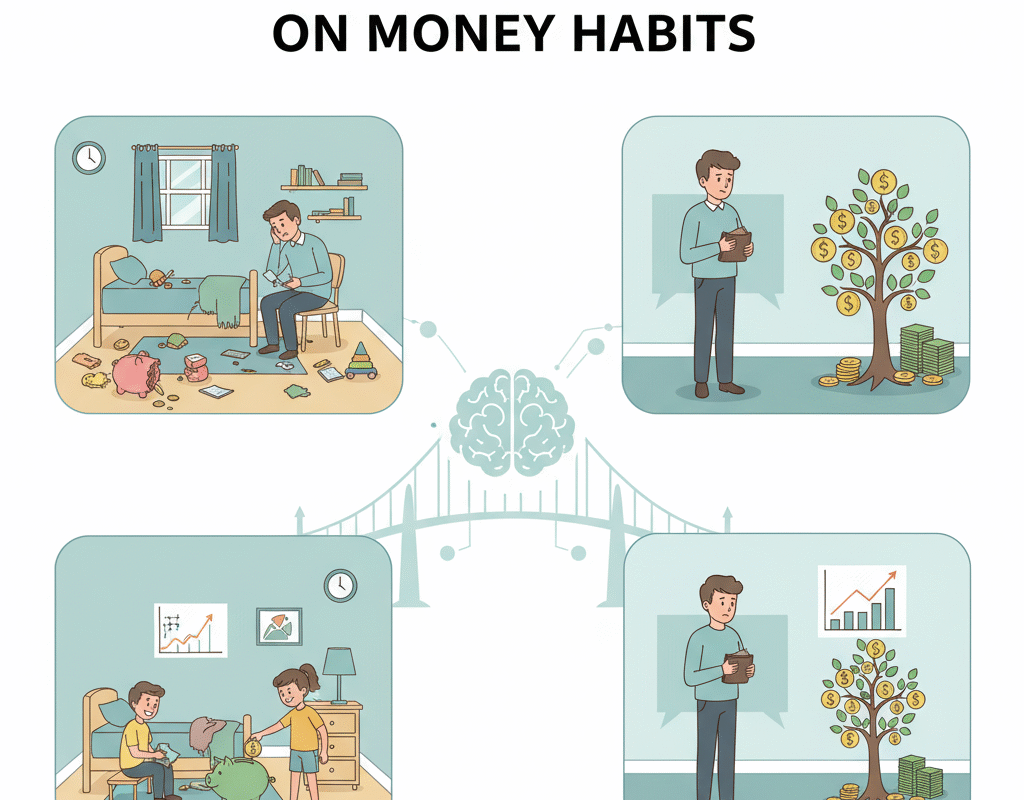

The Impact of Childhood on Money Habits:

The Impact of Childhood on Money Habits:

Our early financial habits are established long before we begin receiving a paycheck, despite the fact that money may appear like an adult responsibility. Children as young as seven years old start to form money mindsets that affect their future financial choices, according to research in financial psychology. Childhood experiences—from witnessing parents’ spending and saving habits to receiving financial education in school and even cultural norms—have a significant impact on how people handle money in the future.

HSBC Cashback Credit Card 2025 – Benefits, Rewards & How to Apply?

Early Life and the Development of Financial Beliefs

Family Behavior’s Early Imprint

Children are like sponges, absorbing behaviors and attitudes from their surroundings. When parents model frugality, budgeting, or impulsive spending, children internalize these practices as “normal.”

- Spending attitudes: A household that frequently indulges in shopping sprees may normalize impulsive purchases for children.

- Saving behaviors: Parents who openly discuss savings goals, emergency funds, or investments create awareness of financial responsibility.

- Debt management: If children see their parents struggling with credit card debt, they may either repeat the cycle or become debt-averse.

Psychologists call this “financial socialization”—the transmission of money habits and attitudes through observation, discussion, and shared experiences.

How Childhood Shapes Adult Financial Behavior

Spending Patterns

- Adults raised in households where money was scarce may develop a scarcity mindset, leading them to either overspend when resources are available or hoard excessively.

- Conversely, children raised in financially secure environments often have a more balanced approach to spending.

