentive stock option spread, etc.).

Subtract the AMT exemption.

The AMT system provides an exemption (i.e., a threshold amount) which reduces AMTI. Importantly, this exemption phases out at higher income levels.

Important Credits, Deductions, and Items That Differ Under AMT

The fact that the AMT calculation restricts or eliminates numerous tax benefits that are available under conventional tax laws is one of the primary problems with AMT. Here are a few of the key distinctions:

- State and local tax deduction (SALT): Under the regular system you may deduct up to a cap (e.g., $10,000 for SALT under some rules). Under the AMT, this deduction is disallowed, meaning you may have to add it back in.

- Miscellaneous itemized deductions: Often disallowed under AMT.

- Tax-exempt interest from private-activity municipal bonds (PABs): While tax exempt under regular rules, under AMT some or all may be treated as taxable for AMT.

The AMT’s Future: Legislative Considerations & Trends

Even though the AMT has been around for many years, its applicability and scope have evolved throughout time and are always changing.

- The TCJA (2017) increased the AMT exemption and phase-out thresholds, which dramatically reduced the number of filers subject to AMT.

- The inflation adjustments and indexation of exemption thresholds also help prevent “bracket creep” (where taxpayers inadvertently become subject to the AMT because inflation pushes their income above thresholds).

- Some analysts caution that if legislation is not updated, or if tax preference items multiply, the AMT might affect more taxpayers again. The overarching policy question remains whether the AMT should apply only to the very highest incomes or a broader group.

Key Takeaways in Summary

- The Alternative Minimum Tax (AMT) is a parallel tax system in the U.S. that ensures certain taxpayers pay a minimum level of income tax, even if regular tax rules reduce their liability.

- It works by forcing taxpayers to calculate their tax liability twice (once normally, once under AMT rules) and pay whichever is higher.

- Key calculation steps: start with regular taxable income → make AMT adjustments/preference add-backs → arrive at AMTI → subtract AMT exemption → apply AMT rate (26%/28%) → compare to regular tax.

- Exemption amounts and phase-out thresholds are critical (for 2024/2025 the amounts are roughly $85-88k single, $133-137k married filing jointly; phase-out begins at roughly $600-626k single, $1.2m+ joint).

Concluding Remarks: How the Alternative Minimum Tax (AMT) Works?

You probably won’t be subject to the AMT if your tax position is rather simple, such as if you are salaried, use the standard deduction, and don’t have any significant tax-preference items.

However, the AMT is a real possibility if you have big itemized deductions, get equity pay, are in a higher income bracket, or have substantial investment income.

You may prepare ahead of time and prevent unforeseen tax liabilities by being aware of how the AMT operates and how it varies from the standard tax system.

Running the AMT calculation (using Form 6251) early in the year might help determine whether you’ll be subject to AMT and what actions you might take, for any taxpayer who feels they may be near AMT levels (or for tax professionals advising such clients).

Why U.S. Credit Card APRs Are So High – Unpacking the Cost Drivers in 2025

Why U.S. Credit Card APRs Are So High – Unpacking the Cost Drivers in 2025