Lifestyle Inflation: How to Avoid It and Take Control

Lifestyle Inflation: How to Avoid It and Take Control

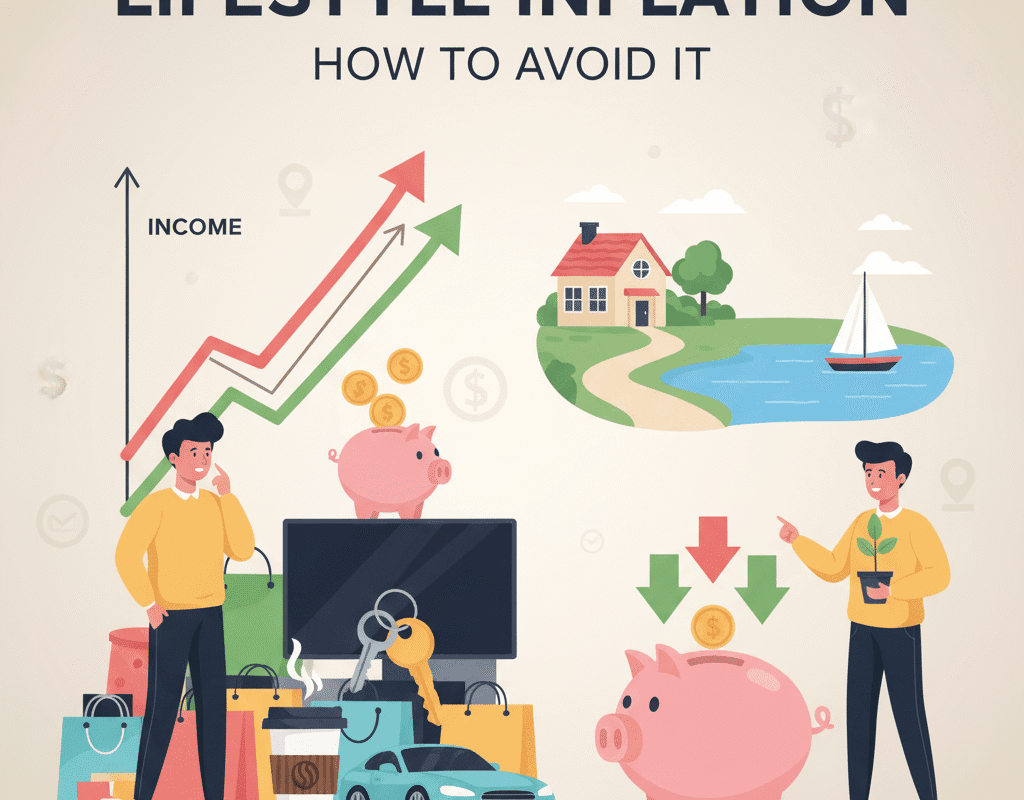

Many Americans find themselves making more money but saving less in an era of growing salaries and easy access to credit. One of the main causes of people’s inability to accumulate wealth in spite of rising incomes is this phenomenon, which is also known as lifestyle inflation or lifestyle creep. When income rises and consumption rises as well, there is less money available for investing or saving. This is known as lifestyle inflation. Anyone hoping to achieve long-term financial freedom and stability must comprehend this financial trap.

HSBC Cashback Credit Card 2025 – Benefits, Rewards & How to Apply?

What is Lifestyle Inflation?

Lifestyle inflation happens gradually, often without notice. As people receive raises, promotions, or bonuses, their spending habits expand accordingly. For instance, a young professional earning $50,000 a year might rent a modest apartment and drive an economical car. When their income rises to $80,000, they may feel justified in moving to a luxury apartment, leasing a high-end vehicle, and dining out frequently. While these choices might seem reasonable, they often outpace the growth of savings, investments, and retirement contributions.

Lifestyle inflation can undermine financial goals, trap people in debt, and prevent them from achieving true financial freedom. Research indicates that many individuals who increase their earnings also increase their spending proportionally, with little consideration for long-term wealth-building strategies.

Indications That Your Lifestyle May Be Inflating

The first step in preventing lifestyle inflation is early detection. Here are a few typical indicators:

Frequently Upgrading Your Home or Vehicle

You are probably engaging in lifestyle inflation if every rise leads to a purchase of a new automobile or a more costly home.

Eating Out More Frequently

Eating at fancy restaurants on a regular basis rather than cooking at home might stealthily deplete your finances.

