Tax Strategies for High-Net-Worth Individuals:

Tax Strategies for High-Net-Worth Individuals:

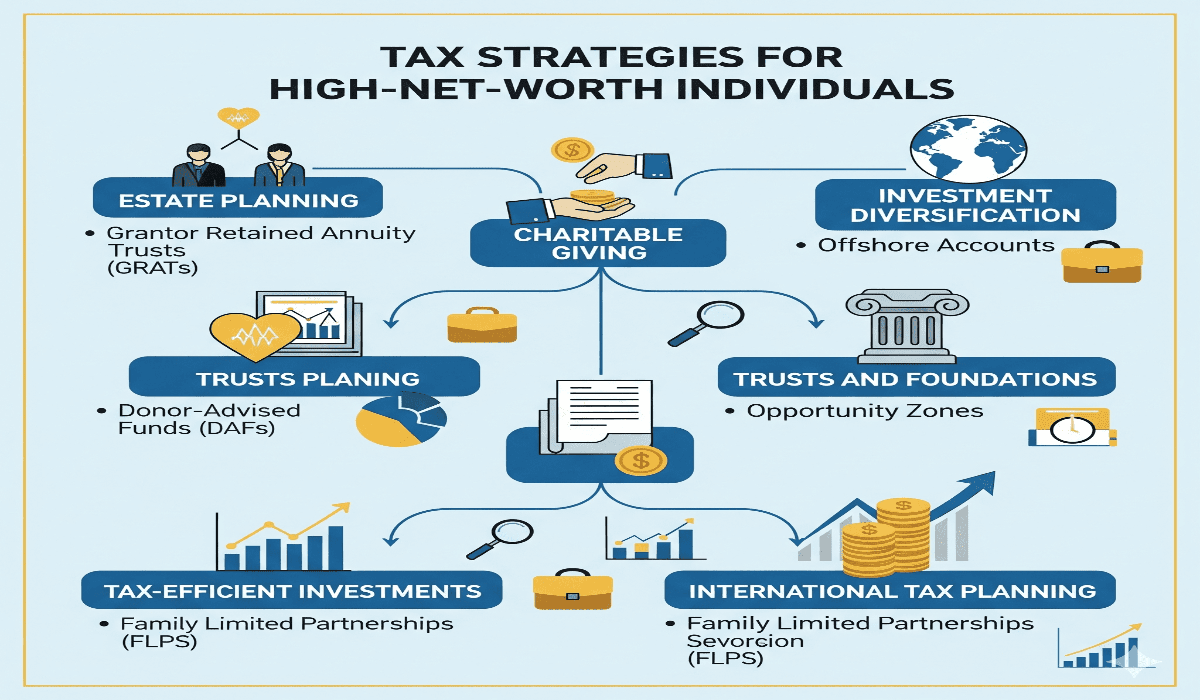

Wealth brings financial freedom, but it also brings tax challenges. For high-net-worth individuals (HNWIs) in the United States, navigating the complex tax landscape has become increasingly vital, especially as federal and state governments adjust policies to close loopholes and increase revenue. With tax reforms regularly making headlines, the ultra-wealthy are turning to innovative and compliant strategies to reduce liabilities, protect assets, and maximize long-term wealth.

This article provides an in-depth look at tax strategies for high-net-worth individuals in 2025, examining methods that combine legal tax planning, philanthropy, estate structuring, and smart investment choices.

HSBC Cashback Credit Card 2025 – Benefits, Rewards & How to Apply?

Recognizing the Tax Issues High-Net-Worth Individuals Face

Those with liquid assets of at least $1 million are considered high-net-worth individuals, and their tax environment is far more complicated than that of the typical taxpayer. The reasons include:

- Higher Tax Brackets: Federal income tax rates for top earners can exceed 37%, while additional state taxes in states like California and New York push total effective tax rates even higher.

- Capital Gains and Dividends: Large investment portfolios often generate significant capital gains, triggering taxes of up to 20% federally, plus 3.8% Net Investment Income Tax (NIIT).

- Estate Taxes: The federal estate tax rate can reach 40%, with some states imposing additional inheritance taxes.

- Global Assets: Wealthy Americans with international investments face compliance burdens under FATCA (Foreign Account Tax Compliance Act).

