How the Federal Reserve Regional Banks Operate?

How the Federal Reserve Regional Banks Operate?

The United States’ central banking system, the Federal Reserve System (often simply called “the Fed”), is uniquely structured. While many countries have a single central bank operation in one location, the U.S. divides its banking-system oversight and monetary-policy implementation across 12 regional Reserve Banks — one for each of the 12 Federal Reserve Districts.

These 12 banks serve as the operating arms of the Fed, carrying out functions ranging from bank supervision to payment-system operations and regional economic research.

In this article we will examine how the Federal Reserve Banks operate across the 12 districts, what their key responsibilities are, how they fit into the broader Fed structure, and why this regional design matters for the U.S. economy.

HSBC Cashback Credit Card 2025 – Benefits, Rewards & How to Apply?

The Historical Background of 12 Regional Banks and Their Reasons

Both structural and historical factors led to the choice to establish several regional banks as opposed to a single organization. The Federal Reserve Act of 1913 established the system in response to banking panics and the need for a stable national banking infrastructure.

According to historical accounts, the map of the 12 districts was drawn during the Act’s formation, with input from regional banking interests and surveys of state banks.

The regional banks were meant to bring decentralisation into the system — to ensure that local economic conditions, commercial banking interests, and regional diversity were represented in national monetary-policy decisions.

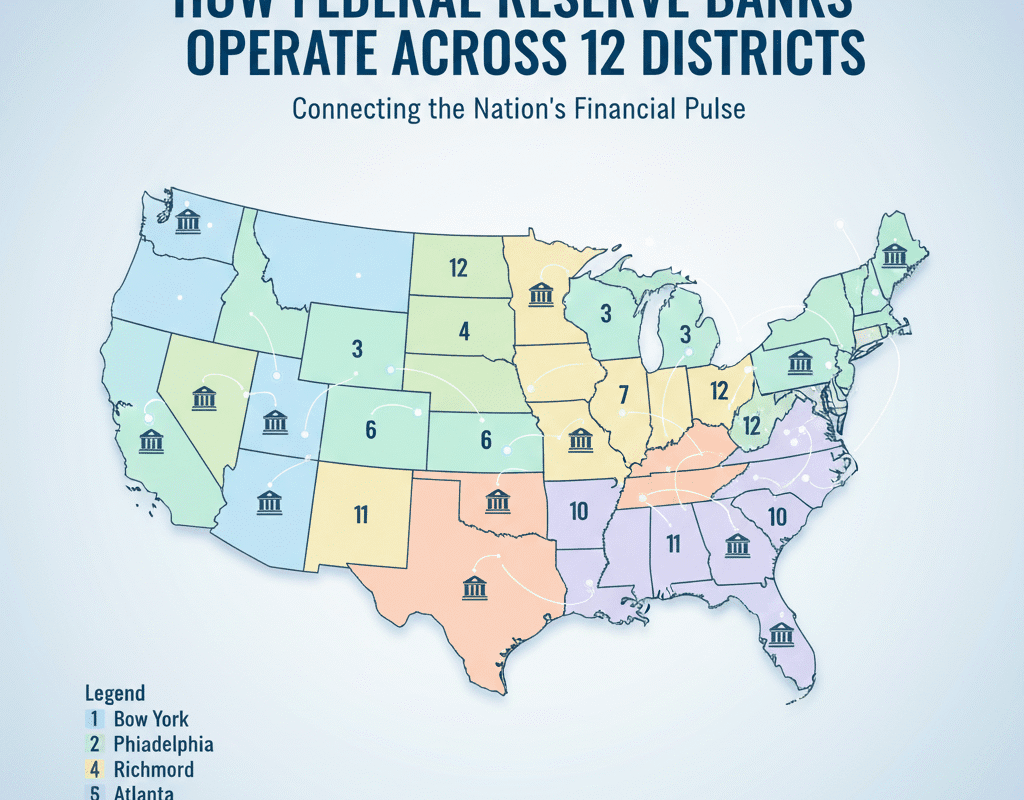

The Twelve Districts: A Summary

The 12 Federal Reserve Districts and their principal regional banks are broken out as follows:

First District – Federal Reserve Bank of Boston (Boston)

Serving Maine, Massachusetts, New Hampshire, Rhode Island, Vermont, and parts of Connecticut.

Second District – Federal Reserve Bank of New York (New York)

Responsible for New York state, northern New Jersey, and oversight of the nation’s open-market operations because of New York’s financial-market role.

Third District – Federal Reserve Bank of Philadelphia (Philadelphia)

Covers Delaware, southern New Jersey, eastern & central Pennsylvania.

Fourth District – Federal Reserve Bank of Cleveland (Cleveland)

Serving Ohio, western Pennsylvania, northern West Virginia, eastern Kentucky.