Saving Habits

- Those who saw parents prioritize savings are more likely to automate savings as adults.

- A lack of savings culture in the household often leads to delayed or absent savings habits in adulthood.

Management of Debt and Credit

The skills learned in childhood—or not—have a big impact on how adults manage debt:

- Some develop healthy credit practices, like paying bills on time.

- Others repeat cycles of overspending and accumulating high-interest debt.

Investment Attitudes

Exposure to investment conversations at home increases the likelihood of financial risk-taking in adulthood. Families that discuss stocks, property, or retirement accounts raise children who are more comfortable engaging with wealth-building strategies.

Emotional and Psychological Associations with Money

Emotional baggage and money scripts

Most adults have “money scripts,” which are ingrained, subconscious ideas about money that were developed throughout infancy, according to financial therapists. Among the examples are:

- “All evil stems from money.”

- “The wealthy are avaricious.”

- “I have to save every cent or I’ll run out of money.”

These patterns may result in excessive spending, financial concern, or avoiding opportunities to accumulate wealth.

Trauma in Childhood and Financial Concern

Children who grow up in houses with uncertain finances are more likely to suffer money-related stress disorders, according to research. In maturity, this shows up as extreme frugal living, financial avoidance, or overspending to “escape stress.”

The Function of Society and Education

Financial Literacy in Schools

In the U.S., financial literacy education varies by state. Some states mandate personal finance classes, while others leave it optional. Studies reveal that students exposed to structured financial literacy programs are more likely to budget, save, and invest responsibly as adults.

Media and Peer Influence

- Children exposed to consumer-driven media often equate happiness with spending.

- Peer pressure among teens encourages trends in clothing, gadgets, and entertainment, shaping financial behaviors that may persist in adulthood.

Cultural Impact

Different cultures hold unique attitudes toward money. For instance:

- In some Asian households, saving is highly emphasized from a young age.

- In certain Western cultures, credit and spending flexibility are normalized.

- These cultural frameworks combine with family experiences to mold lifelong financial practices.

Real-World Examples and Research Findings

- A 2018 T. Rowe Price survey found that 69% of parents are reluctant to talk to kids about money, even though children who do have these conversations are more likely to develop responsible financial habits.

- A Bank of America study revealed that millennials who received early financial education are more confident in managing debt and saving for retirement.

- The American Psychological Association (APA) notes that money is the leading cause of stress for U.S. adults—a stress rooted, for many, in childhood financial instability.

Breaking the Cycle: Building Healthy Money Habits in Children

What Parents Can Do

- Talk About Money Openly – Break the taboo and discuss budgeting, saving, and debt.

- Model Good Financial Behavior – Children learn more from actions than lectures.

- Encourage Saving – Give kids piggy banks or savings accounts.

- Teach Budgeting with Allowances – Allow children to plan their spending and saving.

- Introduce Investments Early – Even basic lessons about stocks or interest can inspire financial curiosity.

The Role of Schools and Policymakers

- Implement mandatory financial literacy courses in elementary and high schools.

- Provide interactive programs like “school banks” where children can save money.

- Collaborate with parents to reinforce lessons at home.

America’s Financial Literacy Future

Teaching financial literacy from an early age is more important than ever as economic issues like mounting student debt, inflation, and housing affordability change. The next generation will face even more complex money decisions, from navigating digital currencies to managing gig economy income streams.

If we can strengthen financial education during childhood, we can prepare adults who are not only financially responsible but also resilient in the face of economic uncertainty.

In Conclusion

Childhood serves as the basis for future financial practices and is more than just a time of innocence. The seeds sown in the early years have an impact on whether people succeed or fail financially as adults, from watching how their parents handle their finances to learning about saving in school.

Society can break negative cycles and raise generations of people who approach money with confidence, responsibility, and long-term vision by making financial education a priority in households, schools, and communities.

Unquestionably, childhood influences financial habits; the earlier we acknowledge this, the more secure our financial future will be.

Why High-Income Earners Struggle to Save Money: Hidden Financial Traps in 2025

Why High-Income Earners Struggle to Save Money: Hidden Financial Traps in 2025