Important Tax Techniques for Wealthy People

Estate Planning and Wealth Transfer

Estate taxes remain one of the largest concerns for wealthy families. Strategic estate planning helps minimize liabilities while ensuring smooth transfer of wealth to heirs.

- Irrevocable Trusts: Placing assets in irrevocable trusts allows families to shield wealth from estate taxes and creditors.

- Grantor Retained Annuity Trusts (GRATs): A GRAT enables individuals to pass appreciating assets to beneficiaries with minimal gift tax.

- Dynasty Trusts: Popular among ultra-wealthy families, these trusts can preserve wealth across multiple generations while avoiding estate taxes.

- Life Insurance Trusts: Using life insurance policies within trusts provides tax-free death benefits to heirs.

Charitable Giving for Tax Reduction

Philanthropy is both a legacy-building tool and a tax-saving strategy.

- Donor-Advised Funds (DAFs): Allow individuals to receive immediate tax deductions while donating over time.

- Charitable Remainder Trusts (CRTs): Provide income during the donor’s lifetime and pass the remainder to charity, reducing estate tax.

- Private Foundations: While more complex, foundations enable wealthy families to shape charitable giving while benefiting from deductions.

Strategic Use of Tax-Advantaged Accounts

High-net-worth individuals maximize benefits from tax-deferred and tax-exempt accounts:

- Roth IRAs & Conversions: Paying taxes upfront allows tax-free withdrawals later, especially beneficial for heirs.

- Health Savings Accounts (HSAs): For those with high-deductible health plans, HSAs offer triple tax advantages.

- 401(k) Maximization: Even though contribution limits are capped, high earners often use “mega backdoor Roth” strategies.

Techniques for Investments to Reduce Capital Gains

Planning investments is crucial to preventing tax erosion.

- Tax-Loss Harvesting: Total taxable income is decreased by offsetting capital gains with losses.

- Investing in Qualified Opportunity Zones (QOZs) lowers and postpones the need to pay capital gains taxes.

- Rich investors find municipal bonds appealing because they provide tax-free income at the federal and occasionally state levels.

- Private Placement Life Insurance (PPLI): Provides tax-deferred growth by enclosing assets in life insurance contracts.

International and Offshore Strategies

Global investors must navigate strict U.S. reporting requirements, but compliant structures can still be beneficial:

- Foreign Trusts and Entities: Can help diversify holdings while providing estate planning benefits.

- Residency Planning: Some HNWIs strategically establish residency in tax-friendly states like Florida, Texas, or Nevada to reduce state taxes.

- Expatriation: In rare cases, ultra-wealthy individuals renounce U.S. citizenship to reduce long-term tax burdens, though this involves an “exit tax.”

Family Office and Professional Advisory

Many wealthy individuals rely on family offices, which provide personalized financial, legal, and tax planning services. Family offices coordinate with CPAs, tax attorneys, and wealth managers to implement advanced strategies such as:

- Consolidated investment management.

- Risk and asset protection.

- Sophisticated charitable giving.

- Estate tax stress testing.

Legislative and Regulatory Outlook

Tax policy in 2025 is under intense debate in Washington. With ongoing discussions about wealth inequality, lawmakers have proposed measures such as:

- Raising capital gains rates for ultra-wealthy investors.

- Tightening estate and gift tax exemptions.

- Introducing wealth taxes or surtaxes on billionaires.

While not all proposals will pass, high-net-worth individuals must remain proactive, as tax law changes can significantly alter long-term planning strategies.

The Future of HNWI Tax Strategies

In the future, high-net-worth tax preparation will progressively include:

- AI-powered tax optimization solutions for instantaneous plan modifications.

- Impact investing and ESG-focused portfolios that offer tax benefits and match riches with social objectives.

- Digital asset planning, as tokenized assets and cryptocurrencies become subject to tax and estate implications.

Concluding remarks

The goal of high-net-worth individuals’ tax strategies is to strategically structure their wealth in order to reduce liabilities, adhere to legal requirements, and protect assets for future generations, not to evade obligations.

Proactive planning, continuous review, and professional advice are still crucial as U.S. tax legislation changes. Wealthy people can lower taxes and improve their financial legacy by utilizing estate planning, philanthropic vehicles, tax-advantaged accounts, and international diversification.