Impulsive buying and extravagant spending

Suddenly buying luxury goods, gadgets, or designer items without saving for them indicates your spending is outpacing your income growth.

Increasing Debt

Higher spending without a proportional increase in savings often leads to higher credit card balances or personal loans.

Feeling Financially Stressed Despite Higher Income

Earning more but still feeling “broke” at the end of the month is a red flag of lifestyle creep.

Why Lifestyle Inflation Happens

Several psychological and social factors drive lifestyle inflation:

- Social Pressure: Friends, colleagues, or social media influencers often showcase lavish lifestyles, prompting comparison and overspending.

- Psychological Reward: Many people use income increases as justification to reward themselves immediately, often prioritizing short-term pleasure over long-term stability.

- Lack of Budgeting Skills: Without a clear budget, it’s easy to let spending rise in tandem with income.

- Underestimating Future Needs: Failing to plan for retirement, emergencies, or investments encourages consumption over saving.

Understanding these factors is essential for crafting a strategy to avoid lifestyle inflation.

The Consequences of Lifestyle Inflation

Ignoring lifestyle inflation can have serious long-term consequences:

Limited Savings and Investments

The more your spending grows, the less you save or invest, delaying financial independence.

Increased Debt

Overspending often leads to reliance on credit cards or loans, creating a cycle of debt that becomes hard to escape.

Financial Stress

Living paycheck to paycheck, even with a higher income, can increase anxiety and reduce overall well-being.

Missed Opportunities for Wealth Building

Money spent on temporary luxuries could have been invested in assets that appreciate over time, such as stocks, real estate, or retirement funds.

Practical Strategies to Avoid Lifestyle Inflation

Avoiding lifestyle inflation requires discipline, planning, and smart financial habits. Here are actionable strategies:

Create a Budget and Stick to It

Budgeting helps track your income and expenses, ensuring you live within your means. Consider using apps like Mint, YNAB, or Personal Capital to simplify the process. Allocate a portion of every raise toward savings or investments rather than increasing spending proportionally.

Automate Your Savings

Automate contributions to savings accounts, retirement plans, and investment accounts. By “paying yourself first,” you reduce the temptation to spend additional income on non-essential items.

Set Financial Goals

Clearly defined financial goals, such as buying a home, paying off debt, or retiring early, provide motivation to resist lifestyle inflation. Goals act as a benchmark for spending decisions, keeping short-term impulses in check.

Delay Gratification

Before making a large purchase, wait at least 30 days. This cooling-off period reduces impulse buying and ensures the purchase aligns with long-term priorities.

Track Your Spending

Regularly review your expenses to identify areas where lifestyle creep might be occurring. Look for trends in discretionary spending such as dining out, entertainment, and luxury purchases.

As income rises, up the savings rate.

Raise your savings rate rather than spending it. For instance, set aside 50% of any increase in income for savings, 30% for investments, and 20%, if required, for lifestyle improvements.

Steer clear of peer pressure

Unnecessary expenditure is driven by social comparisons. Instead of attempting to mimic your friends’ or coworkers’ living choices, concentrate on your own financial objectives.

Be frugal without compromising your quality of life

Being frugal does not equate to being deprived. It’s about making thoughtful financial decisions, such as purchasing high-quality necessities and taking pleasure in activities without going over budget.

Seek Financial Education

Understanding personal finance, investing, and wealth-building strategies helps make informed decisions and resist lifestyle inflation. Many free resources and online courses are available to boost financial literacy.

Evaluate Needs vs. Wants

Before making a purchase, ask if it’s a necessity or a luxury. Prioritizing needs ensures essential expenses are covered and avoids unnecessary spending on transient wants.

In Conclusion

One financial issue that is subtle but significant is lifestyle inflation. Even well-earning individuals can struggle to save and invest if they let spending rise with income. Anyone can attain true financial freedom and prevent lifestyle inflation by comprehending the causes, identifying the warning signs, and putting useful methods into practice.

You may increase your wealth and reap the rewards of a larger income by using strategies like goal-setting, budgeting, delaying gratification, and prudent spending. The key is conscious financial choices, discipline, and a mindset focused on long-term prosperity. Remember, wealth is not just about how much you earn—it’s about how much you save, invest, and grow over time.

Avoiding lifestyle inflation isn’t just a financial strategy—it’s a lifestyle choice that leads to freedom, security, and peace of mind.