Fifth District – Federal Reserve Bank of Richmond (Richmond)

Covering Virginia, Maryland, D.C., West Virginia, North Carolina, South Carolina.

Sixth District Federal Reserve Bank of Atlanta’s

Alabama, Florida, Georgia, eastern Tennessee, southern Mississippi, and southern Louisiana are all included

Seventh District – Federal Reserve Bank of Chicago (Chicago)

All of Iowa and the majority of Illinois, Indiana, Michigan, and Wisconsin

Eighth District – Federal Reserve Bank of St. Louis (St. Louis)

Serving Arkansas, southern Illinois, southern Indiana, portions of Kentucky and Tennessee, Mississippi, and other regions

Ninth District – Federal Reserve Bank of Minneapolis (Minneapolis)

Serves the Upper Peninsula of Michigan, Minnesota, the Dakotas, Montana, and northwest Wisconsin.

Tenth District – Federal Reserve Bank of Kansas City (Kansas City)

Western Missouri, Nebraska, Kansas, Oklahoma, Colorado, Wyoming, and northern New Mexico are all included

Eleventh District – Federal Reserve Bank of Dallas (Dallas)

Serving all of Texas, southern New Mexico, northern Louisiana, and portions of Oklahoma,

Twelfth District – Federal Reserve Bank of San Francisco (San Francisco)

Alaska, Arizona, California, Hawaiʻi, Idaho, Nevada, Oregon, Utah, and Washington, as well as territories like American Samoa, Guam, and the Northern Mariana Islands

These 12 regional banks work together to guarantee that the Fed has a presence throughout the United States, enabling localized input into national policy and regional specialization.

The Role and Functions of the Regional Reserve Banks

Each of the 12 Reserve Banks carries out a set of core functions, while also focusing on their specific district’s economic conditions. The key roles include:

Bank Supervision and Regulation

The regional banks supervise and examine member banks and bank holding companies within their districts, under the oversight of the Board of Governors of the Federal Reserve System.

They also enforce certain consumer-protection and fair-lending rules and promote community development within their regions.

Support for Monetary Policy and Regional Perspectives

Even though the Federal Open Market Committee (FOMC) sets monetary policy, regional banks are essential because they offer insights from their districts through data collecting, economic research, and regional outreach.

The framework guarantees that local circumstances, rather than merely aggregate national data, are taken into account when formulating national policies.

Settlement and Payment Services

Important functions for the U.S. payment system are managed by the regional banks, such as currency and coin distribution, clearing and settlement services, and, in many ways, serving as a bank for the US government (i.e., keeping Treasury accounts).

Governance & Operational Independence

While the regional banks are part of the federal system, they help preserve a degree of decentralisation and regional input.

Each Reserve Bank has a board of directors (typically nine members) — with representation from member banks and public-interest directors.

The president of each Reserve Bank is nominated by its board of directors and subject to approval by the Board of Governors.

Though subject to oversight from the Board of Governors, the Reserve Banks operate with considerable independence in their districts.

The multi-arm design (Board of Governors + 12 regional banks + FOMC) balances central control with regional flexibility.

How These Banks Engage with National Policy and the FOMC

The FOMC is the key monetary-policy decision-making body for the Fed, composed of the Board of Governors (7 members) plus the president of the New York Fed and a rotating set of four other Reserve Bank presidents in any given year.

Even those district bank presidents who are not voting members still attend meetings and participate in deliberations, bringing regional economic intelligence into the national conversation.

The Reserve Banks’ research and input feed into the policy decisions that influence interest rates, credit conditions, inflation, and employment at the national level — and thus ultimately in each district.

A Day in the Life: The Local Operations of the Reserve Bank

This is a condensed example of how a regional reserve bank might actually function:

- The Reserve Bank monitors banking conditions in its district: banks report data, examiners inspect institutions, outreach is conducted to community banks and credit unions.

- The bank’s research team analyses regional employment, industry trends, wages, business surveys, and produces reports.

- The bank distributes currency and coin to member banks in its district, processes payment instructions, and ensures payment systems operate smoothly.

- If a local bank faces liquidity stress, the Reserve Bank can lend (via discount window) to ensure stability — under Fed policy guidelines.

In conclusion: How the Federal Reserve Regional Banks Operate

The 12 regional Reserve Banks of the Federal Reserve System play a crucial role in making U.S. monetary policy and financial-system operations both nationally coherent and regionally sensitive. Their presence ensures that local conditions matter in shaping policy and that the Fed’s reach is broad and operationally capable.

By supervising banks, operating payment systems, researching regional economies and contributing to the FOMC’s deliberations, the regional banks serve as vital pieces of the U.S. central banking architecture.

For anyone seeking to understand how U.S. economic policy works — or how changes in interest rates, banking regulation or payments affect you — grasping the function of the 12 Federal Reserve Banks is essential.